Table of Contents

Customers of digital bank Monzo will soon be able to merge all their old pension funds into the Monzo app.

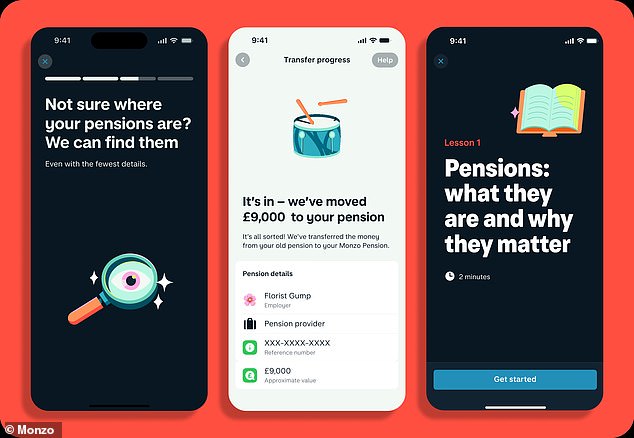

Monzo has launched Monzo Pension, a tool that will allow customers to pool all their existing personal and workplace pensions and keep them in one place on their Monzo app.

Old pensions will be pooled into retirement funds managed by investment manager BlackRock.

Customers will be able to register their interest in Monzo Pension from today in the Monzo app, with the pensions tool rolling out to customers over the coming months.

Monzo Pension: Customers will soon be able to merge their old pensions into the Monzo app

According to research by the banking app, 51 per cent of UK adults may not know how much money they have in their pension pot for retirement, while 64 per cent have not merged their pension pots.

Monzo asked 2,000 people what would make managing their pension easier, and 38 per cent said a process that was more accessible to manage alongside their day-to-day finances.

> Read more: Should you consider merging your pension funds?

How will Monzo Pension work?

Customers must provide some details about where and when they have worked, and Monzo will then track down their old pension funds.

There will be no limit on the number of pensions a client can combine.

The pensions will be merged into retirement funds in the BlackRock LifePath Target Date Fund range.

The funds chosen use the age at which the client intends to retire as a guide, moving from higher-risk investments to lower-risk investments over time.

What are Monzo Pension’s fees?

Monzo customers will pay 0.63 per cent of the value of their pension in fees annually, made up of a 0.45 per cent platform fee and a 0.18 per cent fund fee.

Monzo Perks and Monzo Max customers, who pay £7 and £17 a month for their accounts respectively, will pay a smaller platform fee of 0.35 per cent.

Monzo pensions have no withdrawal or exit fees.

A customer with £10,000 in their Monzo Pension would pay fees of £62.91 a year, for example.

How do they compare to rates elsewhere?

By comparison, Lloyds Ready-Made Pensions has an annual account fee of 0.3 per cent, or a minimum of £5 a month.

The current investment charges are 0.24 percent and there is a transaction cost of 0.14 percent.

Monzo Pension to offer BlackRock funds from BlackRock LifePath Target Date Fund range

Pension Bee’s fee structure decreases the larger your savings amount. Depending on the plan, pension savers will pay between 0.50% and 0.95%. This halves the portion of your savings above £100,000.

Andy Smart, general manager of savings, investments and pensions at Monzo, said: ‘We know from speaking to our customers that visibility and awareness of their pension is low and anxiety is high, which is why we’ve designed Monzo Pension to solve exactly these problems.

‘Managing multiple pensions and planning for retirement is unnecessarily complex, meaning people tend to avoid it and end up at a disadvantage.

‘Now our customers can take the lead and keep track of their future financial goals alongside the rest of their finances in the Monzo app, planning not just for today or next month, but for years to come.’

What to consider before merging your pensions

1. Rates of old and new pension plans

Higher fees can make a significant dent in your future returns.

2. Where are your pensions invested?

Past performance is no guide to the future, but you should do your research into where your money will be held. Read our guide to conducting an investment health check.

3. A private provider vs. your work plan

Pension consolidation companies have emerged to help people manage all or most of their pensions in one place, and this can be cheaper and more convenient.

However, your current workplace plan may have negotiated lower rates, and stacking your older pensions there could be even more useful if you want to reduce administrative costs.

4. High exit fees

Most default workplace pension funds are currently trackers with cheap fees. If you have an old, expensive pension with restrictive investment options, you might want to weigh up the benefits of switching despite the penalties.

But exit fees are capped at 1 percent after age 55, so it might be worth waiting.

5. Continuous employer contributions

Ongoing Employer Contributions You’ll receive free employer contributions into your current workplace plan, and you don’t want to lose that money going into your fund.

SAVE MONEY, EARN MONEY

Boosting investment

Boosting investment

5.09% cash for Isa investors

Cash Isa at 5.17%

Cash Isa at 5.17%

Includes 0.88% bonus for one year

Free stock offer

Free stock offer

No account fees and free stock trading

5.78% savings

5.78% savings

You have 365 days’ notice

Transaction fee refund

Transaction fee refund

Get £200 back in trading commissions

Affiliate links: If you purchase a product This is Money may earn a commission. These offers are chosen by our editorial team as we believe they are worth highlighting. This does not affect our editorial independence.

Some links in this article may be affiliate links. If you click on them we may earn a small commission. This helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationships to affect our editorial independence.