Prince Harry and Meghan Markle’s charity, the Archewell Foundation, has surprisingly delayed publishing their latest tax return online.

The charity raised eyebrows when MailOnline reported that $4 million had not been declared in Archewell’s latest tax return, called form 990, and sources close to the Sussexes insisted it would appear in the following year’s filing.

However, although the Mail understands the charity submitted the new Form 990 to the IRS last week on November 15, there is no sign of the tax return on Archewell’s website.

Instead, MailOnline understands that Archewell has promised it will be released publicly up to three weeks after the IRS deadline in the week beginning December 2.

The decision has been received with surprise. A prominent tax expert said that while delaying release until the IRS had processed the return was not “uncommon” for many charities, given Archewell’s high profile and the publicity about the unreported $4 million, in This case was puzzling.

Cynthia Reed Altchek, a private wealth partner at law firm Katten in New York, told MailOnline it was “a little strange” that Archewell had not released the return publicly, if at all it had been submitted to the IRS.

He said that “given how famous (Archewell is), that’s interesting.”

The private wealth partner added that if Archewell had actually missed the IRS deadline, the charity could have faced a fine of up to $60,000.

Prince Harry and Meghan Markle’s charity has delayed publishing their online tax return

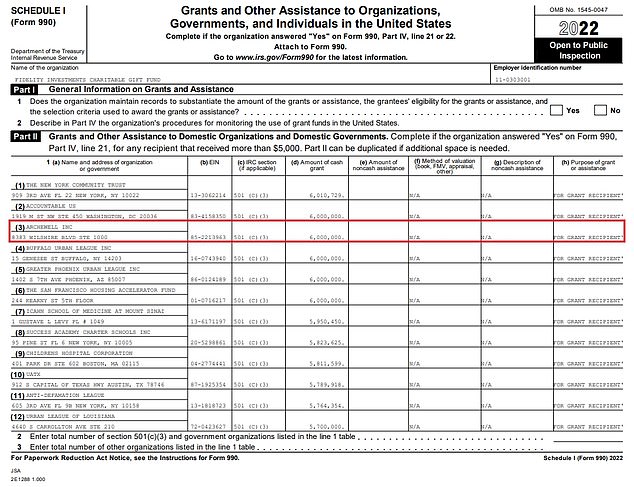

The last two grants to the Archewell Foundation were awarded in the 2022/23 financial year. One totaling $6 million was from Fidelity Charitable (highlighted in red)

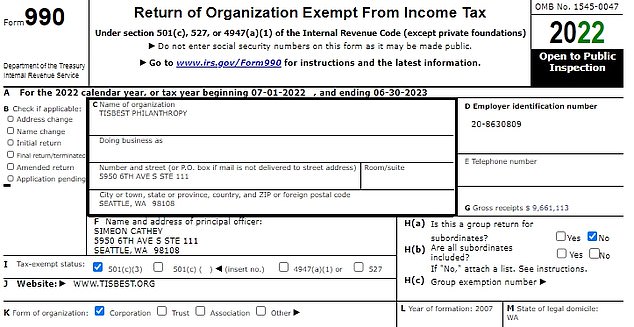

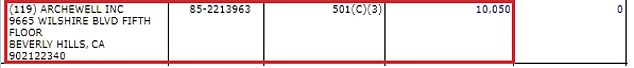

Another donation worth $10,050 came from Tisbest Philanthropy (highlighted in red)

She said: ‘That’s a problem. There are penalties for late submissions.’

If you missed the deadline three years in a row, your tax-exempt status would automatically be revoked.

In early May, the California Registry of Charities and Fundraisers banned Archewell from raising or spending donations, saying it was because the charity had not properly filed its annual report or renewal fees.

Sussex sources said it was actually because a check had disappeared in the mail before saying the next day that it was because the Attorney General’s office failed to process a $200 check.

Later in May, the ban was lifted. Sussex sources previously told MailOnline that the Archewell Foundation’s tax returns for 2022 were filed in full in accordance with all US regulations.

But then in September, MailOnline revealed that $4 million went unreported on his 2022 tax return.

