Your body shape could put you at additional risk of one of the fastest-growing cancers among young people, a study warns.

Colon cancer is the second leading cause of cancer death in the United States, with approximately 150,000 new cases projected by 2024 and 50,000 deaths.

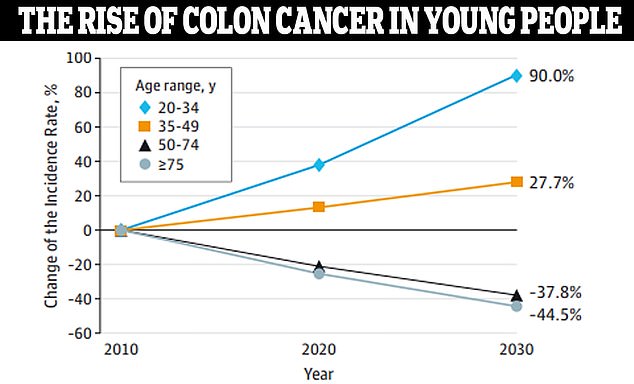

Rates among people under 50 have increased in recent years, and doctors warn that alcohol, junk food and sedentary lifestyles increase the risk.

Now, a study has found that people’s body type and where they store fat (as opposed to how much they have) also play a role.

Researchers from six countries, including the US and the UK, found that “generally obese” people, as well as those who were taller and had more abdominal fat, had a higher risk of colorectal cancer.

The team suggested that having more fat around the midsection could alter processes such as metabolism and blood sugar, increasing the risk of cancer.

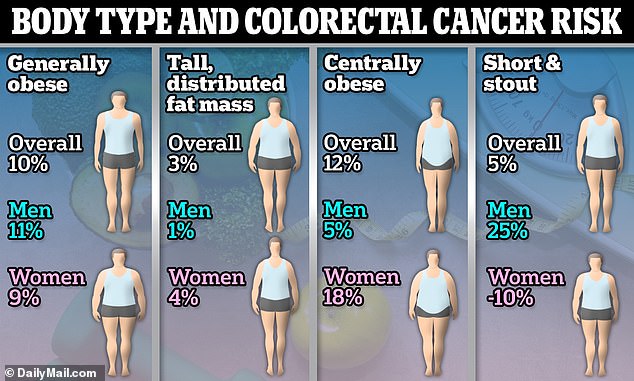

Being “generally obese,” which is typically defined as having a BMI greater than 30, was linked to a 10 percent higher risk of colon cancer than people of a healthy weight.

But researchers found that tall body types not defined as obese but shaped like beer bellies were 12 percent more likely to get colon cancer than the average person.

And women were at higher risk than men in the same way, with an 18 percent higher risk.

Junk food, alcohol and a sedentary lifestyle contribute to a beer belly or an apple-shaped body. It’s unclear if this body type specifically has become more common, although obesity is increasing in the US.

CDC data suggests that 40 percent of Americans are obese and about 69 percent are overweight or obese. According to Harvard University, obesity rates in the United States have doubled since 1980, which could be one explanation for the increase in colorectal cancer among young people.

Meanwhile, those who were tall and had more evenly distributed fat, such as in their arms, legs and breasts, or those who were short and stocky had the lowest risk.

Overall, the former had a higher risk of three percent, while the latter was five percent.

The researchers said the findings show that people with body types that store fat in a concentrated area around the intestine were at the highest risk.

They added that where fat accumulates on the body may be a better indicator of cancer risk than BMI alone.

Data from JAMA Surgery showed that colon cancer is expected to increase by 90 percent in people ages 20 to 34 by 2030. Doctors aren’t sure what is driving this mysterious increase.

Jelena Tompkins (left) was just 34 years old when she was diagnosed with stage three colon cancer. Her first symptom was foul gas. Jill MacDonald (right) was 36 years old when doctors mistook her stage four colon cancer for hemorrhoids.

Dr Heinz Freisling, author of the study and scientist at the International Research Agency in France, said: “We believe that the most commonly used body fat indicators, such as body mass index or body fat distribution (e.g. waist circumference) are underestimating cancer. risk.’

“Despite their usefulness, these indicators group people with a similar body mass index but a different body shape into the same category, while we know that people with the same body mass index may have a risk of cancer very different”.

The team noted that this increased risk could be due to increased levels of growth hormone, as well as fat that accumulates around areas such as the breasts, reproductive organs, nerves and blood vessels.

Increased body fat, also known as adipose tissue, has been shown to cause problems with metabolism, inflammation and blood sugar regulation, leading to higher levels of adipokine hormones.

Adipokines, including leptin, could be “potentially directly relevant to cancer development,” Dr. Freisling said.

Adipose fat can be visceral (between internal organs) or subcutaneous (just under the skin). Visceral fat, which is found deep in the abdominal cavity and surrounds important organs such as the stomach and liver, has also been associated with a number of problems such as high blood pressure, heart disease and diabetes.

Other research has also theorized that taller people have a higher risk of cancer because they have a larger colon and more room for cancer cells to form.

The study was published last week in the journal Scientific advances.

The research team from six countries, including the US and the UK, analyzed the medical records of nearly 330,000 adults in the UK Biobank database to look at the relationship between height and fat distribution and breast cancer. colon.

The team divided the participants into four groups based on their body shape, which was defined by their height and fat distribution.

These groups were PC1 (generally obese), PC2 (tall, but with more distributed fat mass), PC3 (centrally obese), and PC4 (shorter, heavier but with lower hip and waist measurements).

Women in the PC1 group had a nine percent risk and men had an 11 percent risk. Men in PC3 had a five percent risk and women in that group had an 18 percent higher risk.

Men in PC2 had a one percent increased risk and women had a three percent increased risk. While men in PC4 had a 25 percent higher risk, women were 10 percent less likely to develop the disease.

“We believe that the most commonly used indicators of body fat, such as body mass index or body fat distribution (for example, waist circumference), underestimate the risk of cancer due to an unhealthy weight,” the study said. Dr. Freisling.

He noted that the findings show that “people with the same body mass index may have very different cancer risks.”

Additionally, Caucasian, Black, Asian, and Chinese people with these body types had the same risk overall, suggesting that race and ethnicity did not play a role.

“There are probably only limited possibilities, common to all ancestral groups, of how body measurements such as weight and height can be combined to form a body shape,” Dr. Freisling said.

“It also suggests that the biological processes that determine body shape are evolutionarily conserved, as they are key molecular pathways for the survival of the individual.”

Next, the team plans to conduct additional research into potential mechanisms of body shape’s impact on colorectal cancer risk.