A new mortgage product has been launched that promises to help first-time buyers get onto the property ladder with just a £5,000 deposit.

Yorkshire Building Society is the lender behind the new proposal and will allow first-time buyers in England, Scotland and Wales to purchase a property worth up to £500,000 with a £5,000 deposit.

It means that first-time buyers may be able to get on the ladder with as little as a 1 percent deposit.

Yorkshire Building Society is the latest lender on the market to launch a new deal to support the first-time buyer market, but not available for new build homes or apartments

The new mortgage is available directly to customers and through brokers through Accord Mortgages – the lender’s sole broker arm.

Buyers will have to lock in an interest rate of 5.99 percent for five years, which is higher than most rates currently on the market. However, there are no product costs involved.

On the typical £200,000 mortgage for a first-time buyer, that would equate to paying £1,170 per month, if repaid over 25 years.

The mortgage is not available for the purchase of apartments or new-build homes.

Those who apply will also be subject to strict credit scoring and affordability checks.

Yorkshire Building Society’s new deal is not the first to offer a low-cost route to home ownership.

Skipton Building Society made headlines last year when it launched a 100 per cent mortgage for tenants, allowing them to get onto the property ladder without a deposit.

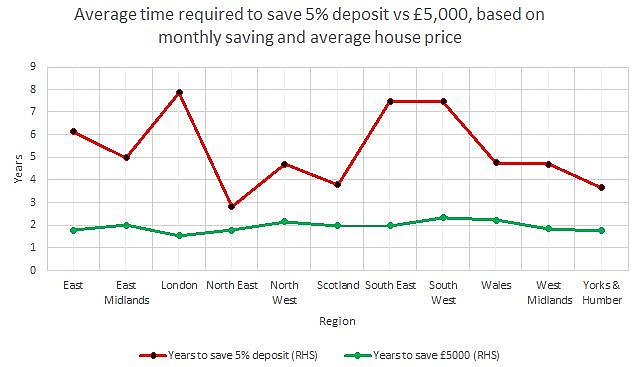

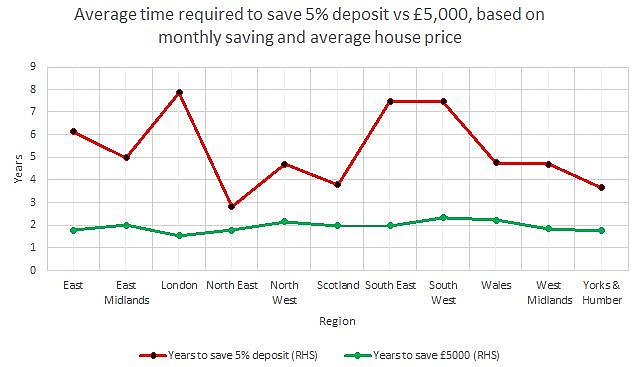

Average savings: Analysts at Yorkshire BS think allowing a deposit of just £5,000 would make a huge difference to first-time buyers as it would reduce the time it takes them to save

Another product that can help first-time buyers get on the ladder without a deposit is the Barclays Springboard mortgage, although this requires family and friends to help with the deposit.

In this case, the helper provides a 10 percent deposit as security for five years and it is placed in a Helpful Start account that earns interest and is repaid after five years.

However, there is thought to be limited adoption of these types of products.

Nicholas Mendes, mortgage technical manager at estate agent John Charcol, says: ‘Those who would benefit from such a deal are likely to be high earners and potential buyers with good credit scores, who simply have not been able to put down a deposit during the crisis. high rents.

Expert view: Nicholas Mendes, mortgage technical manager at John Charcol, thinks the new mortgage product could benefit high-income earners and those with good credit scores

‘While it is encouraging to see lenders launching new products and expanding their existing criteria, sometimes these do not always have the desired effect – especially when considering similar options on the market that help borrowers overcome affordability or deposit barriers.

‘For example, Skipton’s mortgage, Barclays’ springboard or even the recent Own New proposal all support the first-time buyer and home mover market, with fewer caveats and in some cases cheaper rates.’

Ben Merritt, mortgage director at the Yorkshire Building Society, said research from the mutual society has shown that £5,000 is the right amount of deposit needed for first-time buyers.

It said it would reduce the time it takes to take out a mortgage regardless of where they live in the country.

‘Our analysis found that a £5,000 deposit – compared to a typical 5 per cent – would make a huge difference to first-time buyers across the country, by reducing the time it takes them to save and acquire their own home. shortening, of a maximum of 7.5 percent. years (in London), to about 2.5 years,” he said.

‘Although £5,000 represents a 1 per cent deposit for those who need to borrow the maximum amount available, the key is that customers will still be putting money into a deposit, they will still need to demonstrate strong credit and pass an affordability assessment to qualify for a mortgage of £5,000.

‘We have a duty to encourage financial responsibility among everyone who takes out a mortgage.’

Last year, the Leeds Building Society reported that there will be 426,000 fewer first-time buyers entering the housing market over the next five years, compared to the 40-year average of 340,000 first-time buyers per year.

This is partly the result of the increase in mortgage interest rates in recent years.

Yorkshires Our own research shows that 38 percent of starters now receive financial help from friends and family to get on the ladder.

“It creates a level playing field for those who don’t have family financial support to fall back on,” Ben Merritt added.

‘Our research into first-time homebuyers has shown that 78 per cent of people in this category feel that owning a home is becoming an elite privilege, while 63 per cent say Britain is in danger of becoming a nation of renters to become.

‘This is a situation that we believe should not continue. WWe hope this £5,000 mortgage will help first-time buyers overcome the barrier to buying their own home, as we believe this group deserves a chance at home ownership.”

Some links in this article may be affiliate links. If you click on it, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow a commercial relationship to compromise our editorial independence.