Table of Contents

- Price Bailey figures show 4,410 pubs are at highest risk of closure

One in 10 British pubs are at imminent risk of closure, according to new figures which indicate the threat to the hospitality sector is worsening.

Around 11 per cent of the total number of pubs are at significant risk of going out of business, analysis by accounting firm Price Bailey shows.

The figures show that 7,445 pubs (20 per cent of the total) have negative net assets on their balance sheets, meaning they are technically insolvent.

Closed for good: Growing number of pubs at risk of insolvency according to Price Bailey analysis

Of those, 4,410 have a Delphi Risk score in the maximum credit risk category, an increase of 930 from a year ago, when 3,380 were classified as technically insolvent and maximum risk.

Maximum risk companies are unlikely to access finance without personal guarantees from directors and are likely to be subject to winding up petitions or notices of intention to wind up over the next year, Price Bailey says.

Pubs have come under pressure from higher energy, labor and food and drink costs, while consumer demand has weakened thanks to the economic climate.

Price Bailey’s analysis comes as figures show 378 pubs were forced to close in the first half of the year, equaling last year’s record of the highest total since 2013.

The upcoming Budget is unlikely to help the industry’s fortunes either, despite a rate cut over the summer.

A sharp rise in the minimum wage and proposals to ban smoking in pub gardens are likely to add further suffering.

Pubs could also face another rise in bills if business rates relief, introduced during the pandemic, ends next April.

Trade body UK Hospitality has warned of a “devastating cliff edge” that could leave hotel businesses with a bill of £928m.

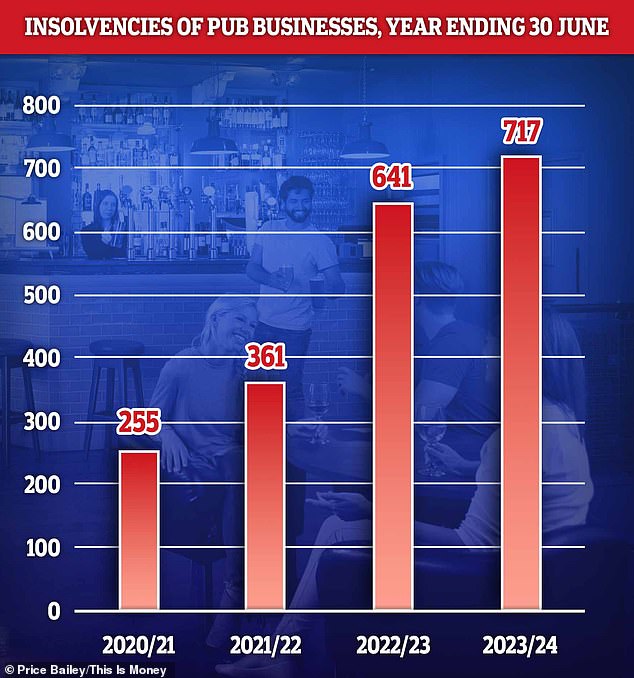

The number of pub insolvencies has soared since 2020 thanks to rising costs

“The pub inflation rate remains stubbornly above the base rate and there is little sign of relief,” says Matt Howard, head of insolvency and recovery at Price Bailey.

‘If the Government announces an increase in the minimum wage to combat inflation in the Autumn Statement, many pubs that are currently on life support are likely to stabilise.

‘Bar workers have been among the biggest beneficiaries of increases in the national living wage, which has risen more than 40 per cent in five years.

Many have to sacrifice long-term customer relationships for profitability while focusing on peak business hours.

Matt Howard – Bailey Price

“Even as pubs see an improvement in their turnover, wage costs mean many pubs remain in the red for much of the trading week.”

In a bid to make ends meet, many pubs are operating on reduced hours to manage energy costs and staff shortages, meaning they are unable to take advantage of any surge in demand.

Howard adds: “Many have to sacrifice long-term customer relationships for profitability while focusing on peak times.”

Small independents are likely to struggle more, but some big-name pub chains received a big boost over the summer.

Last week, Wetherspoons reported revenue growth of 5.7 per cent to £2.04 billion, while its pre-tax profits rose 73.5 per cent to £73.9 million in the year until July 28.

SAVE MONEY, MAKE MONEY

Investment boost

Investment boost

5.09% on cash for Isa investors

5.05% solution after one year

5.05% solution after one year

Prosperous momentum for Al Rayan

free share offer

free share offer

No account fee and free stock trading

4.84% cash Isa

4.84% cash Isa

Flexible Isa now accepting transfers

Trading Fee Refund

Trading Fee Refund

Get £200 back in trading fees

Affiliate links: If you purchase a This is Money product you may earn a commission. These offers are chosen by our editorial team as we think they are worth highlighting. This does not affect our editorial independence.