Table of Contents

New data has revealed that a rise in the price of new-build homes over the past twelve months may be masking what is really happening in the property market.

The cost of the average new build in Britain has risen by a whopping 17.2 percent in the 12 months to November 2023, according to the latest government data.

And although prices for new construction have skyrocketed, the price of existing homes appears to have fallen as a result of higher mortgage rates.

This is hidden in the house price indexes, which tend not to break down their figures by property type and have therefore been reporting that average house prices are rising for several months.

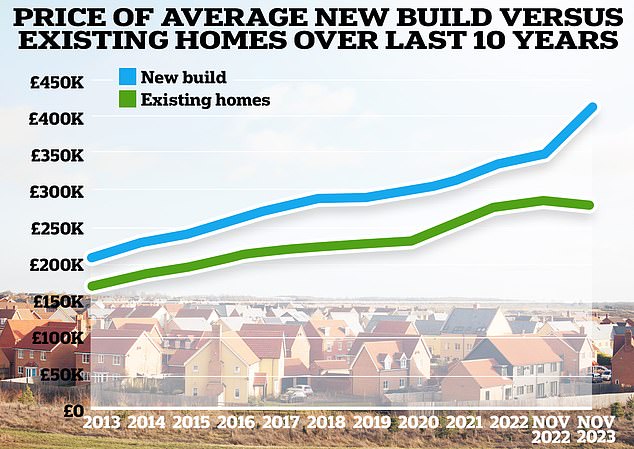

Gap emerges: The typical new home sold for £413,032 in November 2023, compared to the average existing home, which sold for £282,440

But the typical non-new build property, which makes up the vast majority of transactions, actually fell in value by 2.4 per cent in the 12 months to November, according to figures from the Office for National Statistics.

The typical new home sold for £413,032 in November 2023, compared to the average existing home of £282,440.

Historically, both new construction and existing homes have risen and fallen in price at about the same pace. So why are new homes suddenly moving forward?

> Are new-build homes more expensive? We crunch the numbers

Thanks to research from Aprao, a real estate development valuation software company, we were able to compare the price of the average new-build home over time with that of existing homes.

In the ten years leading up to 2023, prices of new-build homes rose by 60 percent, while existing homes rose by 63.5 percent.

On an annual basis, this meant that new construction increased by an average of 5.4 percent per year, compared to existing homes, which increased by 5.6 percent.

But in 2023, it is clear that new-build homes have been the driving force that has kept overall property prices up – and in many regions, strong growth in the new-build sector has even helped to support what would otherwise have been falling house prices.

New builds more expensive in all UK regions

According to Aprao’s analysis, new build values have outperformed existing homes in all regions of Britain.

For example, the average new construction in the Northeast increased in price by 20.9 percent last year. However, existing stock on the market fell by 0.8 percent.

In London, the average new-build home increased in value by 11 percent in the twelve months to November. Meanwhile, existing shares in London fell by an average of 4.4 percent.

In Scotland, the average new build price was up 18.7 per cent in the 12 months to November, compared to a 1 per cent fall in the value of existing stock.

Your browser does not support iframes.

Why are new construction prices rising?

Some real estate experts believe that developers have effectively increased new construction prices by reducing supply.

Last year, sales volumes took a hit amid higher mortgage rates. According to HMRC figures, residential property transactions will have fallen by 19 per cent in 2023 to just over 1.02 million.

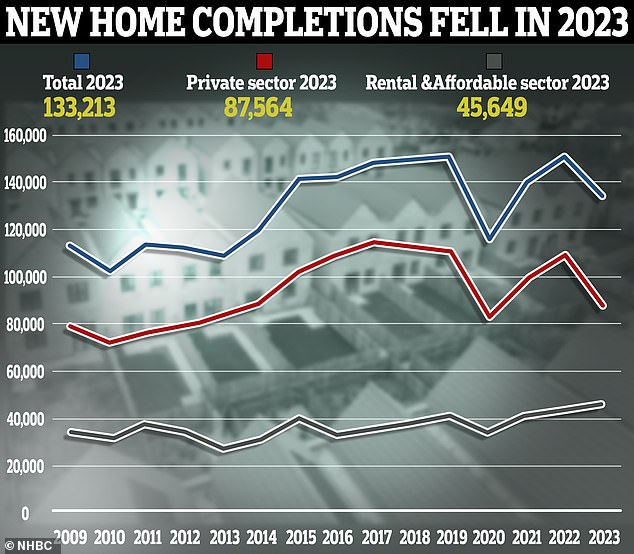

Faced with this falling demand from buyers, many house builders and developers appear to have cut back on construction, according to figures from the National House Building Council.

