Table of Contents

The Mediterranean diet has been a favorite of the nutrition world for the last 30 years.

The common eating style in regions such as Greece, Italy and Spain typically includes fresh produce, lean meats such as fish and chicken, and whole grains, while eating less red meat and sweets.

Research consistently shows that eating a Mediterranean diet reduces the risk of heart disease by 25 percent and premature death by 23 percent.

It has also been found helpful for people trying to lose weight. A 2015 Harvard study found that obese people lost between nine and 22 pounds while following a Mediterranean diet for a year.

Dietitians say the Mediterranean diet is particularly easy to follow because it is flexible, allowing you to eat foods that might be prohibited on other diets, such as cheese, said Emily Kyle, a registered dietitian nutritionist based in New York.

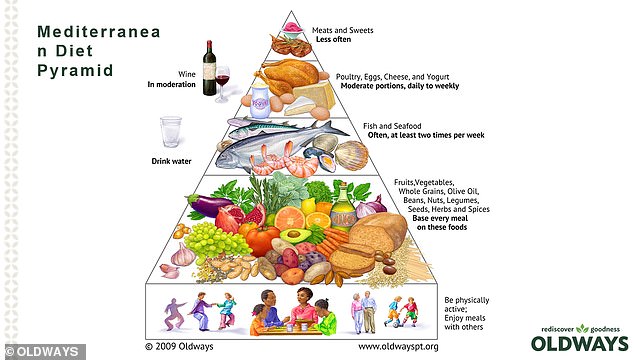

The latest version of the Mediterranean Diet pyramid was launched in 2009 and incorporated the use of regional herbs and spices “because they give regional identity to different dishes”, Sara Baer-Sinnott, who is credited with popularizing it, told DailyMail.com of the diet.

But lax guidelines can make grocery shopping confusing. Luckily, nutrition experts have put together a perfect shopping list.

Three Experts: Ms. Kyle, Kansas-Based Registered Dietitian Cara Harbstreetand Morgan Porpora, a New York-based registered dietitian, said Women’s health on your ultimate shopping list for the Mediterranean diet.

Opt for light vegetables…and frozen is also fine

Summer squash is rich in nutrients like vitamin C, A and B6, as well as high in water and low in calories, according to the University of Wyoming.

Shopping list includes: apples, berries, broccoli, Brussels sprouts, cauliflower, cucumber, dates, figs, grapefruits, grapes, kale, cantaloupe, mushrooms, onions, oranges, parsnips, peaches, pears, peppers, spinach, squash summer and sweet. potatoes, tomatoes and turnips.

Although it’s best to eat these foods fresh, dietitians say you can also enjoy them frozen.

These foods are especially rich in fiber and water, which could help the intestine digest them slowly. “Especially compared to a standard Western diet, the composition of meals in a Mediterranean diet is much better for our gut,” Porpora told Womens Health.

Additionally, fresh produce has many antioxidants, which can help protect the body against stress, according to Harvard TH Chan School of Public Health.

Lots of legumes, nuts and seeds to control cholesterol

Walnuts are a recommended source of vitamins and fats in the Mediterranean diet

In the field of legumes, seeds and nuts, dietitians recommend the following: almonds, barley, black beans, brown rice, cashews, chickpeas, broad beans, flaxseed, hazelnuts, kidney beans, lentils, oats, peas, pinto beans, pistachios , pumpkin seeds, quinoa, rye, sesame seeds, sunflower seeds and walnuts.

This colorful kind of food is full of dietary fiber and protein and has been shown to help lower cholesterol.

As they are plant products, they also contain many nutrients such as vitamin B, magnesium and copper, according to Dr. Rani Polak, a specialist in physical medicine and rehabilitation of Harvard Medical School.

Despite this, he wrote, relatively few Americans incorporate this food group into their weekly diet. “Although research supports the benefits of consuming legumes, only 8 percent of American adults report eating legumes on any given day,” Polak wrote.

In the Mediterranean diet, experts recommend eating at least three servings of legumes a week, The New York Times reported.

The superfood quinoa also belongs to this group, and you may be surprised to discover that it is actually a seed, not a grain.

Fat galore! But the healthy kind…

In moderation, unsaturated fats like olive oil can help lower cholesterol, studies show

In this category, dietitians recommend choosing the following: avocado oil, avocado, basil, cinnamon, extra virgin olive oil, garlic, mint, olives, oregano, nutmeg, rosemary, sage, thyme, and walnut oil.

Fat is an essential part of any diet. The USDA recommends Adults should consume fat between 20 and 35 percent of their daily calories, so on a 2,000-calorie diet, that’s between 44 and 78 grams per day.

By comparison, the Mediterranean diet is slightly higher in fat than the average American diet. The fat in the Mediterranean diet should represent around 30 to 40 percent of your daily calories, which are approximately 67 to 88 grams of fat per day.

But the types of fats found in the Mediterranean diet are different than those found in the average American diet.

Fundamentally, most Mediterranean fats are unsaturated fats, such as olive oil, avocado and salmon. They are popularly known as “healthy fats” because they could help improve cholesterol and, in turn, prevent cardiovascular diseases, according to the American Heart Association (AHA).

But saturated fats, found in butter, pork and palm oil, are the type with the strongest links to heart disease.

Before 2009, the official recommendations for the Mediterranean diet did not include herbs and spices, however this was later updated.

Choose feta and mozzarella cheese… but not too much

Some of the best cheeses to choose are unprocessed, such as feta, parmesan and mozzarella, said dietitian Julia Zumpano.

As for dairy, dietitians recommend choosing cheese, Greek yogurt, and milk. Although dairy is included in the Mediterranean diet, you should eat less than in the American diet. Julia Zumpanosaid a registered dietitian at the Cleveland Clinic.

This is because countries bordering the Mediterranean do not traditionally drink cow’s milk or consume highly processed dairy products like American cheese.

For the two servings you might consume per week, Zumpano recommends unprocessed cheeses like mozzarella, feta, and parmesan.

It also says you can have some ice cream from time to time. “A little goes a long way,” she wrote.

Swap some meat for mackerel

Mackerel is an example of a lean protein that dietitians recommend in the Mediterranean diet.

When you head to the butcher counter at the supermarket, here’s what dietitians recommend keeping in mind: beef, pork, poultry, clams, mackerel, salmon, sardines, shrimp, trout and tuna.

Meat is supposed to be consumed in moderation on this diet; You should try to consume 3-ounce servings several times a week, depending on Harvard Health Publications.

By contrast, the average American ate about 16 ounces of meat per week, according to 2022 research from the University of North Carolina.

The health benefits of reducing meat consumption are supported by a growing body of research.

Less meat consumption was found to extend life expectancy by 9 months and reduce carbon footprint by 25 percent. in a 2023 study from McGill University.

Choosing not to eat meat on weekends reduced participants’ chances of developing bowel cancer by nine percent in a 2022 study from the University of Oxford.

When you want to consume some animal protein (dieticians said you should), opt for lean meats that are low in saturated fat, such as fish instead of beef.