It’s the day when the nation goes to the betting shops.

And a good portion of the money wagered on the Grand National will come from Ladbrokes and Coral punters.

“It’s without a doubt the busiest day of the year for bookmakers,” says Ladbrokes’ Nicola McGeady.

So there will be plenty of interest when Ladbrokes and Coral owner Entain releases its first quarter trading update on Wednesday.

Whether it was a good or bad week at Aintree will depend largely on the outcome of today’s big race.

But there is much more at stake for Entain and its shareholders.

The recent announcement of chairman Barry Gibson’s resignation has sparked speculation that the betting giant is largely a takeover target, with private equity group Apollo among those interested.

Gibson blocked previous acquisition attempts by MGM and DraftKings, but his retirement has put Entain back in play.

And it comes as the company searches for a chief executive following the departure of Jette Nygaard-Andersen in December after less than two years in the role.

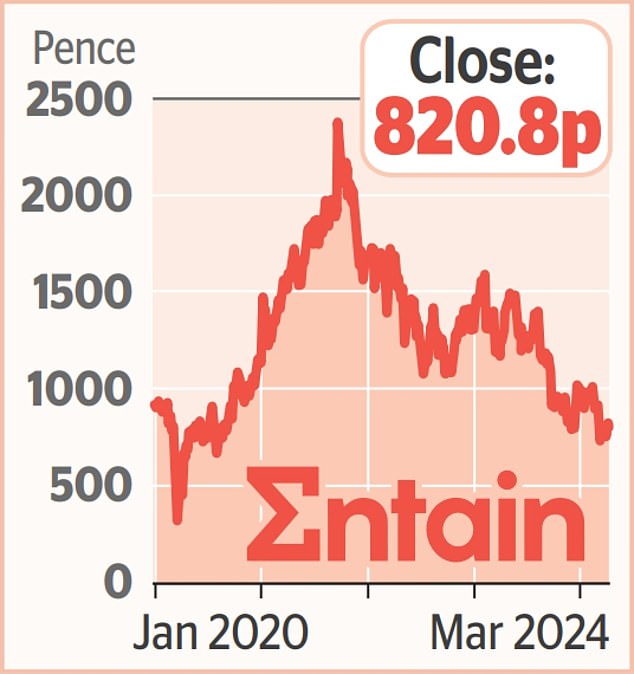

“It’s been a tough start to the year for Entain shareholders and expectations for the Ladbrokes owner look as low as possible,” said Hargreaves Lansdown analyst Matt Britzman.