<!–

<!–

<!– <!–

<!–

<!–

<!–

Ocado’s boss said it has ‘hit the ground running’ this year as it was named the fastest growing supermarket in Britain.

Hannah Gibson, director of the online grocer’s joint venture with Marks & Spencer, said it had made a “strong start to the year” as price cuts and an expanded range of middle-class consumers pulled back.

She also welcomed the success of a new range of small, independent brands called ‘makers market’, while the new M&S ranges also proved popular.

The update came after industry figures showed the grocer is growing faster than its competitors thanks to price cuts.

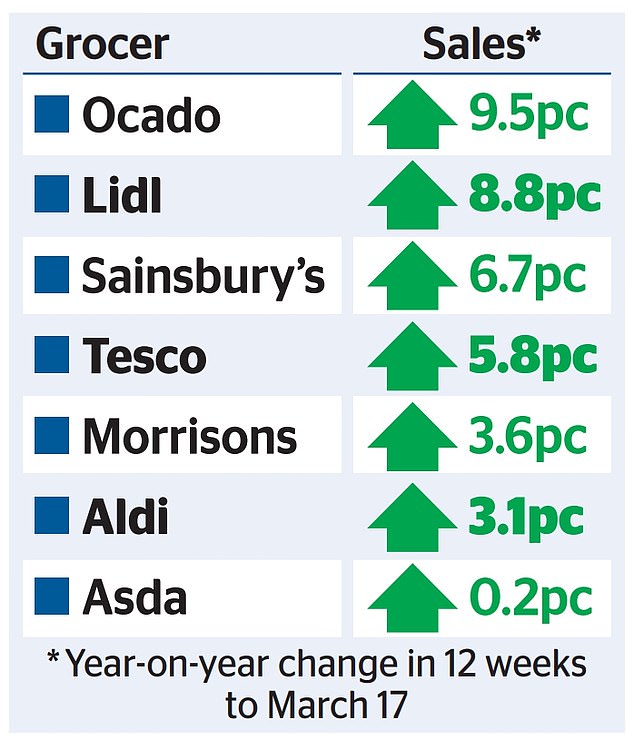

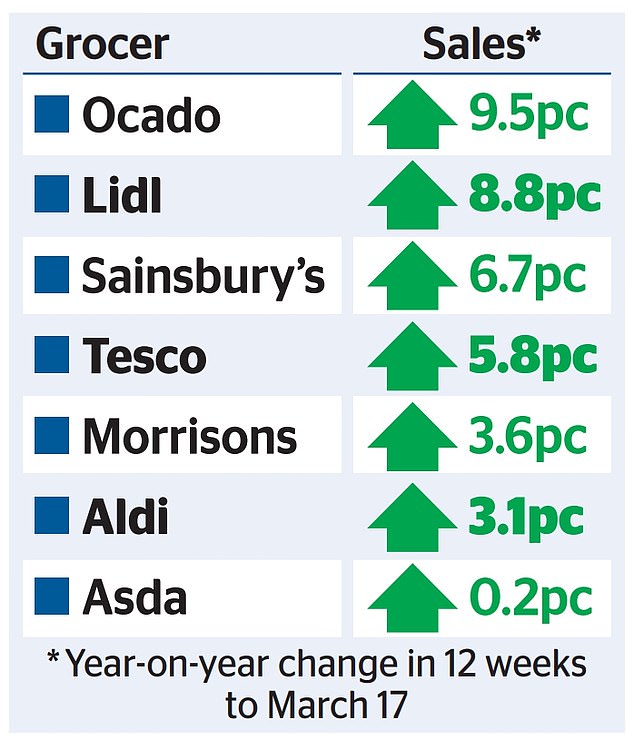

Kantar said sales in the 12 weeks to March 17 were 9.5 percent higher than the same period last year.

Delivering the goods: Ocado’s joint venture with Marks & Spencer made a ‘strong start to the year’ as price cuts and an expanded range of middle-class consumers retreated

That was higher than Lidl on 8.8 percent and Aldi on just 3.1 percent, as well as more traditional grocers including Tesco and Sainsbury’s.

Ocado’s share of the market also rose slightly to 1.9 percent, up from 1.8 percent a year ago.

The positive figures were echoed by Ocado’s own quarterly figures, which covered an earlier time frame than Kantar.

While easing inflation boosted consumer confidence, sales volumes rose 8.1 percent in the 13 weeks to March 3, the grocer’s data showed.

This helped boost total sales by 10.5 percent to £645.3 million in the first quarter of the financial year.

The number of customers exceeded 1 million during the period, up 6.4 percent year-on-year, as customers switched from a “wide range” of competitors, Gibson said.

After a pandemic boom, the supermarket went bankrupt as customers flocked to cheaper rivals as inflation soared.

But they have been pushed back by lower prices, such as a recent discount on 1,700 items.

This comes at a time when pressure on households has decreased and economists are confident that an interest rate cut is in the offing.

M&S bosses have previously been disappointed with Ocado’s dismal performance since its £750m commitment in 2019.

But analysts said the latest figures indicated things were moving in the right direction.

Ocado shares rose 3.3 per cent, or 14.7p, to 467.3p, but are still down around 80 per cent since the pandemic peak in September 2020.