Table of Contents

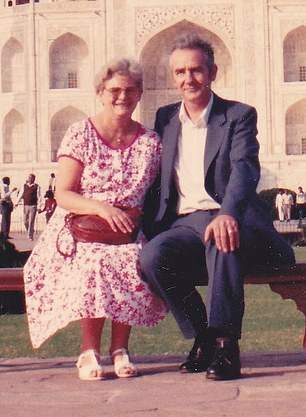

DWP letter received in February: Graham Meyrick and his late wife Betty

Bereaved people say the Department for Work and Pensions is leaving them hanging for months after sending them letters about possible errors in their deceased relatives’ state pensions.

In the latest in a series of cases, Karen Mitchell says a sudden letter in May “stirred everything up” about the death of her mother, Anne, aged 67, a decade ago.

She called the DWP repeatedly to request information and each time received a different response.

This included that forms she had sent in had been lost, that her mother could not be found in the system and separate estimates of £1,000 and £3,000 on what she was owed.

Graham Meyrick, now 83 and pictured right with his wife Betty, who died in 1994, received an unexpected letter in February.

He said he might be owed an increase in his state pension through his National Insurance contributions, but despite replying within days, he heard nothing further.

The amounts involved are not disclosed in the letters, leaving recipients baffled as to what sums they might receive.

After This is Money intervened, Ms Mitchell received an apology and £1,440, but Mr Meyrick received nothing.

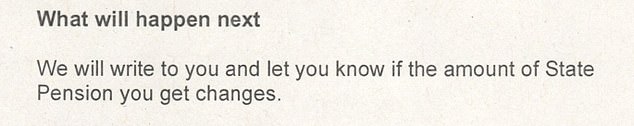

The DWP did not explain why Mr Meyrick’s state pension would not change, telling us that it had explained in its letter that it would write to him again only if there was a change in the amount.

Below is the relevant extract from the letter to Mr Meyrick. It is ambiguously worded and one can probably read into it that the DWP will respond with the outcome either way.

“When the DWP sends out letters about potential underpayments, you need to think about the impact on the recipient,” says Steve Webb, former Pensions Minister and retirement columnist for This is Money.

‘In some cases, the letters refer to loved ones who died years ago and can be quite disturbing.’

“The least we can do is process the documents quickly and let people know the outcome, not leave them in limbo.”

Webb, who is now a partner at pensions consultancy LCP, adds: “The DWP should also ensure call handlers are properly trained and do not give inaccurate information which only increases distress.”

When the DWP sends letters about potential underpayments, you need to think about the impact this will have on the recipient. In some cases, the letters relate to loved ones who died years ago and can be quite upsetting.

Steve Webb, former Pensions Minister

Major mistakes have been made in recent years, resulting in state pension payouts of tens of thousands of pounds and, in some cases, compensation awards of more than £100,000.

Have you or a deceased relative received an insufficient state pension? Find out what to do next

The DWP and HMRC are attempting to contact those affected by the errors and pay the arrears to them (or their beneficiaries, if they have died), but this has led to frustration at the delays and other errors.

Three cases we recently investigated of bereaved families who received letters from the DWP and were then left in the dark for months resulted in separate payments of £3,800 and £27, and an apology for sending a letter in error.

On one occasion, a DWP staff member told a grieving daughter who had called for information: “Don’t book that world cruise just yet” and laughed.

Earlier this year, Webb helped the family of a 90-year-old woman who sought an initial letter for months and at one point was verbally told by the DWP that she could be owed £60,000 or more, but her payment ended up being just over £400.

It also helped a reader who received a letter saying her father, who died aged 100, had received an insufficient state pension for 20 years but then heard nothing from the DWP for six months.

Following Webb’s intervention, our reader inherited his father’s state pension arrears, amounting to just under £8,000.

Many older married and widowed women, and both men and women over the age of 80, were underpaid totalling more than £1bn in a state pension scandal uncovered by our columnist Steve Webb and This is Money.

In another HMRC mistake we highlighted, many mothers lost out on large sums of state pension money due to gaps in their National Insurance records.

‘My mother passed away 10 years ago and this has revolutionized everything’

Karen Mitchell received a letter from the DWP in May saying her mother had been receiving an insufficient state pension for five years before her death in 2014.

STEVE WEBB ANSWERS YOUR QUESTIONS ABOUT PENSIONS

She immediately returned the enclosed form and when she heard nothing further she began contacting the DWP about it once a week.

Ms Mitchell subsequently sent a second form by certified mail, but received a different response from staff each time she called, including the forms being lost and her mother’s details not being located.

“On one occasion they even said they had closed the account because they had not received previous forms that never reached me,” he told us.

“There’s apparently no way to contact them and talk to them. You have to go through the bereavement department, who can email them and send them your details, but it doesn’t make any difference.”

Ms Mitchell said she felt she had tried everything to find out what was owed to her mother, who was a retired cleaner and kitchen worker living in Cumbria.

“My mother passed away 10 years ago and this has revolutionized everything,” he told us.

“I don’t know how they can just reach out to grieving families, give them some hope of money and leave them hanging.”

On one occasion, a DWP staff member told her that she was owed around £3,000 to her late mother, and on another occasion that it was around £1,000 because she had received benefits.

After This is Money raised the case with the DWP, a spokesperson said: “We apologise to Ms Mitchell and have issued the state pension arrears owed as part of her mother’s estate.”

Ms Mitchell received almost £1,440 and thanked us, saying: “I’m sure this only happened after your correspondence.”

Is it reasonable to ask for a written response outlining your conclusions?

Graham Meyrick, who lives in Thailand, received a letter dated late December 2023 from the DWP at the beginning of February this year.

He said he could be owed an increase in his state pension through National Insurance contributions from his late wife Betty, a care assistant who died aged 57 in 1994.

Mr Meyrick, 83, a retired hospital worker who lived in Dorset before moving abroad, completed the form and sent it back within days but received no reply.

“I have to assume, therefore, that I may be being paid the correct amount, but the DWP felt it was unnecessary to inform me of this,” he told us.

Is it reasonable to ask for a written response, setting out your findings and giving full details of the amounts involved?

He added: “It’s a start. We have all paid our social contribution and we expect to receive something in return.”

After This is Money flagged his case, we were told the amount being paid to Mr Meyrick was correct, but the DWP gave no further details despite our request for more information.

The DWP told us that its letter to Mr Meyrick said it would write to him again only if there was a change to the amount of his state pension.

However, as the extract from the letter above shows, it did not say “only if” and the wording was ambiguous as to whether he would be contacted with the outcome of his late wife’s pension.

Some links in this article may be affiliate links. If you click on them we may earn a small commission. This helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationships to affect our editorial independence.