Table of Contents

Luke Shelley and Marcus Ereira are an unlikely couple seeking fame on TikTok.

Both are in their early 30s, have launched three businesses and, by their own admission, have done well.

So why is the couple posting videos online of them slapping each other with plastic tortilla wrappers?

Despite his childish enthusiasm, the desire for virality is much more calculated.

Lucky Egg: Founders Ereira (left) and Shelley (right) address customers via social media

Lucky Egg is “actively manufacturing virality” from its office in the heart of Soho, which it shares with the couple’s card company Central 23.

Four floors above a karaoke bar, his small but colorful office is filled with cards, stuffed animals and games. Shelley and Ereira are like kids in the candy store they now own.

Is Gen Z interested in party games?

The duo are comfortably the oldest in the office, with most employees in their 20s and 30s, meaning they have a solid understanding of their target market, from teenagers to those in their thirties.

It’s an interesting demographic to follow in a category where the average gamer tends to be older.

Lucky Egg hopes its games can revolutionize what has historically been a stale and stuffy category.

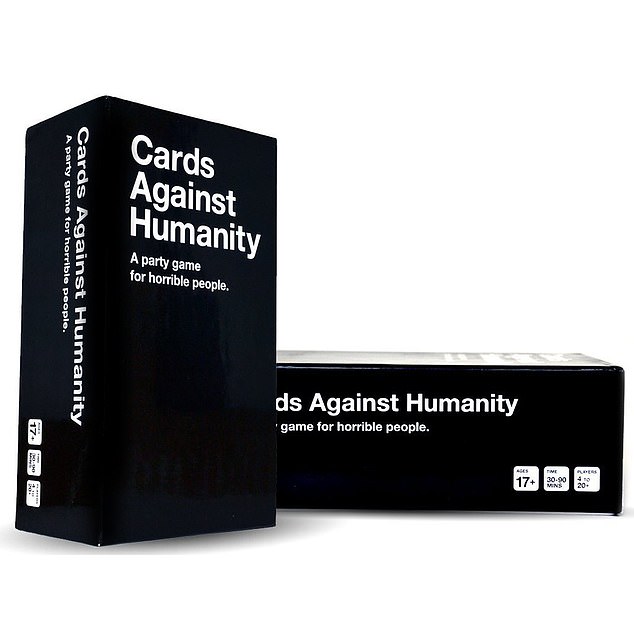

The choice of games can be risky, with a clear attempt to challenge games like Cards Against Humanity, which sells millions every month.

In a saturated market, Lucky Egg has a long way to go, but last year it sold 67,000 units, for around £30.

To ensure it reaches a younger market, Lucky Egg employs game testers, usually college students, to play the game and give feedback.

What works is a matter of luck, and Shelley says there have been “a lot of games that haven’t made it past the testing stage.”

While they fine-tune the types of games, which span both families and adults, Shelley and Ereira insist that younger audiences are just as interested in playing.

The pandemic certainly brought gaming to a younger audience, which has helped Lucky Egg since its launch in 2021.

Lucky Egg aims to revolutionize the industry and challenge games like Cards Against Humanity

The rise of board game cafes has also been a huge success and Ereira says that gaming cafes frequently contact them to tell them that certain Lucky Egg games are the most popular.

However, Shelley believes there is another reason.

‘I think people like to get together and have fun, more so now. We’re still new to the industry… but I know personally that people want to get off their phones.

“I think technology addiction is a growing concern for people and people want to sit at a table and hang out together, play games.”

Why start a video game business?

After the classic entrepreneurial stories about selling sweets in the playground, Shelley and Ereira launched and sold their tutoring business, Tavistock Tutors, before embarking on Central23.

Not content with her success, Shelley began exploring other avenues at Amazon, where her cards had been a hit, and she stumbled upon drinking games.

‘An opportunity on Amazon is a search team with higher search traffic but low supply, and there weren’t many people who had drinking games.

“There was one that was working really well. We looked at all the reviews and thought, ‘Great, let’s use this to improve ours.'”

They moved full steam ahead, to the point that Ereira walked into the office one day during the pandemic to find Shelley with cards pinned to boards – “a bit like a nutty professor” – and was paying comedians who were out of work, to to give him their verdict.

They quickly hit a snag when they discovered that Amazon doesn’t allow ads for drinking games.

There are so many games released every year, we decided our advantage would be to figure out how to make them explode on social media.

