Wyoming is becoming the first state to offer a state-backed cryptocurrency, according to Gov. Mark Gordon.

Speaking at a conference in Jackson Hole on Thursday, Gordon revealed that the state is working on its own stablecoin, which it plans to launch next year.

According State of the Cowboys Diary“We want to do it right. We want to find the right methodology to be able to implement it. We have done a lot of that work,” he said.

In May, the state passed the Wyoming Stable Token Act, which created a commission to study the issue and provide stable tokens, which are typically pegged to another asset such as the dollar.

Wyoming is one of the first states in the country to explore the possibility of having its own cryptocurrency, which Gordon said underscores its commitment to innovation.

Speaking at a conference in Jackson Hole on Thursday, Governor Gordon, seen here, revealed that the state is working on its own stablecoin which it plans to launch next year.

In May, the state passed the Wyoming Stable Token Act which created a commission to study the issue and provide stable tokens, which are typically pegged to another asset such as the dollar.

He added: “It’s a wonderful way for the state to help diversify our economy. It’s exciting to see that as many trust companies have started to move here, financial firms that are looking at Wyoming understand that we have the ability to be early adopters pretty quickly and smartly.”

‘Innovation is in our DNA. That’s why Wyoming was the first to have the LLC law. (Digital) innovation has really developed over several legislations, and it’s really remarkable where we are now.

“I’m delighted that in Wyoming we can continue to work hard to ensure this is a business-friendly environment, taxes are low and we can drive innovation.”

According CNBCThe state is currently researching potential partners to help build the stablecoin.

An exchange and wallet providers, both Coinbase and Kraken offer both, will be required to purchase and hold the token.

The state plans to issue the token to an exchange so that it can then be issued to the retail user.

From there, it would simply be another payment method for buying everyday things, according to Flavia Naves, commissioner of the Stable Token Commission.

She told the outlet: ‘When you enter Cowboy Coffee in Jackson, Wyoming and want to purchase your latte, there will be a wallet there in Solana that you can use to purchase your coffee with the Wyoming Token.

The state plans to issue the token to an exchange so that it can then be issued to the retail user.

Naves also said the commission plans to invest the reserves backing each token in circulation and use the interest to make investments in public schools.

Despite the governor’s enthusiasm for the project, not everyone in the state is convinced that the tokens offer enough to move forward with the risks.

Wyoming Banking Association President and CEO Scott W. Meier told Cowboy State Daily: “Right now, I think we have a vast area of unknowns.

“I wouldn’t say Wyoming community banks are necessarily against it, but they’re not necessarily in favor of it either. Everyone is watching to see how this affects our industry.”

He is concerned about the stability of the token’s operation. Customers will come to buy tokens, which the state would then buy in tokenized US Treasury bills to back that token, in addition to holding cash in reserve.

Meier suggested the problem is what happens to the value of those notes when interest rates rise and someone wants to return their token to get cash.

Despite the governor’s enthusiasm for the project, not everyone in the state is convinced that the tokens offer enough to move forward with the risks.

Although cash would be available, the government would then need to sell the Treasury bills to complete the transaction.

He added: “But if you have a Treasury bill that’s paying 2% and all of a sudden interest rates go up, well, you can’t sell it, because nobody’s going to want to buy it. Those are the kinds of things that the market behaves strangely with.”

Meier is also afraid of taking money out of the system, which could create shortages and have ripple effects on the economy.

He added: “Let’s say a bank in Wyoming has a client who wants to invest $100,000 in a Wyoming stablecoin.”

“That money is no longer in our system. And that can be good or bad, depending on how you look at it, but from a banking standpoint, that’s $100,000 that’s not in the bank. That’s $100,000 that the bank can’t lend out.”

The decision to move ahead with cryptocurrencies has already had its consequences: Gordon listed stress tests and federal agencies putting up roadblocks for smaller banks.

He added: “The Federal Reserve today is more of a drag on innovation than an opportunity to put America first and ensure the dollar remains the standard we all want to see.

“But it’s also the CFPB, the SEC and the FDIC that are interested in trying to de-bank the relationships between digital assets and banks, which is a central part of what we’re trying to do here in Wyoming.”

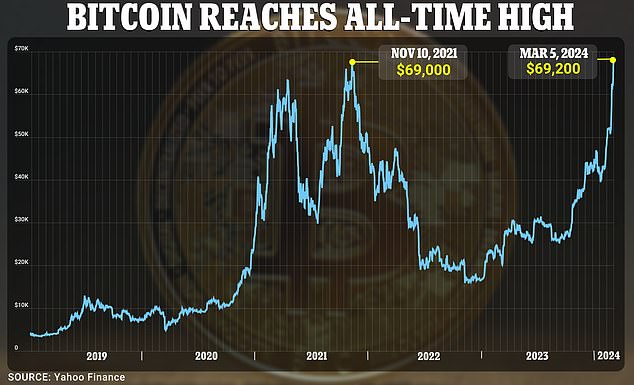

In March of this year tThe price of Bitcoin hit an all-time high of $69,000 as people continue to invest their savings into the currency.

The price of the coin surpassed its previous peak of $69,202 since November 2021 and made a major comeback following its crash in mid-2022 that saw its value drop by almost two-thirds.

The record was boosted by the US securities regulator approving 11 bitcoin exchange-traded funds (ETFs) that allow bitcoins to be bought and sold like stocks.

While corporate investors and young people using smartphone apps have been able to invest in Bitcoin for years, the approval of EFT opened up a new goldmine of investors for the company: namely, those between 60 and 78 years old.

It allowed less tech-savvy baby boomers, born between 1946 and 1964, better access to buying and tracking cryptocurrencies. Instead of investing retirement funds in more traditional stock exchanges, retirees have been buying bitcoins.

Some links in this article may be affiliate links. If you click on them we may earn a small commission. This helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationships to affect our editorial independence.