- The Model 3 Performance will go from 0 to 100 km/h in 2.9 seconds and reach a top speed of 263 km/h.

- On sale today from £59,990, the first UK deliveries are expected to arrive in the summer.

- New exterior and interior adjustments will distinguish it from other Model 3s

The new Tesla Model 3 Performance has just been unveiled and comes with supercar-rivaling performance and a distinctive interior appearance.

The Performance variant of Tesla’s extremely popular electric sedan offers some powerful driving stats. This includes 0-60 mph acceleration in 2.9 seconds, a top speed of 163 mph, and 460 horsepower.

It’s available to order from today (Wednesday 24 April) with prices from £59,990, with UK deliveries coming this summer.

The Tesla Model 3 is back after a brief hiatus (from 2022) and is the fastest Performance model to date. The £59,990 model will do 0-100 in 2.9s, with a top speed of 163mph and will produce 460hp.

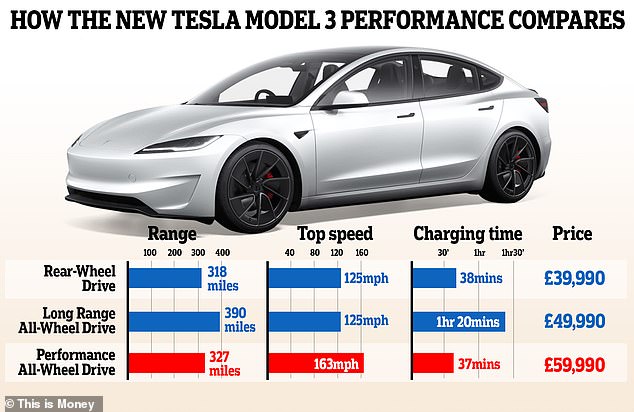

The Performance variant follows the recently updated Model 3 (it had a facelift in 2023) and joins the rear-wheel drive and long-range models to complete the Model 3 offering.

It will use a 75 kWh battery and range is estimated at 328 miles; This is 10 miles more than the rear-drive version, but 62 miles less than the long-range version.

The Model 3 Performance has lower energy consumption than the previous Model 3 Performance (2022) and a more aerodynamic exterior design.

The latter is said to have helped shave 0.2 seconds off the outgoing Performance’s 0-60 mph acceleration time.

The Performance version joins the less expensive rear-drive and Long Range 3 models, and will offer 328 miles on a single charge.

The exterior receives the same updates as the rest of the Model 3 range with an aggressive new front and rear fascia, cooling ducts, rear diffuser and carbon fiber spoiler.

The Performance comes with Tesla’s latest Track Mode V3 with better handling, stability controls and adaptive suspension.

The ‘next-generation high-performance powertrain’ also has a specially designed chassis and track-ready brakes with high-performance brake pads.

The Performance comes with Tesla’s latest ‘Track Mode V3’, which integrates adaptive suspension controls and the optimized performance powertrain into a single system.

A host of tuning options mean you can become Lewis Hamilton and customize everything from handling balance, stability control and regenerative braking.

The exterior receives the same updates as the rest of the Model 3 range with an aggressive new front and rear fascia, cooling ducts, rear diffuser and carbon fiber spoiler.

The interior is different from the other Model 3 interiors: it has special sports seats that are designed to improve the driver’s stability.

The rest of the Model 3 Performance’s cabin follows the same minimalist look that Tesla is known for, with that 15.4-inch main touchscreen.

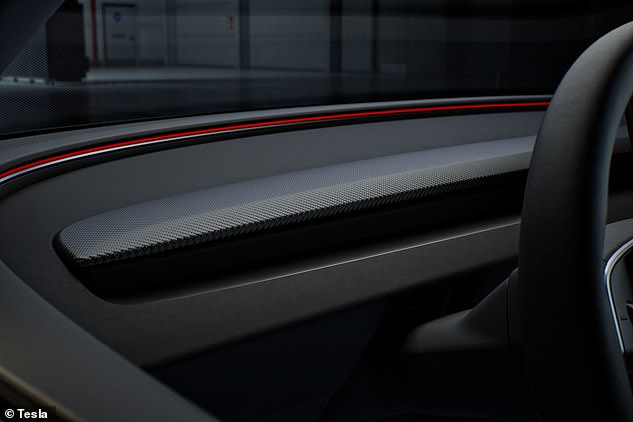

The Performance model also comes with carbon fiber accents, featuring Tesla’s first special carbon fabric.

At £59,000, it’s a marked margin over the other Model 3s on sale in Britain. It costs £20,000 more than the entry-level model and £10,000 more expensive than the mid-level Long Range model.

Inside, customers get the Model 3 interior first.

New heated and ventilated ‘Sports Seats’ with upgraded cushions and side bolsters (for improved cornering support) and carbon fiber trim details debut in this latest Tesla and will likely prove popular with the Teslarati fan base.

It also features the 14.3-inch Tesla touchscreen infotainment system that comes with built-in satellite navigation, charging information, music, games and Spotify.

At £59,000, it’s a marked margin over the other Model 3s on sale in Britain.

It costs £20,000 more than the base model and £10,000 more than the mid-level Long Range model.

Order books are open and deliveries are expected by the end of June.