Table of Contents

The Government’s plans to deliver 1.5 million homes, combined with cheaper mortgage rates and more optimistic economic data, should be the best news for housebuilders.

These businesses have been suffering from lower sales and low profit margins since Liz Truss’ 2022 mini-budget.

But the policy of “getting Britain built again” should improve its fortunes.

Other sources of joy include the latest figures from the Office for National Statistics (ONS), which show six consecutive months of rising property values.

There is also the prospect of deeper interest rate cuts after inflation fell this week to 1.7 percent. As Russ Mold of broker AJ Bell says, “the stars are finally aligning for the homebuilding sector.”

Rebuild: If you’re thinking about investing in home builder stocks, be prepared to take a gamble and be patient

However, if you’re thinking about investing in homebuilder stocks, be prepared to take a gamble and be patient. This will be a long-term bet on Britain’s enduring love affair with home ownership.

The Government’s chances of re-election in 2029 depend on more young people being allowed to realize the dream of owning their own home. To achieve this goal, it seems likely that ministers will work to overcome opposition to development, and this assumption has sent shares soaring.

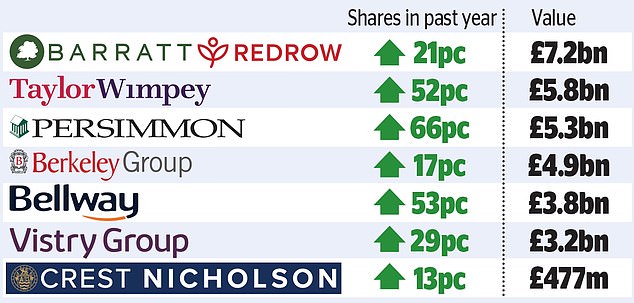

The persimmon price has risen more than 60 per cent to 1,659.5p over the past year and Taylor Wimpey is up 52 per cent to 163p. Over the same period, Barratt rose 21 per cent to 488p. This £7.2bn FTSE 100 group is number one in the industry, thanks to its acquisition of Redrow in August.

But homebuilders seem to doubt the government’s less than encouraging rhetoric. On Monday, Sir Keir Starmer made big promises about cutting red tape, signaling a wide-ranging planning shake-up, with the reintroduction of local housing targets and development on chunks of green belt land that have been named ” gray belt”. .

However, on Tuesday Bellway, Britain’s fifth-largest housebuilder, accused ministers of “disparaging” the housing market and thus curbing customer enthusiasm.

Oliver Creasey, property analyst at wealth manager Quilter Cheviot, says: “Housebuilders may have the land and money to build homes, but they also need a motivated clientele.”

Bellway cited talk of tax increases in Chancellor Rachel Reeves’ first budget that might not be accompanied by incentives. It seems almost certain that stamp duty benefits will end next April.

This means that the initial rate of this tax will return from £250,000 to £125,000.

The introductory rate for first-time buyers will be reduced from £450,000 to £300,000.

Reform: Deputy Prime Minister Angela Rayner

There is also unlikely to be a replacement for Help to Buy. This controversial plan helped thousands of people who could not rely on a subsidy from the Bank of Mom and Dad. But as Creasey points out, Help to Buy was also a boon for housebuilders’ bosses and shareholders.

Possible tax increases are not the only obstacles facing the sector. Other challenges include a shortage of qualified construction workers and short-staffed planning departments.

The consequences of the Grenfell Tower fire in 2017 are another factor. In the wake of the report on the tragedy, Deputy Prime Minister Angela Rayner appears set to give builders 18 months to repair poor cladding on the blocks. Companies have set aside money for these expenses, but acceleration will be costly as there are so few fire engineers.

In August, Bellway was on the verge of buying Crest Nicholson for £720m. But the meeting was abandoned, apparently because of the size of Crest’s remediation bill. Crest is also dealing with defects on some of its older sites.

There is more. Vistry, number two in the league of homebuilders, should be able to build on the push for affordable housing, which is his specialty. But this FTSE 100 business could be distracted by a cost-estimating error at its southern division, which sent its best-performing shares into a downward spiral. The price is down 29 percent this month.

The Competition and Markets Authority (CMA) is also investigating evidence of price fixing among the eight largest companies. But despite these factors, investors remain optimistic, although their optimism is tempered by caution.

Alan Dobbie, manager of the Rathbone Income Fund, which owns Persimmon and Taylor Wimpey, says: ‘Changing the planning system will not be quick or easy. Nimbist objections will still exist and Starmer may find that upsetting small but vocal sections of the electorate is less attractive in reality than in the abstract.’

Aurora Investment Trust owns Bellway and Barratt. Gary Channon, the trust’s manager, is also optimistic about the prospects, but not overly confident. It warns: “We do not believe (the Government) can come close to its target of 1.5 million new homes within its five-year parliamentary mandate.”

In this context, if you already own homebuilder shares, it seems worth holding on. Analysts have set an average price target of 581p for Barratt Redrow, with one analyst predicting a jump to 760p.

Analysts have lowered their price target on Vistry shares. JP Morgan’s target was 1550p. It is now 970p, up from 968.5p today. Crest Nicholson is at 185.7p, but analysts’ average price target is 227p.

If you’re looking to grow your portfolio, analysts rate Bellway a “buy.”

The shares have risen 53 per cent over the past year to 3,222p, but Jefferies believes further gains could be possible, setting a price target of 3,646p.

Other notable options from Jefferies include Persimmon. The brokerage has set a target price of 1,969 pence for these shares.

Like other analysts, this broker also likes Taylor Wimpey, setting a target of 191p, up from the current 162.95p.

Participating in any of these companies is a bet for UK plc. But it’s also a waiting game. Barratt is establishing a partnership with Homes England and Lloyds to build “garden villages” and develop on brownfield land.

But RBC analyst Anthony Codling doesn’t expect people to move into these homes “until 2028-29 at the earliest.”

The Government hopes that other housing construction projects will produce results somewhat sooner.

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free Fund Trading and Investment Ideas

interactive inverter

interactive inverter

Fixed fee investing from £4.99 per month

sax

sax

Get £200 back in trading fees

Trade 212

Trade 212

Free trading and no account commission

Affiliate links: If you purchase a This is Money product you may earn a commission. These offers are chosen by our editorial team as we think they are worth highlighting. This does not affect our editorial independence.

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.