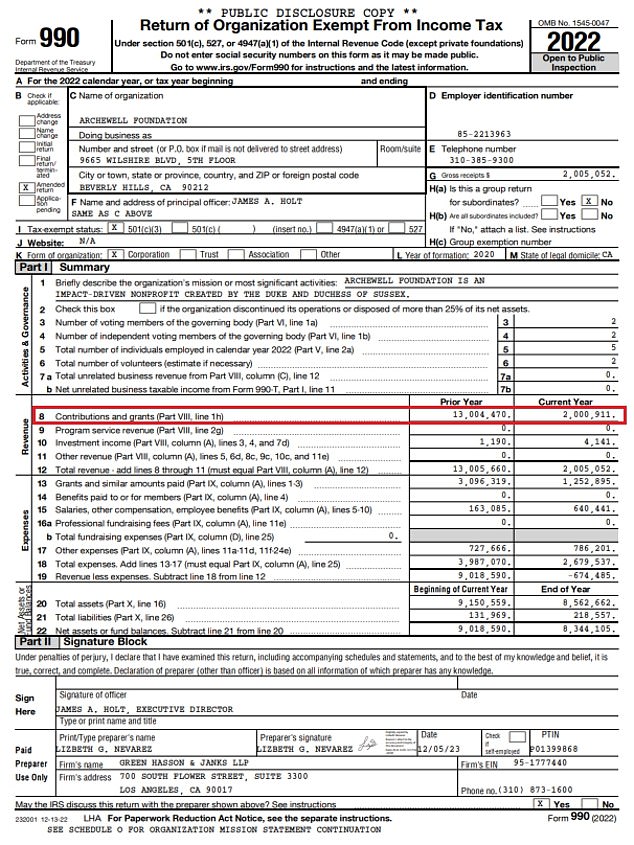

The Archewell Foundation declared $2,000,911 of grants in 2022, meaning $4,009,139 was unreported

Administratively, Meghan and Harry’s charity Archewell has had a troubled year

The huge unreported sum boils down to Archewell not including most of a $6 million donation it received during the last financial year in its 2022 tax return.

In the 2022/23 financial year, Archewell received two donations. One from Fidelity Charitable was $6 million and another was $10,050 from Tisbest Philanthropy, both 990 forms revealed.

However, Archewell only reported $2,000,911 on its 2022 return, meaning $4,009,139 was not reported.

It is likely that individual donors could have used Fidelity and Tisbest to donate money to Archewell anonymously, as was previously the case with large donations to the Sussexes’ charity.

In 2021, a $10 million anonymous donation was made through the Silicon Valley Community Foundation, a mega-rich nonprofit and a vehicle for extremely wealthy philanthropists to make tax-free grants anonymously.

That led to suggestions that Archewell was being funded almost entirely by a single mysterious donor.

In 2022, Archewell said he received only two grants of $1 million each from anonymous donors.

Fidelity Charitable could be the recipient used by one or both donors.

There’s a reason the remaining $4 million not included in Archewell’s 2022 tax return could be on its next filing.

This is because while both Fidelity and Tisbest’s fiscal years run from the first half of one year to the second half of the next, Archewell’s is from January to December of a single year.

It means Fidelity’s $6 million could have been split over two years and appeared as two separate donations to Archewell, while only one to Fidelity. The same could happen with Tisbest cash.

Archewell’s website has its 2021 and 2022 990 tax return forms publicly available, but not the latest one from 2023. Above the documents the charity has posted, it reads: “The Archewell Foundation…operates with complete transparency”.

Prince Harry and Meghan Markle (pictured at separate events in October) created Archewell to “show up” and “do good.”

Cynthia Reed Altchek (pictured), Katten’s private wealth partner in New York, told MailOnline it was “a little strange” that Archewell had not published its latest tax return online if the charity had submitted it to the IRS .

And although Archewell’s financial year ending in December should mean it files its returns on May 15 each year, it is believed that for the past three years, the charity has requested a six-month extension until November 15 with a Form 8868, which Altchek said was “very common.”

Archewell’s website says the charity “complies with all charitable sector deadlines and measures and operates with full transparency” in a paragraph directly above its 2021 and 2022 tax returns.

However, Archewell’s latest tax return is not listed there.

A Treasury spokesperson said: “For legal and privacy reasons, we cannot comment on individual taxpayer situations.”

Prince Harry, Meghan Markle and Archewell have been contacted for comment.