Table of Contents

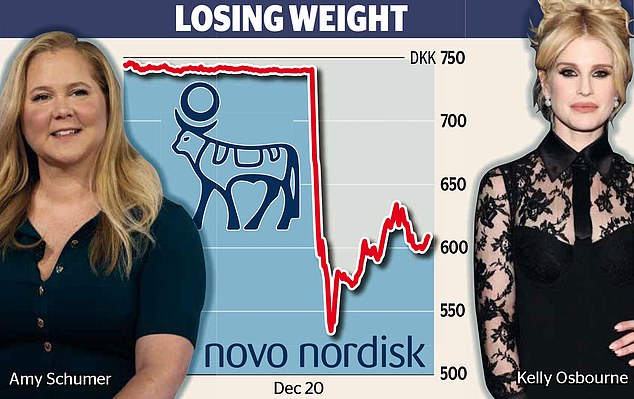

- It was one of Novo Nordisk’s worst days on the stock market

- Shares fell as much as 29% before the pharmaceutical giant recouped some of its losses.

- The group’s valuation has skyrocketed due to the lawsuit from Wegovy and Ozempic

Ozempic maker Novo Nordisk saw its value plummet to £82bn yesterday after a trial of a weight loss drug failed to meet expectations.

It was one of the Danish pharmaceutical giant’s worst days on the stock market, as its shares fell as much as 29 percent.

The company subsequently recovered some of its losses, but at the close it was still losing 21 percent and lost its crown as Europe’s most valuable company.

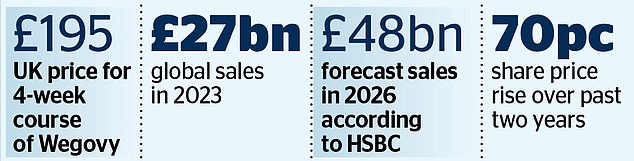

This represented a severe setback for the group whose valuation has soared in recent years due to demand for drugs such as Wegovy and Ozempic.

The company has become so important to the Danish economy that the krone weakened yesterday as foreign investors sold shares and converted the profits into other currencies.

Wegovy is administered as a weekly injection and tricks the body into thinking it is full. It is available on the NHS.

Sister drug Ozempic, which has the same key ingredient, has taken off in the United States. Celebrities who have taken it include actress Amy Schumer and television host Kelly Osbourne.

But investors were disappointed yesterday with the results of a trial of its next weight-loss drug: a combination of Wegovy and another of its drugs, Saxenda.

Novo Nordisk hoped the treatment, called CagriSema, would help patients lose an average of 25 percent of their body weight. But instead, the late-stage trial showed that patients only lost an average of 22.7 percent of their body weight. This has cast doubt on Novo Nordisk’s ability to reign supreme amid fierce competition in the weight loss market.

The drug only slightly outperformed the other leading weight loss drug on the market, Zepbound, known as Mounjaro in the UK. Patients taking the rival drug – made by Eli Lilly, the world’s largest pharmaceutical company – lost 22.5 percent of their weight in an earlier trial.

But Martin Holst Lange, executive vice president of development at Novo Nordisk, said: “We are encouraged by CagriSema’s weight loss profile.”

Some believe the market reaction was overblown. Jakob Westh Christensen, market analyst at eToro, said: “This is just one study and potential drug in Novo Nordisk’s extensive research and development portfolio.”

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free Fund Trading and Investment Ideas

interactive inverter

interactive inverter

Fixed fee investing from £4.99 per month

sax

sax

Get £200 back in trading fees

Trade 212

Trade 212

Free trading and no account commission

Affiliate links: If you purchase a This is Money product you may earn a commission. These offers are chosen by our editorial team as we think they are worth highlighting. This does not affect our editorial independence.