Figures from the NHBC show that 87,564 new homes were completed in the private sector in 2023, a drop of 20 percent compared to 2022, when 109,829 were completed. Completion means when a plot is ready for occupancy.

Less built: New-build homes completed in 2023 have fallen by 20% compared to 2022

Are homebuilders waiting to jack up prices?

Home builders are sometimes accused of hitting hard times on construction projects, slowing the rate at which they complete homes so they can sell them at higher prices after the market recovers.

This causes the supply of housing to decrease and prices may rise due to more competition. Is that what’s happening here?

Peter Bill, property author and commentator, says: ‘The disproportionate increase in the price of brand new homes is directly linked to the deliberate 15 to 20 per cent reduction in supply by major housebuilders. They have successfully maintained prices by reducing supply.”

House builders will also have seen their margins squeezed by rising construction and financing costs.

According to a separate analysis from Aprao, the average cost of building materials has increased by 33.2 percent since 2019.

Some things have increased more than others. For example, insulation materials have increased by 61.4 percent, prefab concrete products have increased by 55.8 percent and plastic doors and windows have increased by 49.6 percent.

> True Cost Mortgage Calculator: Check what a new fixed rate would cost

Shovels in the ground and cranes in the air: since 2019, the average cost of building materials has increased by 33.2% according to Aprao analysis

Daniel Normal, CEO of Aprao, said: “The pandemic brought a host of challenges for the country’s housebuilders, with restrictions around the production and import of building materials leading to a rise in costs.

“But even though the pandemic itself is long behind us, we can say that the same challenges still exist today, with the cost of many materials remaining higher than a year ago.

‘At the same time, developers are confronted with higher costs on other fronts, with higher interest rates playing a role, while their wage bill will also have increased.’

Peter Bill believes that the combination of lower buyer demand and additional construction and financing costs will have led to many housebuilders cutting back on the stock they make available.

Peter Bill is the author of Property Planet and co-author of Broken Homes: Britain’s Housing Crisis: Faults, Factoids and Fixes

He says: ‘A homebuilder or developer must be certain of how much a property will sell for before purchasing a plot. A developer almost always aims for a profit of at least 20 percent.

‘For example, if a developer initially forecasts that his income from sales will be £1,000,000, he will build £200,000 of profit into his figures. They say they have estimated the construction cost at £600,000. That leaves them with a budget of £200,000 to buy the land or old building.

“They acquire the land and make plans to start construction. However, due to higher mortgage rates, the company now expects the project to sell for £900,000 instead of £1,000,000. That will halve their £200,000 profit.

“Meanwhile, higher-than-expected construction costs could also eat into their profit margins.

‘Large house builders are luckier than smaller developers. They can afford to wait for prices to recover, rather than selling at lower margins – or at a loss.

“Instead, they’re cutting costs and slowing the pace of construction, rather than lowering prices.”

However, Anthony Codling, head of investment bank RBC Capital Markets’ European housing and building materials division, believes the price rise is ultimately driven by buyer demand.

‘New construction prices only rise when demand exceeds supply. If the homes are not sold, prices will fall.

Anthony Codling, head of European housing and building materials for investment bank RBC Capital Markets

“Looking at the market, mortgage rates are lower than they were a few months ago and wages are rising, so homebuyers can now afford to spend more than they did a few months ago.”

Instead of housebuilders deliberately cutting back on supply, Codling argues that an inadequate planning system is holding them back.

“Homebuilders are eager to sell more homes,” Codling says. “There are very few, if any, companies trying to sell less product than they could.

‘The problem housebuilders face is a planning system that is moving at a slow pace, housing targets have been scrapped, funding for planning departments has been cut and therefore fewer planning permissions are being granted.

‘It’s the planning system that’s holding back housing supply, not housebuilders; they are busy building houses.

Codling added: ‘Building costs continue to rise, but housebuilders cannot automatically pass these costs on to homebuyers, as remember that for every new build there are seven or eight second-hand alternatives where the building costs have long been forgotten and are therefore no longer possible. are. has no influence on the price.’

According to Codling, if new-build homes were to reduce prices and sell at prices lower than market value, it would be ‘commercial suicide’, especially if they then run out of houses to sell.

He adds: ‘Housebuilders’ profits have already fallen significantly, margins are down by around 50 per cent across the industry, and if housebuilders run out of money and go bankrupt we will get even fewer new homes, so we must be careful about what we do. wishes for.’

*Note: the data on the prices of new-build and existing homes are based on ONS data from the Land Registry. Data on house prices in Northern Ireland have not been taken into account. Prices in Northern Ireland are based solely on quarterly figures.

Some links in this article may be affiliate links. If you click on it, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow a commercial relationship to compromise our editorial independence.