Table of Contents

Cash withdrawals rose for the third year in a row as people turned to physical money to help budget, according to Nationwide.

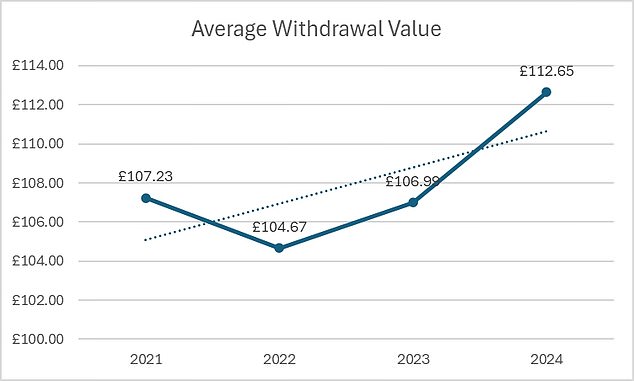

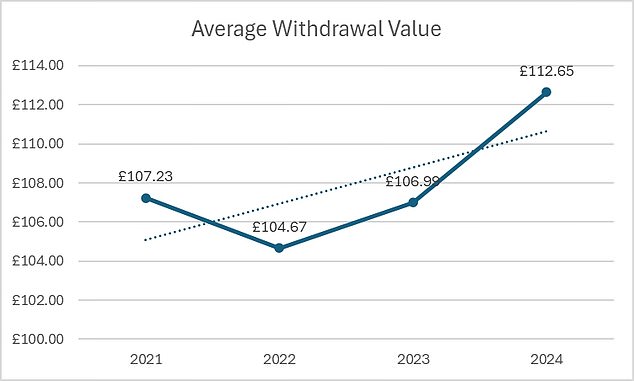

The typical withdrawal value increased from £106.99 to £112.65 between 2023 and 2024, marking another increase from 2021, when the average amount withdrawn from the machines was £107.23.

Nearly 33 million withdrawals were made at 1.26 million Nationwide ATMs last year, representing a 10 percent increase over 2023.

The building society said the recent rise was due to customers opting for cash to ease their budget in the wake of the pandemic, but also the fact that other ATMs in local areas have been removed.

Ahead of 2022, the number of cash withdrawals at Nationwide ATMs had been declining since its 2014 peak, with the biggest drop coming during the pandemic, when withdrawals fell 40 percent.

“The rising cost of living continues to impact people and many are choosing to budget with physical money to avoid going into debt,” said Otto Benz, chief payment officer at Nationwide.

Nationwide said the average amount withdrawn from its ATMs had risen for the third year

The week before Christmas saw the highest demand for cash with £97.9 million withdrawn from Nationwide ATMs, an increase of 1.8 per cent on 2023 and the highest amount dispensed in a week since before the pandemic.

The week before Black Friday at the end of November saw a 12 per cent rise to £85.3 million and the second-highest weekly withdrawal since before Covid.

The biggest increase in cash withdrawals was in Chiswick, west London, where demand increased by 140 per cent, followed by Shotton, Flintshire (up 115 per cent) and Fakenham, Norfolk (96 per cent).

Other significant increases were in areas where Nationwide is the last bank branch in town, including Henley-on-Thames, Oxfordshire (95 per cent) and Cupar, Fife (66 per cent).

Nationwide said demand for ATMs also came at a time when bank branches were closing across the country, with 16 per cent of withdrawals now made by non-Nationwide customers.

More than 6,000 bank branches have closed in nine years, at a rate of 53 a month, according to consumer website Which?

Critics of branch closures say the elderly, the vulnerable and those without internet access are disproportionately affected.

Benz said: ‘Major banks have closed branches in towns and cities across the country, taking away many of the free ATMs that people rely on, which is why the biggest increase in withdrawals is coming from non-bank customers. Nationwide.

“The resurgence of cash shows why we need to continue to have a physical presence on the high street, allowing customers to access their money on their terms, whether digitally or in branches.”

It has also led to an increase in the number of consumers using ATMs for other services, including printing mini statements, paying bills, changing PINs, and paying with cash and checks, which now account for almost half of all ATM transactions.

There has also been a 21 per cent increase in the number of times Nationwide ATMs are used to deposit cash, with an average increase of 0.5 per cent over five years to £278.

Have you started using more cash? Let us know: editor@thisismoney.co.uk

SAVE MONEY, MAKE MONEY

1% refund

1% refund

About debit card expenses. Maximum £15 per month*

Energy bills

Energy bills

Find out if you could save with a fixed rate

free share offer

free share offer

No account fee and free stock trading

4.5% Isa 1 year

4.5% Isa 1 year

Hampshire confident of Hargreaves Lansdown

Sip Rate Offer

Sip Rate Offer

Get six months free on a Sipp

Affiliate links: If you purchase a This is Money product you may earn a commission. These offers are chosen by our editorial team as we think they are worth highlighting. This does not affect our editorial independence. *Chase: Refund available during the first year. Exceptions apply. Over 18 years of age, resident in the United Kingdom.