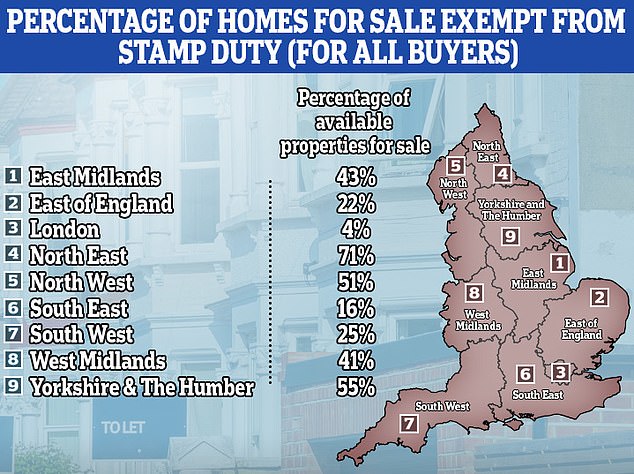

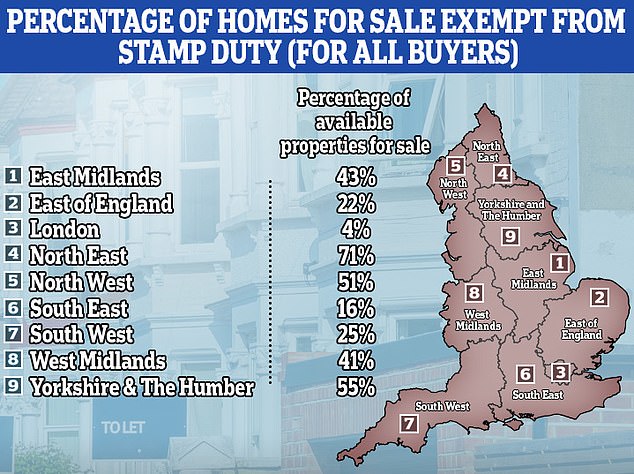

There is a stark North-South divide on stamp duty, as new data shows how few homes in the south of England are exempt from the tax.

Only 4 per cent of homes for sale in London are exempt from stamp duty, compared to 71 per cent in the North East, Rightmove data shows.

There is currently no stamp duty on properties in England priced up to £250,000, but the chances of finding one are significantly reduced in southern areas.

The Midlands score better, but they are the northern areas where buyers are most likely not to receive a tax bill worth thousands of pounds just for moving house.

Rightmove has revealed the percentage of homes for sale in regions across the country that are exempt from stamp duty (for all buyers)

Stamp duty is charged in increasing percentages above certain thresholds. The current stamp duty threshold of £250,000 will be reduced to £125,000 next year.

On the part of the price between £250,000 and £925,000, stamp duty applies at 5 per cent.

The next £575,000 (the part between £925,000 and £1.5 million) is debited at 10 per cent, and the remaining amount (the part above £1.5 million) is debited at 12 percent.

Tax bills: the percentage of homes for sale in different regions that would be exempt from stamp duty for homebuyers

So, for example, if someone buys a typical house for £295,000, stamp duty is currently 5 per cent on the £45,000 price above the £250,000 threshold, i.e. £2,250.

Relief is available, even if the property is a first home. In this scenario, a buyer pays no stamp duty up to £425,000 and 5 per cent on the £425,000 to £625,000 portion. If the price is over £625,000, first-time buyers cannot claim the help.

Buy-to-let homeowners and second home buyers must pay a 3 per cent surcharge on top of standard stamp duty.

> Stamp duty calculator: How much would you pay to move house?

According to Rightmove data, the south east has 16 per cent of homes available stamp duty free, the east 22 per cent and the south west 25 per cent.

On the other hand, 55 per cent of homes in Yorkshire and the Humber are exempt from stamp duty, followed by North West at 51 per cent and Easy Midlands at 43 per cent.

This leaves buyers in the worst affected areas having to shell out large amounts of money simply to cover moving costs, something that has sparked calls for stamp duty reform in the Spring Budget on 6 March.

