Sky watchers had another chance to check one of the best natural sights off their bucket list last night: the Northern Lights.

For the second night in a row, the spectacular light display was visible across the UK after dark.

Viewers have been posting their photos on X (formerly Twitter), including one based at Moffat in Dumfriesshire, Scotland, who called the display “stunning”.

Another viewer on the west coast of Lewis in the Scottish Highlands posted: “It happened again!” with the aurora shining purple and green.

If you missed the stunning display, there is good news as the Met Office says there is a chance the Northern Lights will be visible again tonight.

This photo was posted on X by user @moffat_wigwams and shows the aurora as seen from Moffat in Dumfriesshire, Scotland.

An aurora is created by disturbances in the Earth’s magnetosphere due to a flow of particles from the sun and is generally centered around the Earth’s magnetic poles.

The charged particles are ejected from the sun at maximum speed before interacting with the Earth’s magnetic field.

Color display depends in part on which molecules the charged particles interact with.

The colors red and green tend to be distinctive signs of oxygen, pink and red are signs of nitrogen, and blue and purple are a result of hydrogen and helium.

According to the Met Office, this week’s aurora is due to a coronal mass ejection (CME), a massive ejection of plasma from the sun’s corona, its outermost layer.

It’s possible that the exhibit could be visible again tonight due to the violent ejection event, although the further north you are, the better.

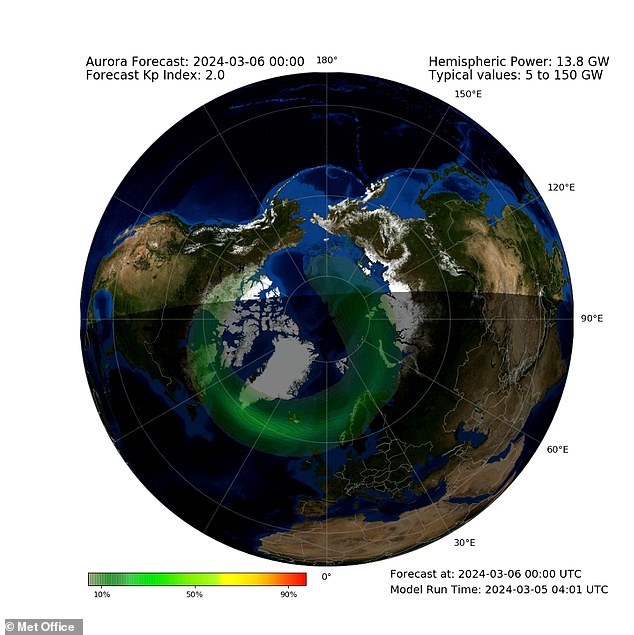

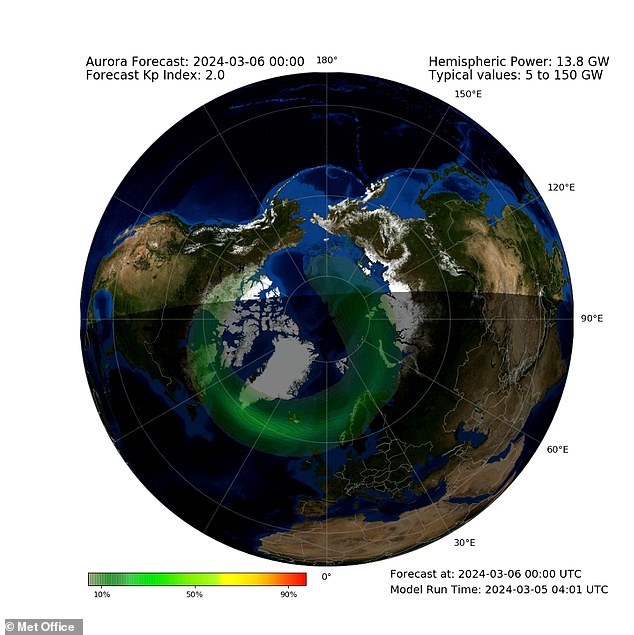

An animation from the Met Office shows the auroral oval around the northern hemisphere, marking exactly where the best chance of seeing the light show is until Friday.

“A coronal mass ejection (CME) is likely to affect Earth on Thursday, March 7,” the Met Office says in a new statement.

“There is a possibility that the aurora could be visible from Scotland and similar geomagnetic latitudes.

“Similar enhancements are slightly more likely to occur in the auroral oval on Friday night.”

Pictured is the auroral oval around the northern hemisphere, marking exactly where the best chance of seeing the light show is.

Twitter user @KmunityOfEquals shared this photo of the Cornish Aurora on Sunday night.

An F-35B Lightning aircraft is parked on a flight deck of the Royal Navy aircraft carrier HMS Prince of Wales, under the northern lights off the coast of Norway, Sunday, March 3, 2024.

The public have already shared photos from Sunday night when the Northern Lights were visible in Wiltshire, Merseyside, Lancashire and even Cornwall.

According to the Met Office, people with a decent camera should be able to capture decent shots of the aurora further south, even when it’s not visible to the naked eye.

“The cameras help, as long exposure lets in a lot of light and enhances colors more than the human eye can see,” a spokesperson said.

“That’s why you sometimes see images as far south as Cornwall, although you’re unlikely to be able to see them with the naked eye that far south.”

The northern lights have fascinated scientists and sky watchers for centuries, but the science behind them has not always been well understood.

The Earth has an invisible force field, the magnetosphere, which protects us from the dangerous charged particles of the Sun, controlled by the magnetic field.

Expert Marty Jopson explains: “While it protects us, it also creates one of the most impressive phenomena on Earth: the northern lights.”

Stonehenge in Wiltshire with the Northern Lights on Sunday March 3, the first major Northern Lights show of 2024 in the UK

The Northern Lights are most commonly seen in places closer to the Arctic Circle, such as Scandinavia and Alaska, so any sightings in the UK are a treat for sky watchers. Pictured, Naworth Castle in Cumbria, March 3, 2024.

This image of Sunday night’s aurora over Giant’s Causeway, Northern Ireland, was posted on Twitter by John O’Neill.

Stunning: Northern Lights at Rhossili Bay, Gower, Wales, taken on Sunday 3 March 2024

“When deadly solar winds collide with Earth’s magnetosphere, some of the charged particles become trapped and are propelled by Earth’s magnetic field lines directly toward the poles.

“And when they reach Earth, they collide with atoms and molecules in our atmosphere, releasing energy in the form of light.”

The problem is that the interruption of our magnetic field creates solar storms that can affect satellites in orbit, navigation systems, terrestrial electrical networks, and data and communications networks.

“Harmful space weather has affected Earth before, but as we become increasingly reliant on systems and technologies vulnerable to blasts from the Sun, future solar impacts could be even more disruptive,” says the European Space Agency. (THAT).