A “treasure hunter” who scours the streets and rummages through piles of municipal trash in search of hidden gems says he makes up to $52,000 a year selling them.

Leonardo Urbano, better known as The garbage lawyerHe has been selling used items since 2020 after the pandemic left him out of work.

Now the 30-year-old from Sydney sells the products full-time at a reasonable price and sometimes even stumbles upon piles of cash.

Leonardo told FEMAIL that through trial and error he managed to figure out what people want to buy, and also managed to furnish his entire two-bedroom apartment with stylish “junk”.

From Dyson vacuum cleaners to a Fendi tracksuit, gold jewelry and lost wallets full of cash, Urbano said it’s surprising how much is thrown away.

Leonardo Urbano, better known as The Trash Lawyer, began selling discarded items found in the trash in 2020 when he had ‘a lot of free time’ due to the pandemic.

Now, the 30-year-old claims he earns $1,000 a week as a full-time “treasure hunter.”

Leonardo grew up in Liguria, Italy, so the economy was “a lot slower” compared to Down Under.

‘There is much less money circulating and people waste less. “It is very difficult for young people to move without the help of family,” she stated.

“A lot of furniture is inherited and never bought new, so coming here was a shock to see how much people spend or throw away.”

Urbano moved to Australia aged 22 in 2016 and has previously lived in England, France, South America, the United States and Asia.

He now makes a living doing what he started as a side job and often can’t believe what people throw away and/or misplace.

“The amount of money that ends up in the trash is staggering: from coins to bills to gold chains and rings,” he said.

“People forget them in the pockets of old jackets and hidden between the pages of books and bags.”

Growing up in Liguria, Italy, the economy was “a lot slower” and seeing what life was like in Australia was a “huge shock”.

From Dyson vacuum cleaners to a Fendi tracksuit, gold jewelry and lost wallets full of cash, Urbano said it’s surprising how much is thrown away.

He gets the unwanted finds in city hall trash cleanups, on the streets, in trash bins and in the basement waste room of his apartment building (pictured).

There are a few notable things Mr. Urbano looks for when researching products: the brand, the year it was made, and whether it is a rare, limited edition piece.

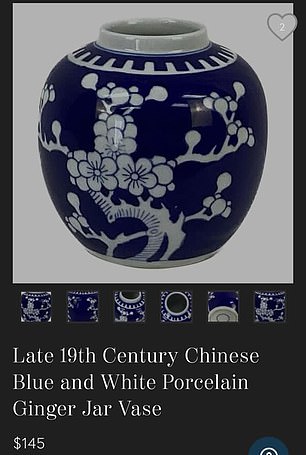

He previously found an antique English Victorian green and white glass epergne valued at up to $1,900, an antique Chinese vase valued at $220 and another Chinese porcelain ginger jar vase valued at $145.

Other finds include a Fendi tracksuit, a $3,000 piece of art by two-time Archibald Prize finalist Dapeng Liu, and an Adidas Allen Iverson Sizers T-shirt valued at $400.

“These items are worth more because they are rare and there is a limited quantity; they sell quite easily,” he said.

Well-known brands such as Apple, Dyson, Miele, Smeg and Sony have a high resale value.

He keeps prices “reasonable” so he can deliver products quickly, since space in his apartment is limited.

‘It usually sells out within a few days, I don’t have space to store everything for long periods of time. If it doesn’t sell, I donate it,’ he explained.

A staggering 70 percent of what you find is in working condition and needs a quick clean, while the other 30 percent needs to be repaired.

“I find it enriching because you learn how to fix things slowly and you gain skills you didn’t have before.”

Other finds include a Fendi tracksuit, a $3,000 piece of art by two-time Archibald Prize finalist Dapeng Liu (pictured) and an Adidas Allen Iverson Sizers T-shirt valued at $400.

There are a few notable things Mr. Urbano looks for when purchasing products: the brand, the year it was made, and whether it is a rare, limited edition piece.

He previously found an antique Chinese vase valued at $220 (left) and another Chinese porcelain ginger vase valued at $145 (right).

On the other hand, he avoids clothes and toys and instead donates them all to charity.

‘I think donating is the right thing to do – reducing landfill and helping someone who may need it. “There are so many things that are thrown away and people don’t realize that not everything is recycled,” he said.

“Hopefully this will reduce the amount going to landfills”

Urbano estimates he has probably donated $100,000 worth of goods over the years, mostly everyday items such as plates, cutlery, children’s toys, paintings and ornaments.

He also managed to furnish his entire two-bedroom apartment for free using the trash he found.

Their house was filled in just a month and a half and everything from cutlery to a TV stand was found for free.

Sometimes he has had to fix furniture or give a piece a coat of paint, but he said it’s all worth it.

And he also managed to furnish his entire two-bedroom apartment for free with the trash he found.

This task comes with the challenge of ensuring the furniture matches, but Mr. Urbano has proven that he has style with his interior design.

Their house was filled in just a month and a half and everything from cutlery to a TV stand was found for free.

Another way Urbano makes easy money is by going to the movies and checking for coins or bills that have escaped from the chairs.

A video shows him flipping the cushions to expose what’s hiding underneath; On one occasion he found a wallet filled with $750 in cash.

Over the years, he estimates he has found about $5,000.

“It’s also surprising how much money is on gift cards: $25 here, $70 there, it all adds up,” he said.

“People don’t realize it, but it’s a lot; there must be millions of people forgotten.”

Urbano said he will continue to find hidden treasures in hopes of reducing landfills and hopes the items sold will be useful to others.