A little-known element of the insurance industry is driving up homeowners’ premiums, consumer advocates warn.

The cost of reinsurance has skyrocketed in recent years, and now higher prices are hitting ordinary Americans, making their coverage increasingly unaffordable.

Reinsurance is effectively the insurance contracted by insurers. It transfers part of the risk so that no company is too exposed to a possible catastrophe.

But as climate change is driving greater risk of property loss in the U.S., this arcane part of the product is getting a lot of attention, said Douglas Heller, insurance director at the Consumer Federation of America.

“I’ve been advocating for insurance consumers for 25 years and never in that time have I seen as much attention as now to the pain that consumers are feeling in the insurance market,” Heller told DailyMail.com.

Climate change is creating an increased risk of property loss in the US. (Pictured: Destruction left behind by Hurricane Ian in Florida in 2022)

“The reinsurance market has been relentless in its pricing for the last seven years,” Heller explained.

‘It is an understatement to say that it is reflected in our policies. It is reaching our policies.

“Because in most states, much, if not all, of the cost of reinsurance is passed directly into the premiums consumers pay.”

Due to climate change, he explained, the risk of loss has increased.

Earlier this week, Governor Ron DeSantis declared a state of emergency in five Florida counties after dangerous rains hit the state.

So insurance companies want more reinsurance to cover that growing exposure, but the market for reinsurance sellers is not growing in terms of available capital.

This creates a seller’s market.

“So that just allows those reinsurance companies to go around the world and find the highest price relative to the risk they’re willing to take,” Heller said.

According to a report Published this month by AM Best, the world’s largest credit rating agency specializing in the insurance industry, the global reinsurance market had a return on equity of 22.5 percent in 2023.

Return on equity effectively measures profitability.

“This return on equity is dramatically higher than the average over the past six years, which was about 8 percent,” Heller said.

‘That’s what happens when there’s a seller’s market. And it is not a battle between one set of corporations against another set of corporations.

“It’s a battle between corporations and consumers that is mediated through the insurance companies that sell us our policies, but it is paid at the expense of homeowners and businesses who struggle to pay for coverage.”

For example, Swiss Re, headquartered in Zurich and one of the largest reinsurance companies in the world, reported net income of $552 million from property and casualty reinsurance alone in the first quarter of 2024.

Meanwhile, Bermuda-based insurance and reinsurance provider Everest Re posted net income of $733 million in the first quarter of this year.

“The reinsurance market has been relentless in its pricing for the last seven years,” explained Douglas Heller.

Some Americans are forced to opt for limited policies that do not include fire or flood coverage.

Others have to pay for an expensive policy with an insurer of last resort in their state, or simply move to another state in hopes of finding cheaper deals.

Others are choosing to abandon home insurance altogether, risking significant losses.

And most are seeing their premiums skyrocket.

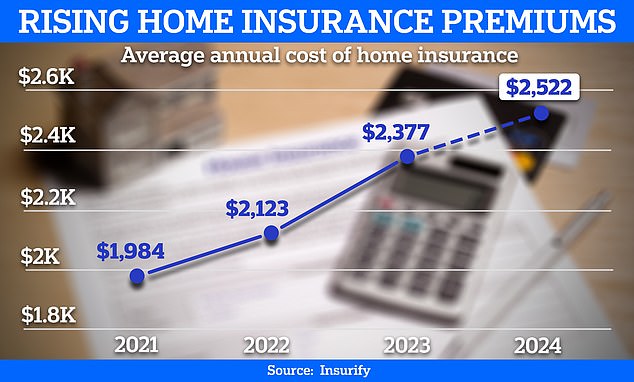

Grim forecasts released earlier this year predicted that the typical annual home insurance premium for the U.S. as a whole will rise to $2,522 by the end of 2024.

According to the insurance comparison platform, this represents an increase of 6 percent compared to 2023. ensure.

But those in higher-risk states face much harsher prices.

Florida homeowners already pay the highest coverage premiums in the U.S., averaging $10,996 annually in 2023.

And according to Insurify projections, this will increase another 7 percent this year, raising the typical premium in the state to a staggering $11,759.

“When you think about weather disasters and high insurance rates, you naturally think about the coast and hurricanes in states like Florida,” said Christopher Schafer, home insurance editor at Insurify.

“But what we’re also seeing now is that the reinsurance market is becoming much more volatile in other parts of the country than one would expect: in places like the Midwest.”

He explained that many storms do not meet the reinsurance threshold for insurers and reinsurers have changed their policies. This means that insurance companies are asked to assume additional losses.

‘This is a bad situation everywhere. And reinsurers are using their influence to make sure they make the best of a bad situation and try to avoid catastrophic losses,” Schafer told DailyMail.com.

The typical annual premium will rise to $2,522 by the end of 2024, according to predictions from insurance comparison platform Insurify.

The reinsurance market is becoming more volatile in parts of the country that you wouldn’t expect, said Christopher Schafer, home insurance editor at Insurify.

Does anyone oppose these price increases?

Earlier this year, California Congressman Adam Schiff introduced a bill that would create a federal reinsurance program to help stabilize the market and protect consumers.

“At least some efforts are being made to start the conversation and hopefully get some reforms and legislation passed,” Heller said.

“I think this is not the time to say ‘markets go up and down,'” he added. ‘This is a time when policymakers, regulators and the industry have to act, and that will require some changes to the way this business works.

‘People’s lives are at stake. We require people to buy the product. So there is a special obligation to ensure that prices are fair and that coverage is available.’

He noted that while the government acted quickly and shared terrorism insurance losses after 9/11, it has yet to intervene during the current crisis.

Consumers can also help minimize pain, he said.

The best thing Americans can do is shop around for a better deal.

The industry has long relied on the fact that insurance is complicated. They know most of us don’t switch, he said, and it could save you hundreds of dollars if you do.

Be careful what you are getting into with each policy, he warned, because companies are selling policies that have lower quality coverage.

‘We are seeing in places where it is more difficult to find insurance, like Florida for example, companies that sell policies that are called surplus lines, or excess and surplus. But they are not regulated by the states,” he added.

“When homeowners buy policies for the most important asset they own and they’re on the surplus line, that’s very, very risky.”

Insurify’s Schafer also encourages consumers to take steps that can improve their insurance rate.

These include improving your credit score or repairing or replacing damaged or outdated items in your home.