They created a smaller version to outpace the competition before turning their attention to the broader gaming market.

As with cards, the pair sought out highly saturated markets and carved out a niche for themselves with little to no experience in the industry.

When their first product did well, they quickly realized how important social media virality would be for Lucky Egg.

“In the beginning we didn’t know much about the industry,” Shelley says. “We started out making games that looked good on the store shelves and were fun to play. Over time, one of the biggest learnings was that the market was saturated; we needed to figure out how to stand out.”

‘There are so many games released every year that we decided our advantage would be to figure out how we can make them successful on social media.’

Capturing the TikTok and Instagram market is big business, so it’s understandable that Lucky Egg has gotten so deep into it.

It now has half a million followers across the two platforms and that has translated into sales. Lucky Egg has decided not to disclose its revenue for 2023, but it expects to make seven figures this year.

Lucky Egg aims to release around 20 games a year for its customers.

Their production is high – possibly unsustainable – with the goal of releasing 20 new games a year, which, according to the two, is a “very, very high” number.

“We’re not looking for perfection,” Shelley says. “There are companies that wait and release one game a year. There are cases where that game is a failure. We don’t want to be in that position.

‘We’re not looking for a group consensus, if (the developers) think it’s fun, it’s fun. The quicker we can get him out, the better.

As such, the team has managed to reduce manufacturing times. When I ask how quickly they can bring a game to market, one of the developers replies: ‘If it’s our ideas, it takes a bit longer, but it probably takes 2-3 weeks to go from a trend to a game idea.’

The 3D printer, humming in the background, has helped streamline parts of the testing process, but some elements pose logistical challenges.

“There’s a game we want to release this year but we can’t,” Shelley says, with problems in the Red Sea increasing shipping times to two months.

Additionally, the seasonal nature of the industry (80 percent of revenue comes in the last quarter of the year) means Lucky Egg needs to forecast and stock well, making cash flow more difficult than with its card business.

How sustainable is a viral business?

More importantly, the sustainability of a viral product is questionable. Customers are likely to wait for the next trend to emerge or opt for a more traditional game, one that has lasting power.

Both Shelley and Ereira seem to have a slightly naive optimism that has, so far, worked in their favor.

In a saturated industry, it’s a bold approach. While the future of many brands will be about reaching customers through social media, consumers are also learning how it works.

“We don’t really have experience of a full market cycle, but one thing we always do is create games that are really fun to play,” Shelley says. “So even if they’re based on a viral trend, they’ll still be fun to play and watch in three years.”

He compares it to Cards Against Humanity, which launched 13 years ago: “We went into Target when we were in New York and it still has like half the shelf space.

‘I don’t think these products will die quickly. It takes a long time for them to filter into the market, until a grandmother finds out.’

They acknowledge that they are still not clear whether opting for products that follow trends is the best option: “It does not mean that we are going to say no to other games, but that we have to find out which games will be most successful.”

It seems short-sighted, especially with the sheer volume they’re producing, but retailers seem to be betting.

Lucky Egg games will be in John Lewis for the first time this year, and Lucky Egg has already secured orders from toy retailers WH Smith and Smyth.

Across the pond, it is sold to retailers such as Barnes and Noble and Target in the United States, and in Canada, to Walmart, Toys R Us and Urban Outfitters.

“Amazon is a central focus and retailers base their purchasing decisions on what happens there. I feel like before Amazon, retailers were guided by their intuition. Sometimes it worked, sometimes it didn’t. Now they are so focused on data that Proof of success elsewhere means proof of success in the store.”

While their optimism may seem naive, they have proven that social media success, however fleeting, can get your brand in front of the right people.

SAVE MONEY, MAKE MONEY

Savings offers

Savings offers

Top rates plus £50 bonus until July 15

Cash Isa at 5.17%

Isa cash at 5.17%

Includes 0.88% bonus for one year

Free Stock Offer

Free stock offer

No account fee and free stock trading

5.78% savings

5.78% savings

You have 365 days’ notice

Fiber broadband

Fiber broadband

£50 BT Reward Card: £30.99 for 24 months

Affiliate links: If you purchase a This is Money product, we may earn a commission. These offers are chosen by our editorial team as we believe they are worth highlighting. This does not affect our editorial independence.

Some links in this article may be affiliate links. If you click on them we may earn a small commission. That helps us fund This Is Money and keep it free to use. We don’t write articles to promote products. We don’t allow any commercial relationships to affect our editorial independence.