Table of Contents

I recently received an email from my mortgage broker warning me that my current home loan is due in seven months.

I will switch to my lender’s standard variable rate and my monthly payments may increase.

My broker told me to contact them in the next few weeks to arrange my next trade and that if I want to start sooner I should let them know.

It also states that if I decide to stay with my current lender, my broker will give me £50 in cash once the transfer is complete.

Should I take the plunge now or should I wait to see if mortgage rates go down?

Also, would it make sense to stick with my current lender like they suggest?

Timing is everything: A reader asks when they should start looking for a new mortgage deal.

Ed Magnus from This is Money responds: It is always wise to plan ahead before your existing mortgage contract ends.

First and foremost because those who do not remortgage a new deal before the end of their deal will revert to their lenders’ Standard Variable Rate (SVR).

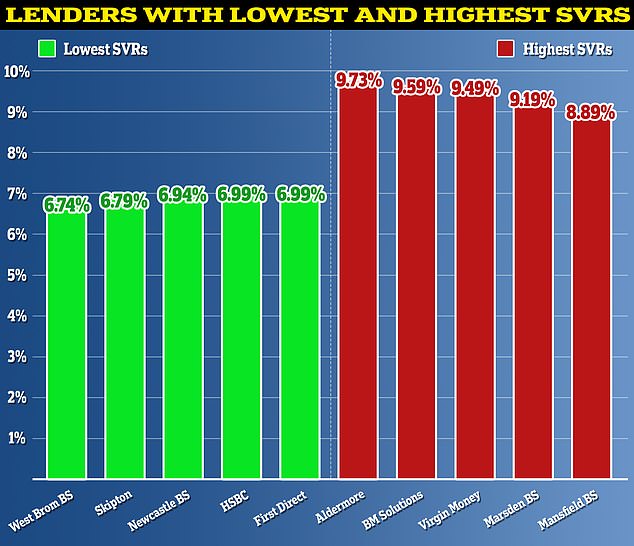

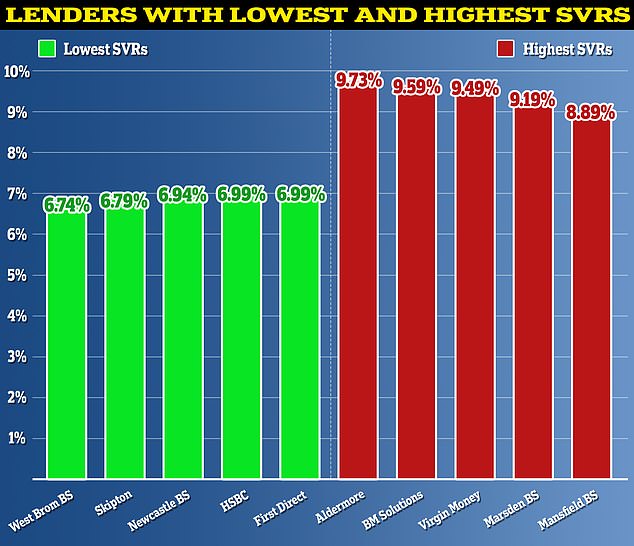

SVRs can be as high as 9.73% depending on the lender and can add hundreds or even thousands of pounds to monthly repayments.

There would be no harm in speaking to your mortgage broker early to evaluate your options.

A typical mortgage offer will last for six months before it expires and there is no obligation to follow through.

That said, there’s no point initiating an application more than six months before your current deal ends unless your mortgage broker says so.

This will depend on your lender. Some offer periods begin to run from the point of application, others from the valuation date, and still others from the date of the offer itself.

The best and the worst: the SVR is set at the discretion of lenders and therefore varies considerably

It’s also worth considering sticking with your current lender in what’s known as a product transfer.

Last year, almost 83 per cent of the 1.8 million people who refinanced their mortgage chose to stick with their existing lender, according to banking trade body UK Finance.

The benefit of a product transfer is that you don’t have to go through the same checks and balances as if you were moving to a new lender – although this could also prevent you from getting the best deal possible.

Product transfers generally require less paperwork, no new affordability assessment, and no reassessment of the property.

Ultimately, the choice of whether to stay or switch lenders should come down to which is cheaper. This is where your broker should advise you.

For expert advice, we spoke to two brokers – Ravesh PatelDirector and Senior Mortgage Consultant at Reside Finance Ltd and Andrew Montlakegeneral director of Coreco.

Should they lock in a mortgage offer early?

Ravesh Patel responds: The majority of remortgage deals are good for six months, so it’s a great idea to lock something in for that time instead of waiting and timing the market, which is often seen as the riskier approach.

If the rates were to increase, you would not have to do anything since you have already obtained your rate.

Expert: Ravesh Patel, Director and Senior Mortgage Consultant at Reside Finance Ltd

If rates drop, you may want to consider switching offers, as you are not obligated to finalize an offer once it has been issued.

From application to completion, remortgages can take anywhere from a few weeks to a few months. It is best to contact your broker regarding deadlines to ensure you do not come across the standard variable rate.

Andrew Montlake adds: Your broker has done you a good service by making sure to contact you in time to inform you that your rate will expire in the coming months.

With most lenders you can now secure a product sooner, but your broker should keep an eye on the market in the meantime.

This means that if a better product comes to market, you should be able to access it in time before your current mortgage ends.

Under the Government’s Mortgage Charter, most lenders are able to let you get a better rate up to two weeks before your expiry date, so you can lock in now and benefit if anything looks better.

What should they discuss with their broker?

Andrew Montlake responds: Your broker should have a detailed discussion with you about your current situation and future plans to ensure they are giving you the best advice when it comes to switching mortgages.

For many people who remortgage now, they will face an increase in their monthly payments as rates have risen significantly in recent years as the Bank of England battles inflation.

So it’s important to understand what these new payments will look like as early as possible and budget accordingly to manage them, or speak with your broker to see if there are ways to offset some increases.

This may involve increasing the term of your mortgage, converting part of your mortgage to an interest-only option or, if you have savings, possibly choosing an offset mortgage.

Expert advice: Andrew Montlake, managing director of mortgage broker Coreco

This may also be an opportunity, if you have some cash reserves, to repay a lump sum on your mortgage and remortgage at a lower level.

Of course, the opposite may be true, and you may be looking to borrow a little more money to renovate your home, or even increase the energy performance to make it more energy efficient and greener.

With this in mind, it’s also worth checking the rating on your energy performance certificate, as if your home has an A, B or C rating you may be eligible for a slightly cheaper rate.

Your broker should take all of this into account and compare what your existing lender is offering you with other offers on the open market and arrive at a recommendation that suits you best.

Should they stick with their current lender?

Ravesh Patel responds: Staying with your existing lender is always much simpler than applying to a new lender.

It involves minimal administration and is extremely fast. While a £50 incentive is nice, your broker should prioritize recommending the best deal available.

A big part of this is checking what your current lender can offer compared to the rest of the open market, as there might be something out there that could save you a lot more.

A good mortgage broker should monitor rates even after a mortgage offer has been issued to their client.

This means that if there is a better deal later, they will let their customers know.

Compare real mortgage costs

Calculate mortgage costs and check which is the best deal taking into account rates and fees. You can either use one part to calculate the costs of a single mortgage or both to compare loans.

Some links in this article may be affiliate links. If you click on it, we may earn a small commission. This helps us fund This Is Money and keep it free. We do not write articles to promote products. We do not allow any commercial relationships to affect our editorial independence.