Table of Contents

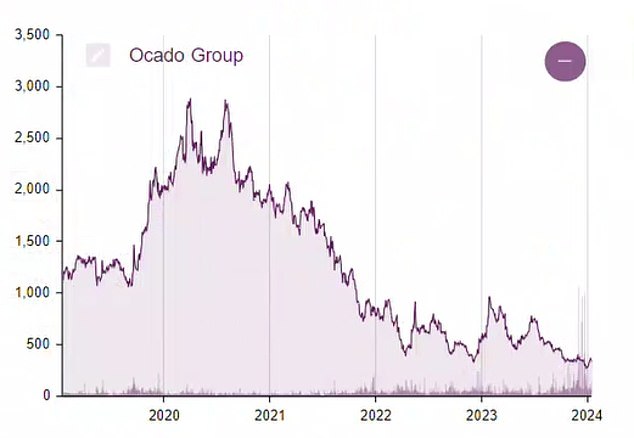

- Ocado shares have fallen almost 90% since their lockdown-induced peak

- Morningstar believes markets are underestimating the potential growth of online grocery retail

Morningstar analysts believe online grocer Ocado is worth almost three times the value suggested by its current share price.

He believes that markets are currently underestimating the potential of the group’s technology, as well as the long-term growth of the online grocery market, which according to Morningstar forecasts will multiply in the next decade.

Ocado shares are down almost 90 per cent since their lockdown-fuelled peak of 2,817p in September 2020, amid concerns over its joint venture with Marks & Spencer and delays in the rollout of its robotic warehouse technology to global third-party retailers.

Ocado investors received a boost on Wednesday after the company reported narrower losses.

Shares received a double-digit boost this week after Ocado posted narrow losses and raised the outlook for its robotic warehouse division, while boss Tim Steiner urged investors to keep faith in the company’s strategy.

Currently trading at 356.3p, Morningstar has backed Steiner’s strategy with a target price for Ocado of 920p.

Michael Field, European equity strategist at Morningstar, said: “Some investors might expect the stock to rally on the back of events after a near 15 per cent move in the share price, but we think there’s much more to this story.”

The rating is a boost to Ocado’s confidence after it lost the support of Bernstein’s brokers, who had been seen as the “last bull” in the group’s shares.

The investment bank cut its rating from ‘outperform’ to ‘underperform’ and reduced its target price from 1,000p to 260p.

“The jam-tomorrow story is now less jam, more tomorrow,” the analysts said, warning that the next three years could be tough for Ocado, with online sales failing to recover after the pandemic, automated warehouses struggling to meet expectations and partnerships with retailers proving tricky.

He added: “We question whether the cultural fit of a high-performing tech company like Ocado works well with slow-moving traditional supermarkets.”

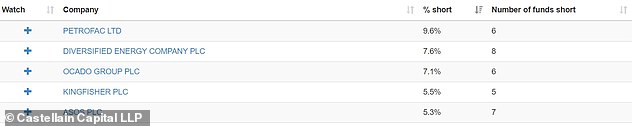

Ocado is among the most shorted stocks on the UK market

Bernstein now questions whether the public market is the “right place for Ocado.” He said the best option was for Ocado to be acquired by U.S. retailer Kroger.

Ocado is the third most shorted stock on the UK market, according to regulatory data, with investors holding 7.1 percent of its shares betting against the company.

But Morningstar believes Ocado’s fair value is much higher given the long-term potential growth of online sales as a proportion of the broader online grocery market, which it forecasts will reach 25 percent by 2040.

Online sales accounted for 13.1 percent of the total UK grocery market share last year, according to research agency Mintel.

Morningstar’s Field said this would deliver “strong growth for both Ocado’s retail and technology solutions businesses”, with the group’s online market share growing by 8-10 per cent.

He told This is Money: ‘The assumptions around most of the revenues and profits we’re talking about here are very far into the future.

‘The market currently believes the technology solutions business will grow around 15 to 20 percent (annually), depending on how optimistic the analysts are, but we think it will grow by 25 percent.

“It doesn’t seem like a huge difference, but a 10 percent difference in growth… over such a long period completely changes the picture.”

Online sales accounted for 13.1 percent of the total UK grocery market share last year, according to research agency Mintel.

Field added that Ocado’s share price spikes in 2020 and 2021 were driven by market estimates suggesting the online share of the grocery market would reach 80 per cent and remain at those levels, which seems “almost fanciful” compared to current estimates.

He added: ‘Some people think that market share will be relatively small even until 2040, which we also think is quite wrong: it doesn’t make much sense that nobody is going to use the Internet and it doesn’t make much sense that 80 percent of people are going to use the Internet.

‘But Ocado will continue to be a leader in technology solutions, it will continue to develop technology that people want when they try to automate fulfilment and infrastructure, for example, and it will continue to be a leader in that space as well.

‘Ocado has been able to generate significant revenue and significant revenue growth in that industry over the last few years.’

Ocado shares have fallen sharply since their peak and remain volatile.

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investment and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free investment ideas and fund trading

interactive investor

interactive investor

Flat rate investing from £4.99 per month

eToro

eToro

Stock Investing: Community of Over 30 Million

Trade 212

Trade 212

Free and commission-free stock trading per account

Affiliate links: If you purchase a product This is Money may earn a commission. These offers are chosen by our editorial team as we believe they are worth highlighting. This does not affect our editorial independence.