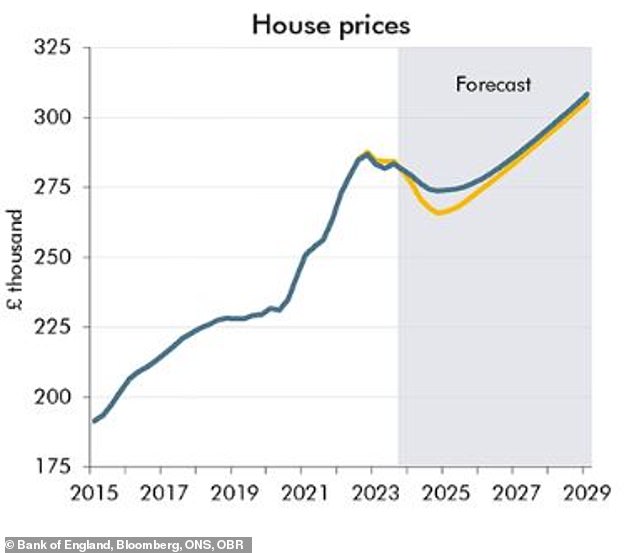

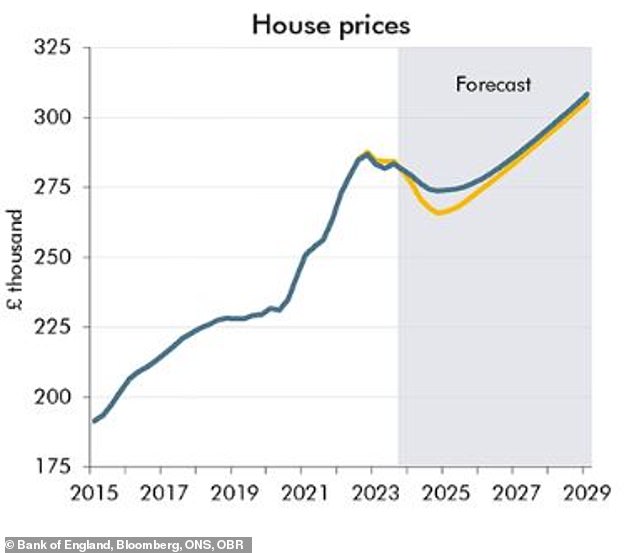

- The average house price is expected to fall to just below £275,000 by the end of this year.

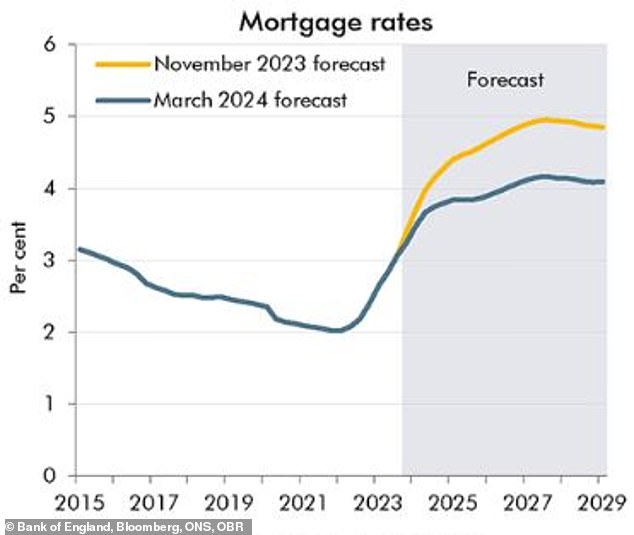

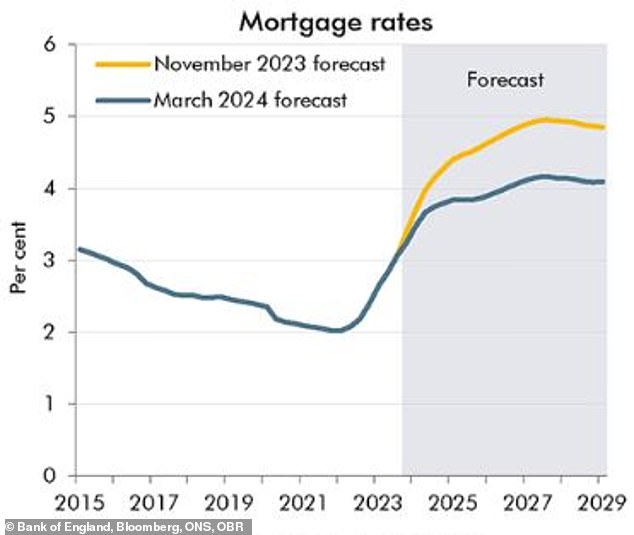

- Mortgage rates expected to remain below 4% through 2026

<!–

<!–

<!– <!–

<!–

<!–

<!–

House prices will fall less than previously expected in 2024 and mortgage rates are also expected to rise less sharply, the data shows.

The median house price is expected to fall 2 percent this year, according to the Office for Budget Responsibility’s central forecast.

This compares with a previously expected fall of 5 per cent which the OBR predicted just four months ago in the Autumn Statement.

Lighter falls: OBR says average house price will exceed £300,000 by 2029

He said the average house price is now expected to fall to just below £275,000 in the final quarter of the year, with the smaller fall due to lower mortgage rate expectations.

House prices will continue to fall through 2025, before growing again in 2026, rising 2 percent over the year, before rising 3.5 percent in 2027 and 2028 as a result of lower mortgage rates .

By 2029, the OBR predicts that the average house price will have risen to more than £300,000, having surpassed the previous peak of £285,000 in the first quarter of 2027.

Following his spring budget, the Chancellor abandoned plans for a 99 per cent mortgage scheme, fearing it could lead to a rise in property prices.

Jeremy Hunt also promised to build more homes and provide more support for first-time buyers, including pledging £188 million for housing projects in Sheffield, Blackpool and Liverpool.

Meanwhile, mortgage problems could ease somewhat in the coming years, with OBR figures indicating average mortgage interest rates will peak at 4.2 per cent in 2027, 0.8 percentage points lower than the forecast of the OBR held in November.

While rates are expected to continue rising, they will do so more slowly, staying below 4 percent through 2026, when the previous forecast had anticipated rates reaching this point in 2024.

This is an average rate taken from the entire housing stock.

More stable: House prices expected to fall less than expected

Less painful: Mortgage interest rates expected to peak at 4.2 percent in 2027

The OBR said the lower mortgage rates are the result of a decline in market expectations for the Bank of England’s base rate, which currently stands at 5.25 per cent.

‘However, there are significant risks to our mortgage rate forecast, as evidenced by the large moves in bank rate expectations since November.

“This also poses a risk to household incomes, residential housing transactions and house prices,” he said.

Ahead of the anticipated cuts to the base rate, the OBR said new mortgage rates will continue to fall, and housing demand will increase due to these lower mortgages.

Housing transactions fell by more than 40 percent to 265,000 in the third quarter of last year, compared with the post-pandemic peak, as the Bank’s rate rose.

The OBR said it now expects housing transactions to remain broadly stable this year, having previously forecast a 7 per cent fall.

According to the Zoopla House Price Index, 1.1 million homes are expected to be sold in 2024, compared to 1 million last year, with 21 percent more homes on the market this year due to growing demand .

Buyer demand has increased 11 percent compared to a year ago, Zoopla said.