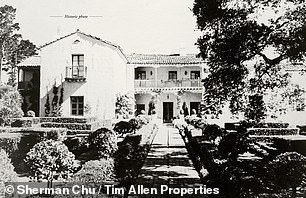

A stunning mansion that is one of the oldest properties in the posh coastal community of Pebble Beach has hit the market for $22.75 million.

The circa-1920 Spanish Revival spans 8,400 square feet and has seven bedrooms.

Situated on an exclusive 6.5-acre estate with stunning views of the Pacific Ocean, the century-old estate has recently been renovated.

Realtor Tim Allen of Coldwell Banker Realty revealed that the beautiful Spanish-style home was one of the first homes built in Pebble Beach.

Pebble Beach is a small coastal residential community on California’s Monterey Peninsula that was founded in 1919.

A stunning mansion that is one of the oldest properties in the posh coastal community of Pebble Beach has hit the market for $22.75 million.

The circa-1920 Spanish Revival spans 8,400 square feet and has seven bedrooms.

Situated on an exclusive 6.5-acre estate with stunning views of the Pacific Ocean, the century-old estate has recently been renovated.

The coastal city is known for its stunning golf courses, gated communities and the ’17 Mile Drive’, which is the main road through Pebble Beach and which non-residents are charged a toll to use.

Selling the exclusive property is Ann Soske, 80, along with her three adult children.

Realtor Tim Allen of Coldwell Banker Realty revealed that the beautiful Spanish-style home was one of the first homes built in Pebble Beach.

Soske purchased the home in the 1970s with her late husband Joshua Soske, who died in 2022.

The couple purchased the Pebble Beach property for $600,000, according to public records.

Originally, the house was built for then-president of the Cypress Point Club of Pebble Beach, Harry Hunt.

Sports Illustrated reported in 1956 that Hunt played a round of golf with President Dwight Eisenhower at the club.

The Soskes made the Pebble Beach house their primary residence, and Stephen Soske, who grew up there with his brothers, recalled, “For a while, we had four horses.”

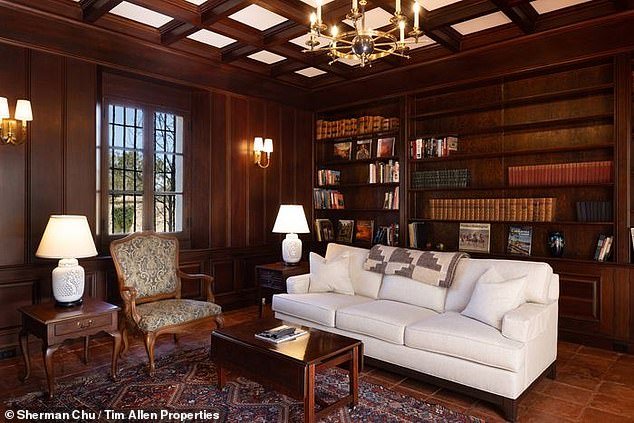

The recently renovated house retains much of its original character, including the Spanish influence, seen here in the tiles on the stairs and curved doors.

The property’s kitchen has been recently renovated, but still shows the Spanish Renaissance influence in the bright backsplash tiles and rough symmetrical brick floor design.

Selling the exclusive property is Ann Soske, 80, along with her three adult children. Soske purchased the home in the 1970s with her late husband Joshua Soske, who died in 2022.

Now that the children are older, the house has become the family’s secondary residence.

For the past few years, Stephen has been overseeing the renovation of the property: “We wanted to update the rooms to make them look more modern, whilst maintaining the heritage and architectural style of the house.”

Pebble Beach is a small coastal residential community on California’s Monterey Peninsula that was founded in 1919.

The home’s original features, such as iron railings and carved wooden doors, were preserved and restored during the renovation.

The unique terra cotta and Douglas fir floors were maintained while the kitchen and master bathrooms were renovated.

Stephen declined to disclose the cost of the home improvement project, but says she will be greatly missed.

“It’s going to be a real loss for our family,” he said.

The home’s original features, such as iron railings and carved wooden doors, were preserved and restored during the renovation.

The Soskes made the Pebble Beach house their primary residence, and Stephen Soske, who grew up there with his brothers, recalled, “For a while, we had four horses.”

The unique terra cotta and Douglas fir floors were maintained while the kitchen and master bathrooms were renovated.

It’s not unusual for Pebble Beach homes to make a lot of money: Another home in the community was listed for sale last month for a staggering $39 million.

The record for the most expensive home sold in Pebble Beach is held by a 3-acre estate that sold for a whopping $36.9 million last year.