Shares of New York Community Bank fell 24 percent Friday morning after the struggling lender announced new leadership and reported an additional $2.4 billion loss.

The bank, with 420 branches and hundreds of thousands of customers, has faced a crisis in recent months after the quality of its commercial real estate loans deteriorated and rating agencies downgraded its credit status to junk.

Companies are giving up offices and retail spaces downtown, after Covid normalized working from home and catalyzed the decline of downtown shopping.

That left commercial building owners unable to pay lenders like New York Community Bank (NYCB). About 16 percent of its loans are for commercial real estate acquisition, development and construction.

Two weeks ago, Shark Tank star Kevin O’Leary wrote in a column for DailyMail.com that small regional banks are “dinosaurs” and predicted that “NYCB will be gone in three months.”

New York Community Bank Has Been Facing a Crisis Over Soured Commercial Real Estate Loans

The Shark Tank star recently predicted that the bank would disappear completely within months

“If your bank is in the news, be worried,” O’Leary wrote.

On Thursday, the Long Island-based bank was in the news again after it revised its fourth-quarter results to report losses 10 times larger than it had previously posted, citing the $2.4 billion charge it associated with pre-2007 purchases. .

The bank’s share price first fell in late January after it cut its dividend and posted a surprise loss.

On the last day of the month it plummeted 38 percent, from $10.38 to $5.47. Since then it continued to decline until last night’s big drop. Losses since January now stand at around 64 percent.

On Thursday, the bank also announced that its CEO, Alessandro DiNello, would assume the role of president and CEO, effective immediately.

NYCB also noted that it had found “material weaknesses” in the processes it uses to evaluate risks associated with loans.

It also hurts NYCB, which is a major lender to New York apartment owners, many of whom have taken hits to profits from multifamily residences after New York tightened rent controls in 2019.

“To be sure, the situation looks a little uncertain at NYCB right now,” Piper Sandler analyst Mark Fitzgibbon wrote in a note to clients.

“We fear additional problems will arise as a new team takes the reins,” he added.

Covid normalized working from home and catalyzed the decline of downtown shopping

In the photo, the Chrysler building in New York: office buildings face more and more empty spaces

But in a statement Thursday, DiNello assured that the bank would weather the storm.

“It is my mandate as president and CEO, together with our board of directors, to continue our transformation into a larger, more diversified commercial bank,” he said.

“While we have faced recent challenges, we are confident in our bank’s direction and our ability to deliver for our customers, employees and shareholders over the long term.”

The bank also revealed in that statement that its chairman of the board would be replaced by Marshall Lux.

But like Kevin O’Leary, experts and industry bodies are not as optimistic about the future of regional lenders.

About $929 billion of outstanding commercial mortgages held by lenders and investors will mature in 2024, or 20 percent of the $4.7 trillion in total outstanding debt, according to recent data from the Mortgage Bankers Association.

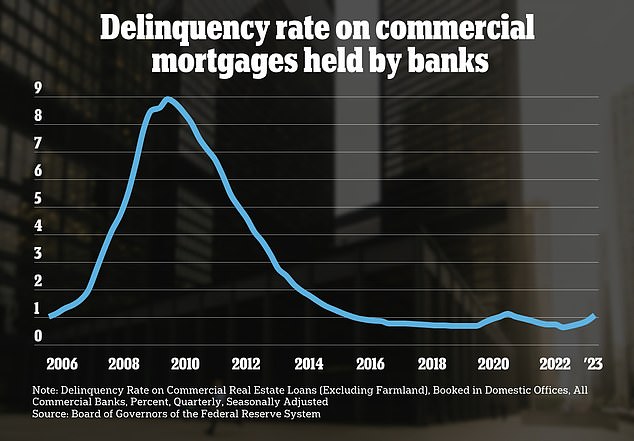

The commercial mortgage delinquency rate, a leading indicator of defaults, rose last year but is so far well below the level seen in the Great Recession, when it approached 10%.

And about 14 percent of all commercial real estate loans and 44 percent of office loans appear to be “underwater,” with current property values that are less than outstanding loan balances, according to a recent study. worksheet for the National Bureau of Economic Research.

“If nothing changes, if interest rates remain high and property values do not improve, we see defaults at the pace of the Great Recession, and indeed even higher, as a strong possibility,” said one of the co-authors. from Columbia Business. School teacher Tomasz Piskorski recently told DailyMail.com.

Piskorski said he and his co-authors view a commercial mortgage default rate of 10 percent or more as “quite likely” given the current proportion of underwater loans.

“This is the icing on the cake that can really create a problem for quite a few banks, mainly small and medium-sized banks.”