Table of Contents

The monthly cost of owning a home is once again much cheaper than renting, as lower mortgage rates further tip the balance in favor of first-time buyers.

Research by property website Zoopla found that the average monthly mortgage cost for a typical first-time home buyer is now 17 per cent cheaper than the average rent, although buyers may of course need to save a substantial deposit.

This time last year, the difference was 2 percent, as mortgage rates were higher.

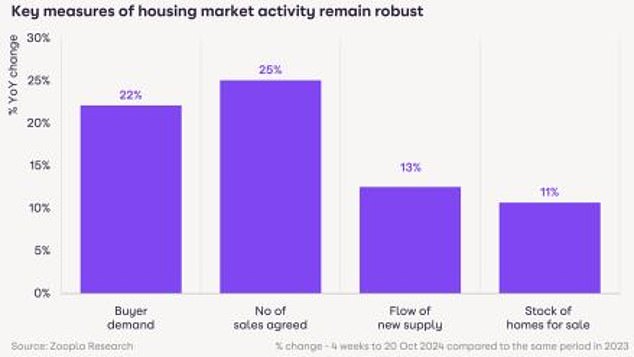

Active market: Income growth and lowest mortgage rates in two years support highest level of new sales agreed since autumn 2020

A year ago, average mortgage payments for a typical first-time home buyer with a 20 per cent deposit over a 30-year term were £1,085 a year ago, versus £1,110 for a similar rental property.

The cost of renting has risen 5 per cent to £1,170 a month, while lower mortgage rates have reduced average mortgage payments by 10 per cent to £972.

The result is that first-time buyers are driving a sales boom across the property market, according to Zoopla.

It says home sales are reaching the highest level since the Covid housing boom of 2020, with the The sales pipeline agreed 25 percent more than a year ago.

It is estimated that there are currently 306,000 homes with an agreed sale principle, 62,000 more than a year ago.

Matt Thompson, head of sales at estate agents Chestertons, says Zoopla’s findings reflect the reality on the ground at the moment.

Pent-up demand, better mortgage deals and people’s desire to find a property ahead of budget have been key motivators.

“The property market has been extremely active this year and we currently have 17 per cent more properties on offer than in 2020,” Thompson said.

“Pented demand, better mortgage deals and people’s desire to find a property ahead of the autumn budget have been key motivators for house hunters to end their search.”

According to Zoopla, lower mortgage rates combined with rising incomes are believed to be behind the increase in people buying and selling.

Many first-time buyers put their plans on hold in 2023, as rates soared and rumors of falling home prices filled the airways.

However, now that house prices are rising and many can now get a mortgage rate between 4% and 4.5%, many are deciding to take the plunge this year.

Ahead: The number of property sales agreed in the four weeks to October 20 was 25% higher than the same period last year, according to Zoopla.

First-time buyers could account for a third of 2024 sales

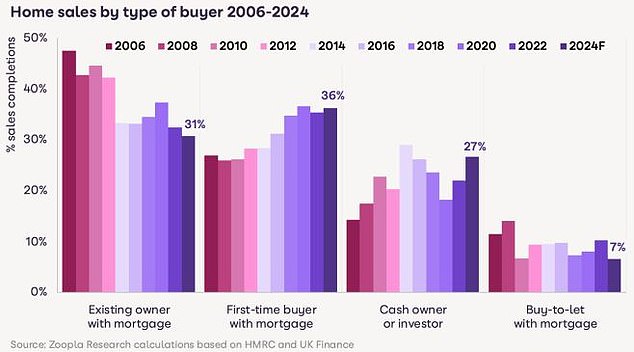

Zoopla says first-time buyers are on track to become the largest group of buyers in 2024, accounting for 36 per cent of all sales.

They are followed by existing homeowners (31 percent), cash buyers (27 percent) and homeowners buying with a mortgage (7 percent).

First-time buyer numbers are supported by homeowners selling homes, as the median sales price of these homes tends to be lower.

Up to 12 per cent of homes put up for sale at the moment were previously rented, with a higher-than-average concentration of owner sales in London, according to Zoopla.

The average sales price of a previously rented home is £307,000, 16 per cent less than the UK average sales price of £365,000.

On the scale: First-time buyers with mortgages will account for 36% of all buyers this year

While it may be good news for buyers, landlords who sell can drive up rents because they create shortages, and this hits low-income renters the hardest.

Chris McLaughlin, director of Bristol-based Ocean Estate Agents, said: ‘The property market is experiencing significant variations between districts and price bands.

‘In some areas, volume has grown more than 50 percent, but on average year-on-year growth has reached approximately 30 percent, driven largely by lower interest rates, which have spurred a resurgence of first-time buyers. .

“In addition, many sellers, who had switched to renting homes during the period of higher interest rates, are now re-entering the market, often without mortgages or with substantial deposits.”

‘Buy-to-let activity has declined markedly as smaller or casual landlords leave the market, influenced by less favorable financial conditions and increasing regulation.

“Consequently, much of the new housing stock is now made up of former rental properties.”

House prices remain practically stable

While the number of sales is booming, the same cannot be said for home prices.

House prices rose just 1 percent over the 12 months to September 2024, according to Zoopla, compared with a fall of 0.9 percent a year ago.

Zoopla says house prices are kept in check thanks to a wide variety of homes for sale, while purchasing power is kept in check due to affordability pressures.

There remains a North-South divide when it comes to house prices.

Home values are rising at a faster than average rate in areas with more affordable housing prices.

For example, in the North East and Yorkshire and the Humber, prices have risen by 2 per cent over the last year. In the North West they are up 2.43 per cent, Scotland is up 2.4 per cent and house prices in Northern Ireland are up 5.6 per cent.

However, house prices are recording small falls in East Anglia and South East England, where prices have fallen by 0.3 per cent and 0.1 per cent respectively over the past 12 months. The south west of England has seen no change compared to last year.

In terms of cities. Belfast is the best performer, with house prices up 5.5 per cent.

In Manchester average prices rose by 2.8 per cent, while in Glasgow and Liverpool house values rose by 2.4 per cent.

Looking ahead, Zoopla expects mortgage rates to remain close to current levels and for most people to borrow at rates between 4% and 4.5% during 2025.

This means wage growth will have to do the hard work to support affordability and purchasing power, and house price growth is likely to remain modest.

It says house prices are on track for a modest 2 percent increase in 2024.

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.