Table of Contents

Mortgage rates continue to rise despite the Bank of England cutting interest rates last week.

The last fixed interest rates below 4 per cent offered by major banks and building societies were withdrawn from the market today.

So far this week, seven major lenders have raised their mortgage rates.

This may have come as a surprise to households with a mortgage, particularly given that the Bank of England voted to cut the base rate from 5 per cent to 4.75 per cent last Thursday.

As expected, many banks responded by cutting rates on savings products. Immediately afterwards, big banks including Chase and Monzo reduced the rates available through their easy access deals.

As of Monday, at least 27 easy access deals have been cut or withdrawn since the base rate cut.

Banks also reduce rates on tracker mortgage deals that track the base rate and also on standard variable mortgage rates – the rate borrowers revert to after their fixed-rate deal ends. This could benefit about 1.4 million borrowers.

However, fixed rate mortgages, which are the preferred product of 7 million households, are being phased out.

Rising: Mortgage rates are rising because markets now think interest rates will stay high longer, and inflation is also expected to stay higher than previously expected.

Just a couple of months ago, there were more than a dozen banks offering rates below 4 percent.

Only Allied Irish Bank now offers rates below 4 per cent, and they are expected to withdraw them soon.

David Hollingworth, associate director at mortgage broker L&C Mortgages, said: “The large number of rate changes in recent weeks has continued to push rates higher, reflecting higher costs for lenders, as the market outlook for rates have moved closer to a “higher for longer” level.

“Now fixed rates at all major UK lenders are back above 4 per cent.”

Why are fixed mortgage rates rising?

Market expectations about how fast and low interest rates will be in the future have changed lately, and this is having a direct impact on fixed mortgage rates.

The Bank of England’s base rate is still expected to fall over time, but markets are now wondering if the pace will be as fast.

Last year, forecasts for where the base rate would eventually peak fell from a high of 6.5 percent to 5.25 percent, and mortgage rates changed with it.

Earlier this year, markets were pricing in six or seven base rate cuts in 2024, with investors betting rates would fall to 3.75 percent or 3.5 percent by Christmas.

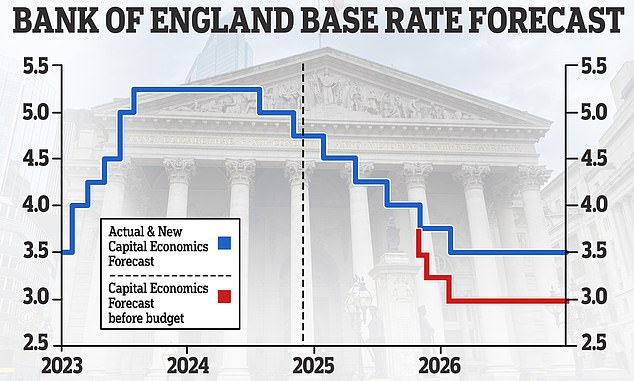

New forecast: Capital Economics has changed its interest rate forecast because it now believes the Bank of England will cut rates more slowly

But this did not materialize, and markets now expect only three or four interest rate cuts between now and the end of 2025, meaning the base rate would fall to 4 percent or 3.75 percent.

This has changed in particular in the last two weeks, as Labour’s budget plan to borrow and spend more has slightly unsettled government debt markets, raising interest rate expectations and bond yields.

There are also fears that Donald Trump’s return to the White House could have an inflationary impact in Britain. This could cause the Bank of England to keep interest rates higher for longer.

Jack Tutton, director of brokerage SJ Mortgages, told news agency Newspage: ‘The budget has been a disaster for the mortgage market. It came just when we were seeing the green shoots of recovery.

‘The cost of borrowing has increased significantly for lenders compared to what it was before the Budget.

“This has left lenders with no choice but to pass on these increases and raise mortgage rates.”

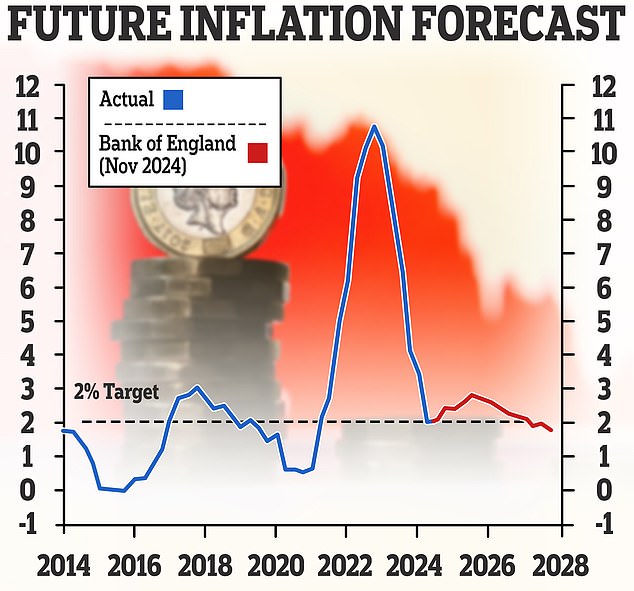

Tutton believes this is due to concerns that inflation could start to rise again, above the Bank of England’s 2 per cent target. It is currently 1.7 percent.

The Chancellor’s budget policies of increasing employers’ national insurance contributions could increase inflation, he says.

Inflation forecast: Bank of England expects inflation to remain slightly above 2% until 2027

“Many companies will have no choice but to increase prices to help cover these additional costs,” he added.

‘These increases are likely to boost inflation once they come into effect, meaning interest rates will stay high for longer. This will hurt mortgage holders.’

Mortgage market expectations are reflected in something known as Sonia swap rates.

These are arrangements in which two counterparties, such as banks, agree to exchange a stream of future fixed interest payments for a stream of variable future payments.

Simply put, swap rates show what financial institutions believe the future will hold with respect to interest rates.

As of Nov. 12, five-year swaps were at 4.05 percent and two-year swaps were at 4.26 percent, both trending well below the current base rate.

Five-year swaps have risen from 3.87 per cent on October 29, the day before the Budget. They are an increase from 3.7 percent on October 24.

Emma Cox, managing director of real estate at Shawbrook Bank, said: “The pricing of fixed rate mortgages is based on a range of factors beyond the Bank of England’s current base rate, including swap rates and economic risks. generals”.

‘These factors consider the anticipated cost of funds over the term of the mortgage.

‘The Bank of England’s base rate may decline today, but the market could simultaneously adjust its expectations around the pace and size of future rate cuts.

“This change may lead to higher prices for longer-term fixed rates, as we have seen recently.”

What happens if I need to remortgage?

Forecasts change frequently, but for now the advice for borrowers who need to remortgage in the coming months is to get a new rate now.

Borrowers can usually still change their mind and switch to a different rate, either with their current lender or a new one, if a cheaper one is available before their new mortgage starts.

On the other hand, acting early means you’ll avoid missing out if rates rise.

“For customers nearing the end of their fixed rate terms, it is essential not to delay in the hope that rates will return to levels seen weeks ago,” said Nicholas Mendes of mortgage broker John Charcol.

‘Getting a deal now provides security in an uncertain market. There is always the option to review and adjust if circumstances change, but acting promptly minimizes exposure to further rate increases.

“I cannot emphasize the importance of staying informed and proactive when managing mortgage commitments in today’s rapidly changing financial environment.”

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.