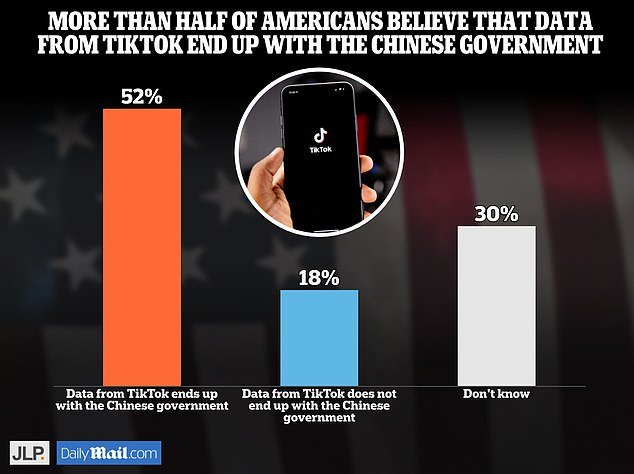

More than half of Americans believe that data collected by the popular social media app TikTok ends up in the hands of the Chinese government, according to the latest JL Partners/DailyMail.com 2024 survey.

However, huge enthusiasm for the site among young users means the public is divided over whether to ban the app.

The results indicate that Americans are becoming more wary of the Chinese-owned app as lawmakers consider legislation that could lead to the company being banned from U.S. phones.

In a survey of 1,000 likely online voters, 52 percent said they believe Chinese Communist Party (CCP) officials can gain access to social media data, including that of TikTok’s 170 million American users.

Even allowing for the 3.1-point margin of error, Americans still largely think the data can be accessed in China.

TikTok fans descended on Capitol Hill earlier this month to protest a bill that could ban the app in the U.S. if China-based parent company ByteDance doesn’t divest the company. .

On the other hand, 18 percent of Americans do not believe the Chinese government can access TikTok data, while 30 percent responded “I don’t know.”

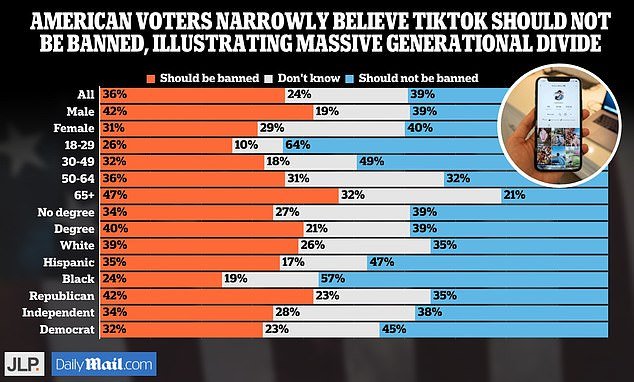

Age is a major factor among those who believe TikTok data ends up in the hands of the Chinese government.

The CCP cannot access TikTok data, 44 percent of people between 18 and 29 responded. This was the cohort most likely to think that.

While most people 65 and older believe the opposite, 65 percent say the CCP can access data. Only four percent of those in that age group said the Chinese government did not have access to the data.

But Americans don’t necessarily think the app should be banned.

By a narrow margin, 39 percent of likely voters believe the app should not be banned, while 36 percent of voters believe it should be banned.

However, 24 percent responded that they do not know.

Once again, age appears to be the main divider between those who believe the app should and should not be banned.

A whopping 64 percent of likely voters ages 18 to 29 said the app should not be banned.

While 47 percent of people over 65 believe TikTok should be banned.

Earlier this month, TikTok sent notifications to its users urging them to call their lawmakers to defend themselves against the bill that could result in the app being banned. As a result, congressional offices received thousands of calls, with some even threatening to harm members if they voted for the bill.

In total, the survey also found that Americans have a net negative view of the app.

Only 27 percent said they had a positive view of the app, while 37 percent said they viewed it negatively.

“Americans may not like where they think TikTok data ends up, but they still use it and don’t want it banned,” James Johnson, co-founder of JL Partners, told DailyMail.com.

“Two things are at play here: Despite all the negative opinions about social media or technology, we simply cannot stop using it for its ease and entertainment value.”

“Second, while some may have a negative view, they may not want it banned, perhaps speaking to a trend toward less government action and regulation over companies, even if their intentions are nefarious.”

And it is very possible that TikTok will be banned.

Earlier this month, the House passed in a bipartisan 352-65 vote a bill that would force ByteDance, TikTok’s China-based parent company, to divest the app within 165 days or face a ban in the US

The bill breezed through the House, easily passing just a week after it was introduced.

The House China Select Committee, which formed the bill, says CCP officials through ByteDance are using TikTok to spy on the locations of its American users and dictate its algorithm for conducting influence campaigns, which which makes it a threat to national security.

Leaders of the bipartisan China Select Committee have warned that the CCP can access TikTok data and has used that information to spy on Americans and journalists.

TikTok CEO Shou Chew has said the bill would ban the app, signaling that ByteDance has no intention of divesting from the popular video-sharing platform.

The Senate is now mulling over the legislation, and if they decide to pass it, President Joe Biden has said he would sign it into law.

And the Senate has been busy learning about the threats posed by the app.

Earlier this month, officials from the FBI, the Office of the Director of National Intelligence and the Department of Justice hosted a meeting with senators to brief them on the security implications posed by the Chinese-owned company.

“My reaction to this briefing is that TikTok is a gun held to the heads of Americans,” Sen. Richard Blumenthal, D-Conn., told DailyMail.com after leaving the meeting.

“The urgency of this clear and present danger should motivate immediate action.”

The upper house also held a hearing with TikTok CEO Shou Chew in January, where lawmakers questioned the executive about security concerns regarding the platform and how it has been used as a tool for child exploitation.

Meanwhile, Senate Majority Leader Chuck Schumer, D-N.Y., has not indicated if or when the House-passed bill will be voted on on the floor.

“The Senate will review the legislation when it comes from the House,” is all he has said on the matter.