- Michael Chidozie, 26, was shot and killed by his wife Keaiirra Shavoiyae Chidozie, 28, in the Houston area.

- He spent 18 days in the hospital before dying from complications of a spinal injury.

- His wife was charged with assault, but the charge has not been upgraded to murder since his death.

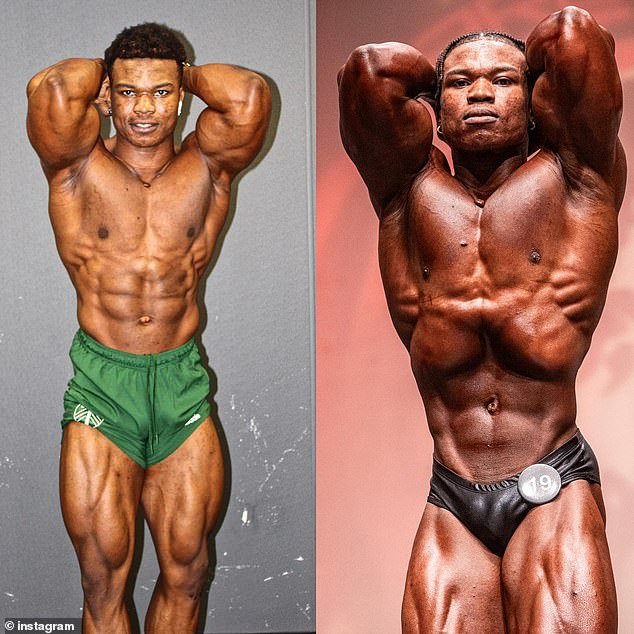

A bodybuilder has died weeks after being shot dead by his wife in the middle of an argument in front of their children.

Michael Chidozie, 26, died last week after his wife Keaiirra Shavoiyae Chidozie, 28, shot him four times at their Houston home on March 21, police said.

He was rushed to Ben Taub Hospital after police found him with gunshot wounds and his panicked wife holding their two children, aged three and two.

Chidozie remained on life support as his family prayed for his recovery, but he suffered a devastating spinal injury and died from complications 18 days later.

Michael Chidozie, 26, died last week after his wife shot him four times in their Houston home on March 21.

Keaiirra Shavoiyae Chidozie, 28, was charged with aggravated assault with a deadly weapon after the shooting, and her charges have not been upgraded since her death.

Chidozie remained on life support as his family prayed for his recovery, but he suffered a devastating spinal injury and died from complications 18 days later.

Keairra was charged with aggravated assault with a deadly weapon after the shooting, and her charges have not been upgraded since her death.

She claimed to have shot Chidozie in self-defense because she feared for her life during the argument when he followed her to her bedroom.

It is not clear what the reason for the argument was.

The argument began in another part of the house before she went to the bedroom, where she grabbed a gun and shot him.

Chidozie was shot in the arm, once in the chest and twice in the torso and left to die on the bedroom floor.

Police found Keairra with the children in a nearby parking lot after witnesses called police to say she was frantically running for help.

Friends said they never saw the couple be violent toward each other and were shocked that an argument escalated into something deadly.

Chidozie was shot in the arm, once in the chest and twice in the torso.

Chidozie’s family is trying to raise $70,000 to bring his body to Nigeria for burial as his dream was to one day return to his homeland.

Friends said they never saw the couple be violent toward each other and were shocked that an argument turned deadly.

Chidozie’s family is trying to raise $70,000 to bring his body to Nigeria for burial as his dream was to one day return to his homeland.

‘His passing has left a deep void in the lives of all who knew and loved him. “He was a devoted father, a beloved son and a dear friend to many,” they said.

“Chidozie’s kind heart, infectious laugh and unwavering love for his family will always be remembered and appreciated by all who were lucky enough to know him.”

Keaiirra was released on bail and will next appear in court on May 23. Her children are in the care of another family.