A major law firm has quietly reduced by six weeks the amount of paternity leave it offers to most of its lawyers amid widespread layoffs in the industry.

Non-partners at global firm DLA Piper are now eligible for just 12 weeks of parental leave, compared to 18 and less than the 16-week average at most major law firms.

However, birth mothers will have an additional six weeks of leave.

It comes as law firms engage in an employment bloodbath and hiring freezes caused by economic uncertainty.

In a statement, communications director Geneva Dawn Youel said the company had to “strike a balance” between offering competitive benefits to staff while ensuring client work is adequately covered.

Non-partners at global firm DLA Piper are now eligible for just 12 weeks of parental leave, compared to 18 and less than the 16-week average at most major law firms.

In a statement, communications director Geneva Dawn Youel (pictured) said the company had to “strike a balance” between offering competitive benefits to staff while ensuring client work is adequately covered.

Companies rarely cut these benefits, as they are a crucial pillar for recruiting and retaining staff.

But widespread hiring freezes and layoffs have hit the legal sector. Industrywide hiring fell 35 percent in 2023 compared to the previous year, according to a report from the National Law Placement Association.

Therefore, drastically cutting paternity benefits could be seen as a cost-cutting measure to avoid layoffs, axios reports.

Youel told the outlet: ‘As a law firm, our top priority is to provide exceptional and consistent client service.

‘To achieve that goal, we must strike a balance between providing our attorneys with competitive benefits while ensuring the firm has adequate coverage of client matters. We’ve done it here.’

DailyMail.com has contacted DLA Piper for comment.

Experts criticized the decision because it would hamper their ability to hire more staff.

Hilarie Bass, former co-president of Greenberg Traurig and former director of the American Bar Association, told Axios: ‘I think it’s a really short-sighted approach. I think it will hurt them competitively in the world of recruiting.”

In an article for Above the Law, Kathryn Rubino said, “This is absolutely the kind of thing that associates abandon at firms, even if the change doesn’t immediately affect them.

“This shows how little the firm cares about its non-partner attorneys.”

A 2022 study shows that the number of organizations offering paid maternity leave fell 35 percent that year. It had fallen 53 percent due to the pandemic in 2020.

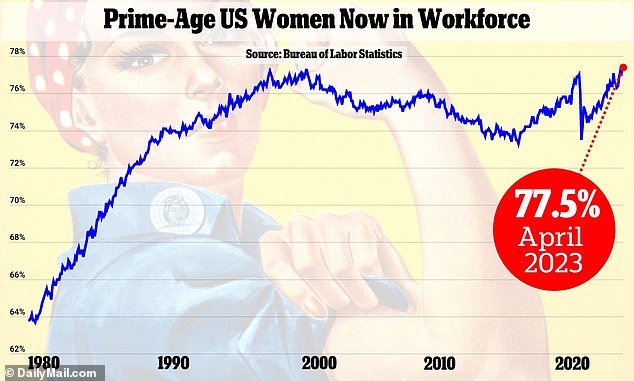

In April, women’s labor force participation rate hit a record 77.5 percent, surpassing the high reached in 2000.

Findings from the Society for Human Resource Management (SHRM) found that the proportion of companies offering paid parental leave similarly fell from 44 percent to 27 percent.

More companies that cut benefits risk reversing the historic gains made by women in the workplace.

Last year, the number of women in the American workforce reached its highest level ever recorded, breaking a record set in 2000.

Data from the US Bureau of Labor Statistics showed that the gains had been driven by an increase in the number of working mothers.

About 73 percent of women with children under 18 were employed or seeking employment.

The trend was sparked by a pandemic-induced shift toward hybrid and remote work, which made it easier for mothers to balance childcare duties with their careers.