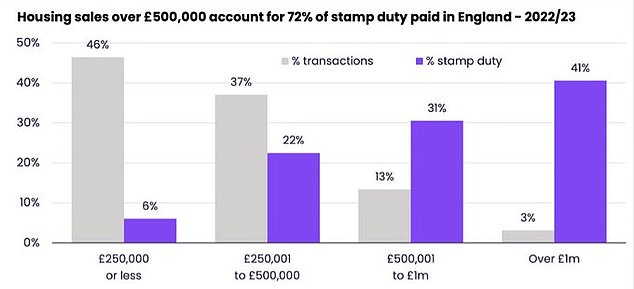

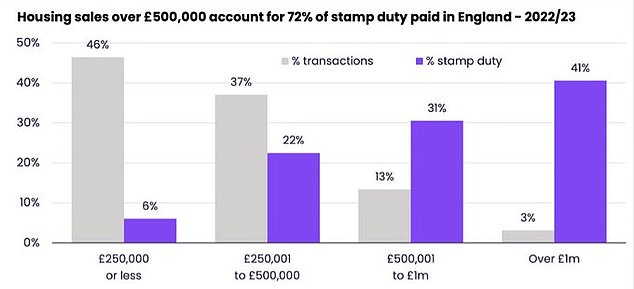

Uneven burden: Zoopla highlights how much of the stamp duty collected comes from homes over £500,000

| Region | Percentage of homes for sale exempt from stamp duty for all buyers | Percentage of homes for sale exempt from stamp duty for first-time buyers |

|---|---|---|

| East Midlands | 43% | 82% |

| East of England | 22% | 62% |

| London | 4% | 28% |

| Northeast | 71% | 91% |

| northwest | 51% | 82% |

| Southeast | sixteen% | 52% |

| South west | 25% | 66% |

| West Midlands | 41% | 79% |

| Yorkshire and the Humber | 55% | 85% |

| Source: right movement | ||

Rightmove’s findings also revealed the percentage of properties available for sale exempt from stamp duty for first-time buyers.

Once again, the most affected region was London at 28 per cent, while the least affected was also the North East at 91 per cent.

Tim Bannister, of Rightmove, said: “Stamp duty is a big barrier to moving, and some who would potentially consider a move are likely to be put off by high stamp duty, plus other moving costs.”

Raising stamp duty thresholds in line with these regional variations would seem a logical first step for stamp duty reform.

‘At a minimum, the Government should consider making the current changes to stamp duty charges for first-time buyers permanent, with the higher thresholds introduced in 2022 expiring next year.

‘However, we believe there is an opportunity to go one step further. With such regional variations in property prices, increasing stamp duty thresholds in line with these regional variations would seem a logical first step for stamp duty reform.

“While longer-term supply measures are also needed, this could be a way to help first-time buyers trying to get on the ladder in more expensive areas of England.”

Tomer Aboody, of property lender MT Finance, said: “Stamp duty reform would be very positive for the property market as it would give people the opportunity to move up or down the road, putting the savings towards deposits or house renovations. home”.

‘Some help would also be helpful for the shrinking market, reducing or eliminating stamp duty for those moving up the ladder, encouraging older people to sell larger homes. In turn, this would bring more inventory to the single-family home market, which is crying out for homes.’

There are calls ahead of the Spring Budget on March 6 to reform stamp duty

Savings for first-time buyers

Zoopla added that it is calling for the current tax relief for first-time buyers to be made permanent.

According to property website Richard Donnell, more than 90 per cent of first-time buyers currently looking for homes on Zoopla would not pay any stamp duty.

In England, 203,300 first-time buyers claimed stamp duty exemption in 2022/23, saving £3,500 per purchase on average, the equivalent of £708 million in total, according to Zoopla.

It said 150,000 first-time buyers did not pay any stamp duty, meaning they bought properties under £425,000.

Meanwhile, 53,000 people had to pay partial stamp duty because they bought a property costing between £425,000 and £625,000 – the part of the property price that carries a 5 per cent stamp duty charge.