Table of Contents

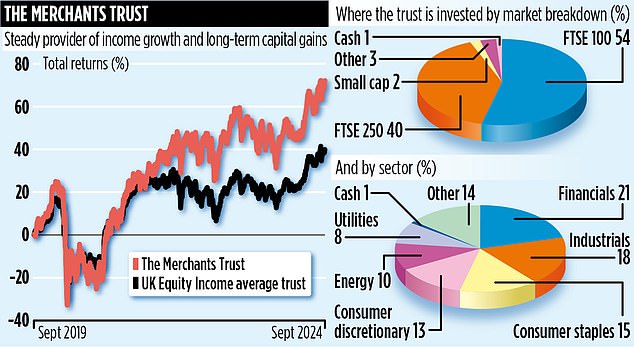

The Merchants Trust is a solid investment fund with a history stretching back 135 years. However, there is nothing outdated or dated about this £889m fund which continues to provide investors with an attractive combination of income and capital returns on the UK stock market. It stands out among its peers.

The trust is managed by Allianz Global Investors and is led by Simon Gergel, who has been in charge of the investments for more than 18 years. He is supported by Richard Knight and Andrew Koch in portfolio management.

The trust’s performance figures are impressive. Over the past one, three, five and ten years, it has outperformed its UK equity peer group average. For example, over the past year it has produced a total return of 20 per cent compared with the peer group average of 18 per cent. Over five years, the outperformance is magnified: 70 per cent versus 38 per cent.

There is no magic formula for its success, just a lot of hard work and a commitment to an investment style that focuses on identifying undervalued companies that the team believes will succeed over the long term. These companies typically offer dividend yields above the market average. The trust’s current annual yield is 4.8%, which compares with a 3.5% yield on the FTSE100 index.

Indeed, income is central to Merchants’ investment proposition. Along with a small group of other investment trusts, it has a track record of annual dividend growth stretching back decades.

Although other trusts have a longer track record – such as Alliance, Bankers and City of London – 42 consecutive years of annual dividend increases is impressive. Gergel and the trust’s board are keen to maintain the record, reassured by the fact that the fund has more than half a year’s worth of income stashed away in reserves, which will be used if dividends from existing holdings decline.

Dividends are paid quarterly and the first payment of the current year was 7.2 shares per annum, an increase of 0.1p on the equivalent payment made 12 months earlier. Shares in the trust are priced at just under £6.

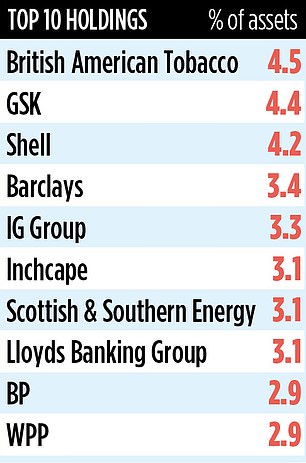

The portfolio currently includes just over 50 stocks, with well-known dividend-paying companies among its top holdings: oil companies such as BP and Shell and British American Tobacco.

Gergel and his team are bold investors who take positions in companies that have fallen out of favor. Among the latest additions to the trust’s portfolio is luxury goods maker Burberry, a company that has suffered from poor sales, culminating in the appointment of a new chief executive, Joshua Schulman.

Although the trust bought shares in the company before the boardroom turmoil and suspension of its dividend,

Gergel says he is prepared to “maintain strong business franchises through a period of restructuring where we can see significant value.” Burberry shares are almost 70 percent lower than they were at this time last year.

Gergel adds: “There is a lot of value in the UK stock market, especially in companies like Burberry, where its share price has taken a hit.”

Other recent additions to the portfolio include high-tech engineering firm Dowlais and student accommodation specialist Unite.

Gergel said: “Dowlais is an attractive business with a decent yield (6.5 per cent) while Unite continues to benefit from strong demand for student accommodation and its share price could go far.”

The trust’s total annual charges are competitive at 0.55 percent. Its identification code is 0580007 and its symbol is MRCH.

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investment and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free investment ideas and fund trading

interactive investor

interactive investor

Flat rate investing from £4.99 per month

Saxo

Saxo

Get £200 back in trading commissions

Trade 212

Trade 212

Free treatment and no commissions per account

Affiliate links: If you purchase a product This is Money may earn a commission. These offers are chosen by our editorial team as we believe they are worth highlighting. This does not affect our editorial independence.