Table of Contents

- Brent crude rose another 2% to $76.14 a barrel

Oil prices rose yesterday as Iran’s missile attack on Israel stoked fears of an all-out conflict in the Middle East.

As the world prepared for Israel and its allies to retaliate against Tehran, Brent crude rose another 2 percent to $76.14 a barrel.

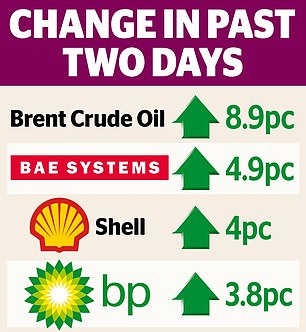

That brought gains since oil was trading below $70 before Tuesday’s attack to nearly 9 percent, raising fresh concerns about the outlook for inflation.

Prices: Oil prices rose yesterday as Iran’s missile attack on Israel stoked fears of an all-out conflict in the Middle East.

Analysts warned that oil could now surpass $80. Fawad Razaqzada of City Index said: “Crude oil could rise by $5 in the coming days if we see further rally.”

The rally came as a Bank of England report showed banks and other financial firms are increasingly concerned about global political developments, which pose the biggest perceived risk to stability.

The Bank also warned that markets “remain susceptible to a sharp correction” after the summer sell-off.

Meanwhile, oil and defense stocks continued to rise as a result of the latest developments in the Middle East, with Shell, BP and BAE Systems all rising strongly.

Fears of weakening demand from China and signs that supply remains more than adequate had pushed oil below $70 a barrel before the escalation of tensions, down from nearly $90 in July.

That helped petrol prices for UK motorists fall to their lowest level in three years and reduced inflation. But fears that a regional war could engulf Iran and other oil-producing countries threatens to halt that trend.

Analysts said much will depend on how Israel responds. “The main message from geopolitics is that inflation hasn’t gone away,” said Trevor Greetham, head of multi-assets at Royal London Asset Management.

David Oxley, chief climate and commodities economist at Capital Economics, said: “Until the geopolitical situation in the Middle East calms, oil prices clearly remain at risk of soaring further.”

But over the next year, the backdrop of “hesitant demand and increased supply in the broader market” meant risks were “possibly skewed to the downside.”

Global stock markets were under pressure yesterday as safe assets such as gold and government bonds made gains.

Germany’s Dax index fell, but the FTSE 100 ended up 0.2 percent and New York stock markets were little changed.

It came as the Bank of England’s financial policy committee, which monitors threats to the financial system, flagged the risks of a market crash at a time when global share prices are at record levels. The report said ‘overstated valuations’ were not discounting the risks to global growth.

“Markets therefore remained susceptible to a sharp correction, with investors sensitive to developments in what remained a challenging global risk environment,” he said.

And he pointed to the possibility that the sharp global sell-off in August, when investors grew nervous about U.S. jobs data and tepid technology results, could have gone further.

Other risks could come from the US bond market, where investors are anxious about rising debt levels with next month’s presidential election.

Hedge funds have taken a record $1 trillion (£750 billion) in short positions in US Treasury futures, a gigantic bet against US government bonds.

Asset management companies are on the other side, building “long” positions in the asset.

The liquidation of these positions could “amplify the transmission of future stresses,” the Bank stated.

A Bank survey of financial firms showed the proportion of those concerned about “geopolitical risk” was high. Some 93 per cent said it was the biggest source of risk to the UK financial system.

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free Fund Trading and Investment Ideas

interactive inverter

interactive inverter

Fixed fee investing from £4.99 per month

sax

sax

Get £200 back in trading fees

Trade 212

Trade 212

Free trading and no account commission

Affiliate links: If you purchase a This is Money product you may earn a commission. These offers are chosen by our editorial team as we think they are worth highlighting. This does not affect our editorial independence.