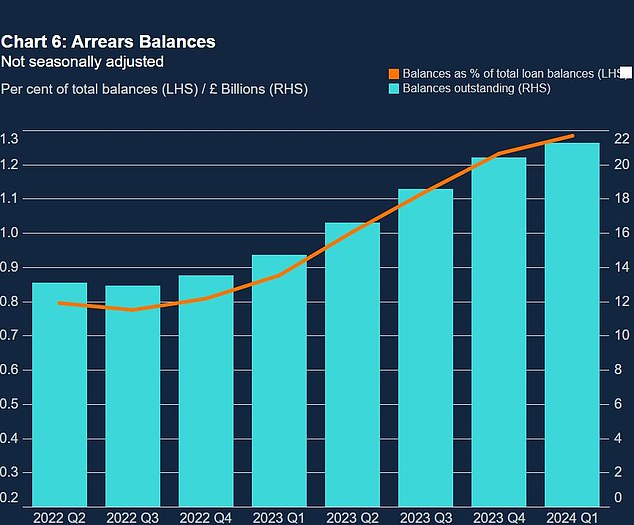

The number of mortgage arrears soared 44.5 per cent in the first three months of this year as homeowners struggle with higher rates, Bank of England data has revealed.

Outstanding arrears rose to £21.3 billion, up 4.2 per cent compared to the last three months of 2023 and up 44.5 per cent compared to the first three months of that year.

This is the highest total amount of arrears recorded since 2014.

Homeowners who come to the end of fixed-term deals agreed when rates were much cheaper and need to remortgage continue to face payment spikes.

In the red: According to official statistics, the number of borrowers behind on their mortgage payments of at least £1,500 has been rising over the past two years.

Separate research published today by rates monitor Moneyfacts Compare suggests that those reaching the end of a five-year fix this month can expect to see the interest they pay almost double, with average rates rising from 2.85 per percent then to 5.5 percent now. .

The proportion of all mortgages in default increased from 1.23 percent in the last three months of 2023 to 1.28 percent in the first three months of 2024, which was the highest level since late 2016.

On a mortgage with an outstanding balance of £175,000 and a remaining term of 20 years, that would mean the difference between paying £957 and £1,204 each month.

If they kept the same rate for the rest of the mortgage term, the total amount of interest they would pay would increase from £54,790 to £113,913.

In the two-year fixes, the change has been even more drastic. The average rate rose from 1.99 per cent in July 2020 to 6.85 per cent three years later, as the base rate rises and the mini-budget sent interest soaring.

James Hyde, of Moneyfacts Compare, said: ‘Mortgage rates may have fallen significantly since they peaked last year, but they remain much higher than they have typically been over the past 14 years.

“For example, those reaching the end of a five-year arrangement in June 2024 can expect their interest payments to almost double.

“If they want to lock in a shorter term to keep their future options open, rates will be even higher: the two-year average is currently close to 6 percent.”

> Calculate how much a new mortgage would cost you using the This is Money calculator

Data from the Bank of England also revealed that homeowners are borrowing less when taking out new mortgages.

The value of gross mortgage advances (new loans to borrowers) fell 2.6 per cent on the previous quarter to £51.6 billion, the lowest since 2020, and was 12 per cent lower than a year before.

This reflects the tendency of some homeowners to buy cheaper homes than they would have otherwise, to offset the effects of higher mortgage rates and broader pressures on the cost of living.

Despite the increase in the total balance of arrears, the data showed that the number of homeowners falling into arrears for the first time decreased.

New cases of arrears decreased 2.6 percentage points between January and March 2024 compared to the previous three months, falling to 13.2 percent of total outstanding mortgage balances in arrears.

This could suggest that the rise in arrears is largely due to those already in mortgage debt struggling to get out of it and accumulating more, rather than many more people falling into debt.

Borrow less: New advances to borrowers shrink as homeowners feel the squeeze

Simon Gammon, managing partner at Knight Frank Finance, said that while mortgage debt was rising, there was still no “systemic risk” to the property market.

“The value of mortgage arrears has increased as household finances have come under pressure from both higher mortgage rates and the rising cost of various goods and services,” he said.

‘This is serious for people struggling to pay their mortgage, but does not yet present a systemic risk to the housing market.

‘The proportion of total non-performing loan balances remains relatively low at 1.28 per cent, although Bank of England officials will monitor this data closely. In fact, new cases of arrears decreased slightly during the quarter, suggesting that the situation could be stabilizing.

‘Anyone concerned about falling behind on their mortgage payments should contact their lender as soon as possible. Lenders have been strictly instructed by regulators to offer forbearance, either by extending mortgage terms or temporarily switching to interest-only payments.

Mortgage rates have stagnated in recent months and could begin to fall further once the Bank of England decides to reduce the base rate. This could happen at the June 20 meeting, but markets are now forecasting August or September.

“Mortgage rates are currently trading sideways and, barring any unpleasant surprises, should continue to fall once the timing of the Bank of England’s first base rate cut becomes clear,” Gammon added.

Data on arrears comes from around 340 regulated mortgage lenders and servicers.

Arrears are only counted in the data when they reach 1.5 percent or more of the borrower’s current loan balance.

For example, if the loan balance is £100,000, loan arrears will only be included once they have reached £1,500 or more.

It means more homeowners who haven’t yet reached that level could be in default.

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.