Table of Contents

The most expensive private colleges aren’t worth it, a shocking new report shows.

The analysis ranked 1,500 colleges and universities by comparing graduates’ earnings with what they paid for their degrees.

Those with an Ivy League degree easily got their money’s worth even though they paid a lot of money for their education, as such qualifications give graduates the highest-paying jobs.

But if they weren’t admitted to an Ivy League school, they should think twice before going to what is often considered the next best.

That’s because below those eight top-tier schools, spending money on a degree from prestigious private non-Ivy schools like Tulane, Oberlin, and the University of Southern California doesn’t guarantee the same “return on investment.” “.

Ivy League universities offered the highest return on investment ten years after enrollment. Pictured is Lockhart Hall at Princeton University. It had the highest return on investment of any Ivy League at $340,000.

Instead, the study found that “flagship” public universities offer better returns on investment ten years after enrollment than prestigious and selective private schools, sometimes known as the “hidden ivies.”

Flagship public schools include those such as UC Berkeley, UCLA, the University of Michigan, the University of North Carolina at Chapel Hill, and the University of Virginia.

The analysis by Bloomberg used estimates from the Georgetown Center on Education and the Workforce, and publicly available tuition and earnings data for graduates who accepted federal financial aid.

To calculate the return on investment, the report analyzed the average cost of a degree at each university. He compared that to the average total earnings of that university’s graduates over the ten years after they enrolled.

The difference (subtracting commissions from income) was called return on investment.

Ivy League (e.g. Princeton University)

Return on investment: $265,500

Price – $75,000 – $80,000 per year

Degrees from Ivy League universities had by far the highest return on investment despite their very high costs.

The Ivy League is made up of the following eight institutions: Brown, Columbia, Cornell, Dartmouth, Harvard, Princeton, the University of Pennsylvania and Yale.

Elite Soldiers (e.g. University of Southern California)

Return on investment: $135,000

Price – $70,000 – $80,000 per year

By comparison, prestigious private universities such as Fordham, Rice, Duke and Northwestern cost between $70,000 and $80,000 a year, but only offer returns of about $135,000 compared to the $265,500 that Ivy League degrees generate.

While they can offer quality education and good income, in many cases this is offset by their high price.

The study’s authors defined elite private schools based on a list provided in Howard and Matthew Greene’s book The Hidden Ivies, of which there are 63.

The University of Southern California had an average annual cost of attendance of more than $77,000 a year. Their return on investment was $170,000 after ten years, according to the analysis.

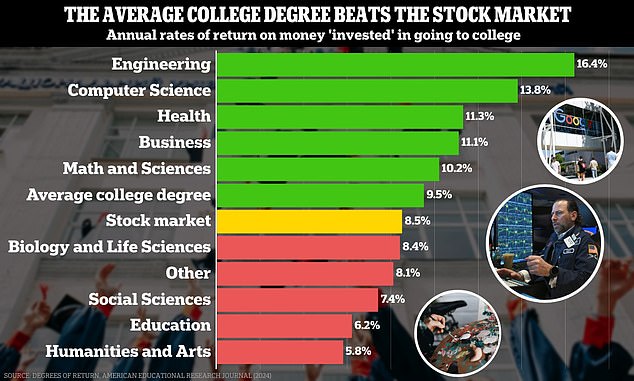

Going to college is almost always worth it, new research shows. He found that most college degrees offer better returns than the stock market.

Pictured is the home of the University of Southern California Trojans football team. The average annual cost of attending college is more than $77,000 a year. Your return on investment is $170,000 after ten years, according to the analysis

Flagship audience (e.g., University of Texas at Austin)

Return on investment: $148,000

Price – $20,000 – $40,000 per year

Therefore, a better option may be reputable public universities, which were worth an average of $148,000 despite costing between $20,000 and $40,000 a year.

These are the most prominent public institutions in various states. They include the University of Florida, Pennsylvania State, the University of Texas at Austin and the University of Illinois Urbana-Champaign.

‘If you buy an Ivy, the return on investment will be excellent. But if you’re part of the 99 percent of students who don’t get in, regional and state flagship schools can punch above their weight and enable a strong return on investment,’ Michael Itzkowitz, founder of HEA Group and former director of College Scorecard, said to Bloomberg.

The University of Texas at Austin had a return on investment of $176,000 and an annual cost of attendance of about $27,000.

Aerial view of the University of Texas at Austin campus. Your return on investment is $176,000 and your annual cost of attendance is around $27,000.

Public (e.g. Iowa State University)

Return on investment: $118,000

Price – $5,000 – $40,000 per year

The same trend was observed even among non-elite private universities and non-flagship public universities: public colleges Auburn in Alabama and the City University of New York outperformed their private counterparts.

They generally cost around $20,000 a year, but still generate promising returns well above $100,000.

For example, Iowa State University costs only about $22,000 a year, but its degrees offer an average return of $153,000 after ten years.

Some of the top-performing universities in this category were Missouri University of Science and Technology, the University of Connecticut, and several maritime academies.

Private (e.g. Syracuse University)

Return on investment: $82,000

Price – $10,000 – $80,000 per year

The private category ignores the eight Ivy League schools and the list of 63 elite and expensive Hidden Ivies.

The cost of attending regular private universities varied greatly, although most amounted to more than $40,000 a year. Syracuse in New York had a return on investment of almost $115,000 and a cost of almost $73,000 a year.

Meanwhile, Southwestern Baptist University in Missouri had an annual cost of attendance of about $35,000 and a return of $75,000.

It’s worth noting that because the study only considered students who received financial aid, it ignored the future income of those who paid out of pocket. It also does not consider lifetime earnings, only those earned about five or six years after graduation.

Some private universities argued that this skewed the results against them.

“It’s impossible to sum up a given university’s excellence in one ranking, especially one that only looks at success in terms of dollars and cents,” Oberlin spokesperson Andrea Simakis told the outlet.

He noted that the school’s graduates are well represented among Grammy winners and MacArthur genius fellows.

In general, many arts schools were expensive and generated low or even negative returns. Examples include the Pennsylvania Academy of the Fine Arts, Berklee College of Music, and the California Institute of the Arts.

An independent study recently found that investing in a career generally generated higher returns than the stock market.

Almost all of the majors that generated the highest salaries for graduates were in engineering

In contrast, schools that offer more science, technology, engineering and math courses had higher returns.

“Not only does this study fail to capture the lifetime return on investment (ROI) for these individuals, it also fails to capture the return on investment (ROI) for the world,” the Oberlin spokesperson said.

Recently, another report showed that the salaries Americans earn after graduation vary dramatically depending on their major. After five years, those who studied engineering earn more than twice as much as those who dedicated themselves to the arts.

Meanwhile, there has been concern that the costs of college degrees are skyrocketing: the annual cost at Vanderbilt University reaches nearly $100,000 a year. Students at the private university face a bill of $400,000 for a typical four-year course.

Columbia University has been in the news in recent weeks for camps in Gaza where students have expressed support for Hamas. One October 7 survivor criticized protesters for “supporting a terrorist regime” and said they “would not last a day” under Hamas rule.