One in five private renters spend more than half their gross salary on rent, according to data published by tenant referral service Canopy.

With approximately 11.6 million people renting privately across the UK, this would suggest that approximately 2.3 million renters spend more than half their pre-tax salary on rent.

The average renter’s expense is just under one-third or 30.6 percent of their pre-tax salary.

On the rise: Rents have increased 29% since before the pandemic, according to Zoopla

Renters are being hit by rising rents, as well as higher costs for their other essential expenses.

Last month, Zoopla reported that average rents in the UK have increased by 29 per cent since just before the start of the pandemic.

Meanwhile, rising inflation will also have hit renters hard, as what £100 could buy in 2019 now requires £123.

Chris Hutchinson, chief executive of Canopy, said: “It’s sobering to see that one in five renters spend the majority of their salary on rental payments, and neatly sums up the difficult situation many renters with aspirations of homeownership find themselves in. of a home”.

‘It highlights the financial pressure on tenants, meaning they can save less money to achieve their goals.

“Where we could see a positive shift is towards longer tenancies for those who want them, encouraging greater security for families and communities.”

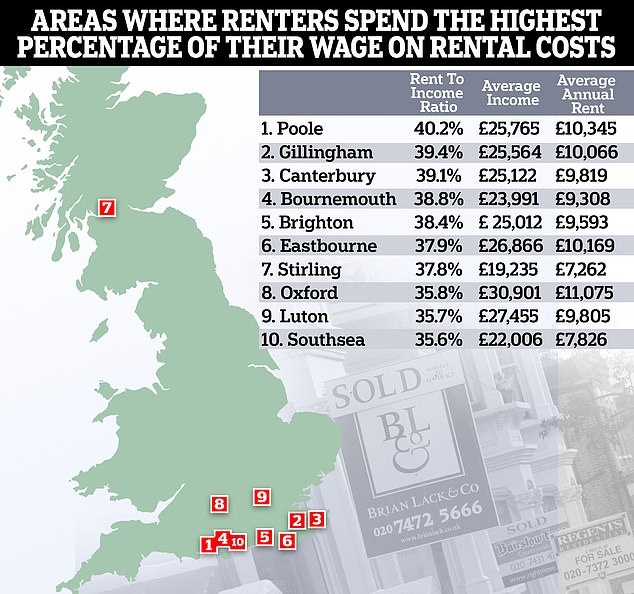

Canopy also revealed where in the UK renters spend the highest percentage of their salaries on rental costs.

The results are based on each individual’s share of the rent if they live with other people, not the cost of the house as a whole.

Poole, Dorset, is the toughest area in the UK for rent affordability, with the average renter spending more than 40 per cent of their salary on rent alone.

A similar story appears to be unfolding in both Gillingham and Canterbury in Kent. The average renter in these two cities spends nearly 40 percent of their take-home pay on rent.

In Brighton, the typical renter spends 38.4 percent of their take-home pay on rent, Canopy said.

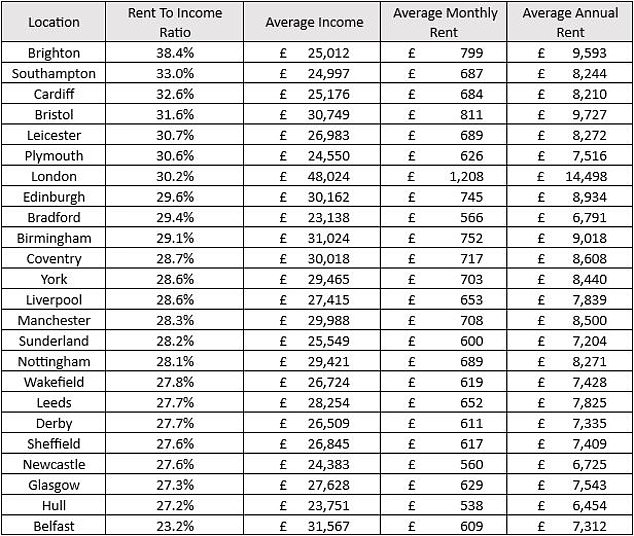

The average tenant earns £25,012 a year, according to Canopy, while the average rent is £799 a month (£9,593 a year).

