An auto insurance company left an Arizona motorist thousands of dollars in debt after it refused to pay a claim because he paid 60 cents less than he should for his $60,000 car.

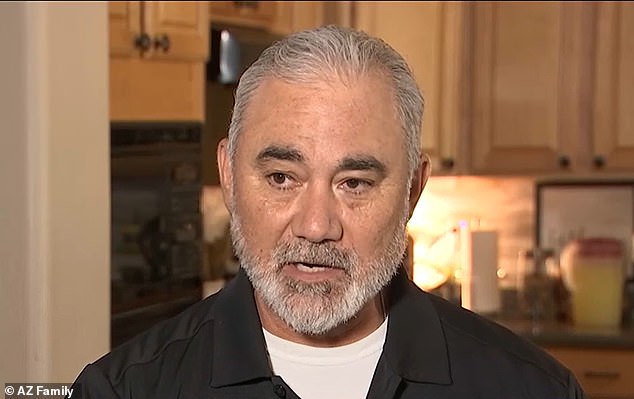

Peoria salesman Manny Muñoz overspent on his BMW X5 in 2020 when he needed a new car for his job at the height of the pandemic.

The cars were selling for thousands of dollars more than usual as international supply chains collapsed, and Muñoz agreed to pay $60,517.86 for the then-two-year-old vehicle.

His credit union accidentally sent the dealer a check for $60,517.26, or 60 cents less, but it went unnoticed until November of last year when his car was totaled, and his insurer Safe-Guard Products used the discrepancy as an excuse not to pay.

“The claim was rejected because the loan amount did not match the contract amount,” Muñoz said. azfamily.com. “There was a 60-cent difference.”

Manny Muñoz was left with a debt of $18,000 due to an inadvertent discrepancy of 60 cents

His BMW was rear-ended during a prank in November last year and, although the damage appeared relatively superficial, his insurance company insisted the car was written off.

Grandpa paid for the car through a finance deal and took out an insurance policy to cover the full amount specifically because its value was likely to depreciate rapidly from its pandemic peak.

And he found himself filing a claim when he was rear-ended during a trip late last year.

The damage appeared relatively superficial, but Safe-Guard deemed his car a total loss.

“I guess there are a lot of sensors in the car and cameras,” he speculated.

He still owed $45,000 on the car, but the insurance company sent him a check for only the $26,709 it would have been worth at the time of the accident.

He was told that the amount charged for the car and the amount paid had to match the penny for the gap policy to be valid, leaving him without a car and with an outstanding debt of $18,651.

Seven months of disputes failed to move the Atlanta-based insurance company, so it contacted AZfamily’s On Your Side consumer show and its host Gary Harper.

The discrepancy only came to light more than three years later, when he made a claim.

Muñoz, pictured with his wife Dora, received a letter from the insurance company suggesting his claim is being “processed.”

“I was sitting there trying to contemplate what to do and then I got online and said, let me find Gary Harper and here we are,” he told the show.

And after contacting the firm, Muñoz received a promising letter suggesting that his claim is now being “processed.”

But he refuses to get his hopes up until he receives a check for the correct amount.

“I have no problem being patient because I think I’ve been more than patient,” he said.