Nearly one in five homes sold in San Francisco has sold at a loss in recent months, well above the rate nationally.

Murders, robberies, robberies and widespread public drug use are forcing residents to flee the city and deterring people from moving into what was once the hottest real estate market in the United States.

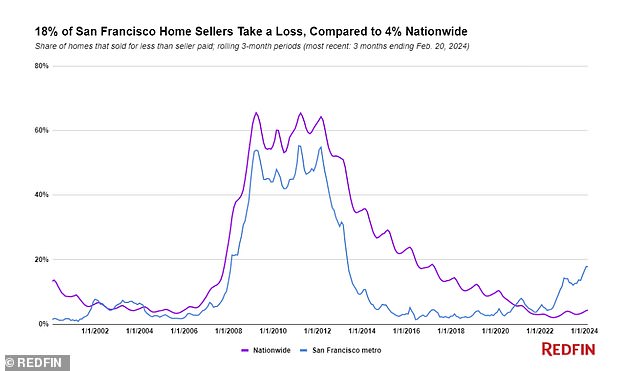

The 17.8 percent of San Franciscans who lost money on the sale of their home in the three months through the end of February is the highest level in a decade. And it’s four times the national average of 4.3 percent.

In San Francisco, the typical homeowner who recently sold at a loss parted with their home for $155,500 less than they bought it.

Nationally, the average loss during the same period was about $40,000, the data from real estate brokerage Redfin reveals.

Nearly one in five homes sold in San Francisco sold at a loss in the three months through February 29, new data reveals.

Local Redfin agent Christine Chang said the San Francisco market, in particular, is stumbling more than other parts of the Bay Area.

“House prices have fallen from their peak, especially when it comes to condos,” Chang said. ‘It’s not just because mortgage rates are high.

‘San Francisco has lost some of its appeal after the pandemic. Many big-name tech and retail employers have moved out of town, and some of my clients have reported leaving the area because they don’t feel as safe as they used to.

Local Redfin Premier agent Christine Chang said San Francisco has lost some of its appeal after the pandemic.

San Francisco’s Westfield, once a thriving shopping center that housed America’s largest Nordstrom in the center of the city, is now a shadow of its former self after a series of big-name store exits.

Occupancy was a paltry 25 per cent in January, and staff and shoppers told DailyMail.com how they were left “scared” by the “increased crime, drug use and homelessness” in the area.

Last month, residents of a wealthy neighborhood in the city said they had been “traumatized” by a recent spike in robberies, muggings and murders.

Some longtime residents said they had even resorted to using chicken wire to protect their homes from intruders and felt so unsafe they were considering moving.

Since the housing market recovered from the 2008 financial crisis, the percentage of home sellers in the city who sold at a loss has been below the national average, according to Redfin data, but this trend reversed in 2021.

Home sellers in California City are also much more likely than those in the rest of the country to lose money, as home prices have fallen significantly since skyrocketing during the pandemic home-buying boom.

The median sales price in the city peaked at $1.66 million in April 2022 and has since fallen 15 percent (about $250,000) to $1.41 million in February of this year.

Worsening drug use and crime has contributed to more homes being sold at a loss, experts say (Pictured: drug users in the city)

Since the housing market recovered from the 2008 financial crisis, the percentage of home sellers in San Francisco who sold at a loss has been below the national average, according to Redfin data, but this trend reversed in 2021.

Despite this dramatic drop, the Bay Area is still home to the most expensive real estate market in the United States.

The typical person who bought in San Francisco at almost any time in 2021 or 2022, when the housing market was red hot due to ultra-low mortgage rates, would have suffered losses if they had sold during the first few months of this year.

But the real estate brokerage notes that prices in the city have risen after hitting a low point of an average of $1.28 million in January 2023, when prices were falling amid high mortgage rates and tepid demand. .

Home sellers would probably get a higher price now than they did a year ago, he said.

After San Francisco, Detroit had the highest share of homes sold at a loss (about 10.8 percent) in the same period.

This is followed by three other Rust Belt and Midwestern metro areas: Cleveland at 8.2 percent, St. Louis at 8.1 percent and Chicago at 7.9 percent.

Sellers in those places are more likely than most to lose money because, like in San Francisco, home prices have fallen from their pandemic peak.

In Detroit, for example, the median sales price is down about 20 percent from its pandemic high.

On the other hand, homes were least likely to sell at a loss in Providence, Rhode Island, where only 1.2 percent of homeowners who sold in the three months ending Feb. 29 lost money.