Europe is beset by a post-pandemic surge in sexually transmitted infections (STIs), health chiefs warned today.

Gonorrhea rates across the continent have more than doubled in just one year. Syphilis rates have soared by more than a third.

Holiday destinations popular with Brits, such as Spain, Italy and Malta, are among those that have reported an increase in STIs in data recorded for 2022.

As in the UK, Covid lockdown rules in many parts of Europe effectively put an end to casual sex, leading to a drop in STI transmission.

Health officials suspect that this period of unexpected chastity was followed by a post-lockdown boom in the number of people having condomless sex with new or casual partners.

Your browser does not support iframes.

STI testing itself was greatly reduced during the pandemic as health systems shifted their focus to Covid.

While the majority of STI cases reported in data from the European Center for Disease Prevention and Control (ECDC) are among adults between 20 and 30 years old, some experts suspect that the rise of the “silver stroke” is also could be a factor.

The term reflects an increasing number of older people seeking new sexual partners after a divorce or bereavement, facilitated by the increasing ease of online dating.

ECDC data recorded 17.9 Gonorrhea cases per 100,000 people reported in 27 European countries in 2022, 53 percent more than the 11.7 recorded in 2021.

The figure is approximately equivalent to almost one in every 5,000 people on the continent suffering from an STI.

By comparison, the rate was just 10.4 per 100,000 people in 2019.

Meanwhile, syphilis rose 35 percent, from 6.3 per 100,000 to 8.5, equivalent to just under one in 10,000 people. In 2019 its rate was 6.5.

Chlamydia has also increased by around a sixth (16 per cent), to a rate of 87.9 per 100,000, up from 75.8 recorded in 2021 and equivalent to almost one in 1,000 people. Its rate stood at 77.8 in 2019.

Cases of congenital syphilis (caused by transmission from mother to fetus) also increased from 1.8 per 100,000 people to 2.4.

Writing in the diary, eurosurveillanceThe researchers said the findings highlight “an urgent need for action” to prevent further spread of infections.

ECDC Director Dr Andrea Ammon also said: ‘Tackling the substantial rise in STI cases requires urgent attention and concerted efforts.

‘Testing, treatment and prevention are the basis of any long-term strategy. We must prioritize sexual health education, expand access to testing and treatment services, and combat the stigma associated with STIs.

‘Education and awareness initiatives are vital to empower people to make informed decisions about their sexual health.

“Promoting consistent condom use and encouraging open dialogue about STIs can help reduce transmission rates.”

STIs such as chlamydia, gonorrhea, and syphilis are usually treatable, but can lead to serious health complications if left to develop.

These include pelvic inflammatory disease or chronic pain.

In extreme cases, chlamydia and gonorrhea can cause infertility, while syphilis can cause neurological and cardiovascular problems.

The NHS advises waiting 14 days before testing for chlamydia and gonorrhea and four weeks for syphilis and HIV.

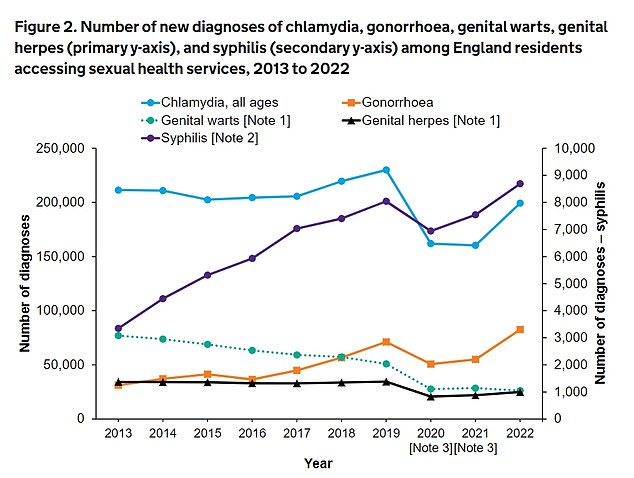

The latest data from the UKHSA shows that STIs – chlamydia, gonorrhea and syphilis – have enjoyed a post-Covid boom, with diagnoses rising sharply in 2022. Syphilis diagnoses (purple line) have a separate Y axis on the right compared to other STIs.

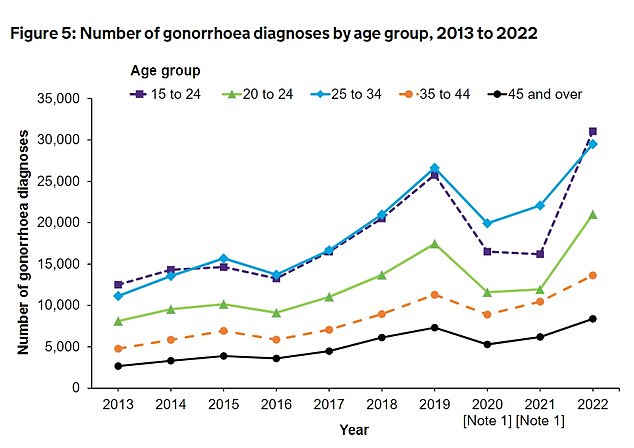

The data suggests that, overall, Brits aged 15 to 24 were the most likely to test positive for an STI. Here are gonorrhea diagnoses broken down by age group.

According to the new ECDC guidelines, researchers recommended that people get tested for STIs, especially if they are with a new partner or multiple partners, to detect the diseases at an early stage.

Other tips included practicing safe sex with condoms and encouraging open communication about STIs with sexual partners to reduce stigma.

The latest figures from England, published last year, also show that gonorrhea diagnoses have risen to their highest level since the end of the First World War.

Statistics revealed that 82,592 people, including children up to 13 years old, were diagnosed with STIs in England in 2022.

The figure was 16.1 percent more than in 2019, before the arrival of Covid, and 50.3 percent more than the 2021 total.

Cases of the dangerous STI syphilis, and also THE LEAST SERIOUS ones? chlamydia, also jumped.

The Local Government Association (LGA), which represents councils, has warned that sexual health services in England are grappling with “unprecedented” increases in demand and has urged ministers to provide them with additional funding.