At the opposite end of the spectrum, Belfast is the most affordable city for renters in the UK, with the average renter spending less than a quarter of their salary on rental payments.

Despite being home to the highest average rental costs, London is actually more affordable than other areas of the UK based on local incomes, he said.

Tenants have to pay an average of £1,208 a month to rent in the capital, but thanks to a host of well-paid jobs in the city, they also enjoy high incomes of more than £48,000 a year on average.

This means that renters in London spend 30.2 per cent of their income on rent, which is just below the UK average of 30.6 per cent.

This table shows major cities in the UK and the average renter salary and rent-to-income ratio.

Why are rents in Stirling so high?

Nine of the 10 places where renters spend the highest proportion of their salaries on rental costs are in the south of England.

The only anomaly on the list is Stirling, in Scotland. The city’s renters have a low median income, meaning they spend an average of 37.8 percent of their salary on rent payments.

While Stirling is far from the most expensive rental area in the country, with an average rental price of around £605 per month, the average renter’s salary in the city is only around £19,235.

Stirling is therefore a good example of how difficult things can be for lower-paid tenants, as even modest rental prices compared to the rest of the country can prove very difficult to cope with unless your monthly salary is at a certain level.

Stirling in Scotland is a surprising inclusion in the top ten, with a low average income meaning renters spend an average of 37.8% of their salary on rental payments.

The worry is that things could get worse for tenants in Stirling and other Scottish towns and cities, before they get better.

Until recently, Scottish landlords could only increase rents on current tenancies by up to 3 per cent, unless given special permission.

However, the cap was lifted from March 31 and means rental costs will be back under landlords’ control, 18 months after the first price freeze was introduced.

Oli Sherlock, managing director of insurance at rental platform Goodlord, said: “We can expect to see a number of repercussions as a result.” First, renters should prepare for an increase in rents.

‘Over the last 18 months, many landlords will have seen their mortgage costs soar, so they will be looking to recalibrate rental prices.

‘This is likely to cause a domino effect across the market, as tenants come forward and look for new, cheaper places to rent.

‘This will cause regional average prices to change and will particularly affect demand outside of city centres.

He added: “In addition, we may see rumors of homeowner exodus reduce; lifting this restriction could encourage hesitant homeowners to stay and not sell, which is positive for the market overall.”

How and when to haggle with your landlord

In recent years, rents have increased with an increasing number of tenants competing for housing in an undersupplied market.

Average private rental costs rose by 9 per cent in the year to February, figures from the Office for National Statistics revealed late last month.

Tenants pay, on average, £102 more rent per month than a year ago.

It can often seem like landlords hold all the cards when it comes to a rent increase. However, this is not necessarily always the case.

To start, it’s important to remember that one thing a landlord doesn’t like is void periods, a period of time in which the property is empty.

Upon serving the notice, they will need to find someone to replace the outgoing tenant. By doing this, they risk the property being empty for weeks or even months between the end of the current tenancy and the start of the new one.

Aside from the added hassle, there are also costs involved in finding a new tenant, particularly if the landlord uses a letting agent.

These include a search fee, referral fees, inventory costs, and sometimes an entry and exit fee that the owner must pay to the rental agent.

There are also possible cleaning and repair costs before the start of the new tenancy.

The additional work and cost required to establish a new tenancy should give tenants some confidence when negotiating rent increases, although this comes against the backdrop of a rising rental market.

Ultimately, trying to negotiate with the landlord is often worth it for any tenant looking to remain in a property.

When faced with a rent increase, they might try to find a middle ground between the current rent and what the landlord or real estate agent is now requiring.

It is important to emphasize, without confrontation, that rent has always been paid on time and the property has been kept clean, and that there is no guarantee that any future tenant will extend the same courtesy.

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.