Table of Contents

- Political and regulatory pressure keeps investors at bay from struggling sector

- Industry regulator Ofwat to make final decision on household bills

The business risk facing British water companies is growing as the sector struggles to attract investment amid strong public, political and regulatory pressure, Moody’s has warned.

The credit rating agency, which this summer helped Thames Water breach its operating license with a downgrade, on Tuesday maintained a “negative” outlook for the sector.

It pointed to continued poor performance, driven by overspending and regulatory fines.

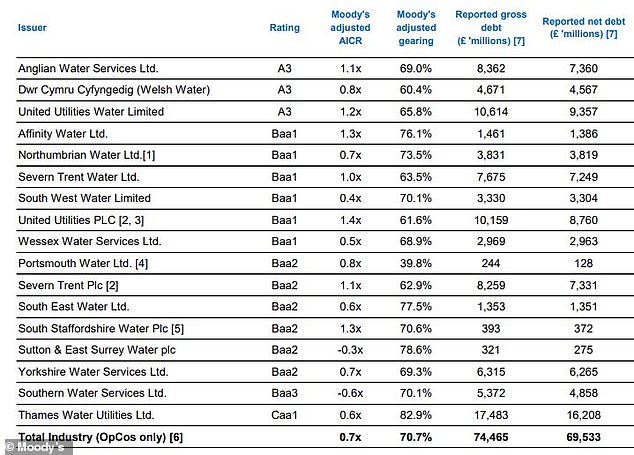

Moody’s said water companies, which have combined net debts of more than £69.5bn, are suffering from “declining investor confidence” ahead of a final decision on household bills due in late 2024. .

Thames Water boss Chris Weston said Ofwat’s draft determinations would leave it ‘neither bankable nor investable’

Industry watchdog Ofwat in July revealed its draft decisions on how much it would allow firms to increase bills over the next five years.

While bills are expected to rise by £94 on average over the period, Ofwat’s determination fell far short of what many water companies say they need to improve critical infrastructure while still attracting investment capital.

Chris Weston, chief executive of Thames Water, said Ofwat’s proposal that it can increase bills by 23 per cent by 2030 would leave Britain’s biggest water company “neither bankable nor investable”.

Thames, which has debt of £16.2bn, instead wants to increase bills by 52 per cent over the period.

The water sector has a combined reported net debt of £69.5bn, with Thames Water being the most indebted.

Moody’s said on Tuesday that while Ofwat’s final determinations “are typically less onerous than drafts”, the water industry’s “commercial risk is growing with ongoing public, political and regulatory pressure diminishing investor confidence.” “.

The company said it could change its outlook from “negative” to “stable” if Ofwat’s final determination “supports the investment needs of the companies or management and shareholders take mitigating action to strengthen credit quality.”

Many water companies “are laying the groundwork for an appeal” to the Competition and Markets Authority “if ‘the risk and return profile is not rebalanced in their favour'” in Ofwat’s final decision, according to Moody’s.

Moody’s said: ‘If companies decide to appeal to the CMA, the final agreement may not be known before autumn 2025, because the CMA normally has six to 12 months to process appeals.

‘Weak operating performance, exacerbated by strict regulatory targets, may make it difficult for companies to attract capital investment in the future.

“An unfavorable risk-return profile will end up increasing the cost of financing and, therefore, the bills consumers pay.”

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free Fund Trading and Investment Ideas

interactive inverter

interactive inverter

Fixed fee investing from £4.99 per month

sax

sax

Get £200 back in trading fees

Trade 212

Trade 212

Free trading and no account commission

Affiliate links: If you purchase a This is Money product you may earn a commission. These offers are chosen by our editorial team as we think they are worth highlighting. This does not affect our editorial independence.