When the email arrived, I almost dismissed it. Another press release, I thought, adding to the hundreds I receive every day.

But this one had a somewhat cryptic message and an attachment that I was urged to read.

“Anthony found this the other day,” the sender said. ‘Would you like to chat with him?’ Curiosity took over me.

I’m glad it was that way. It was a copy of an investment article I had written 30 years ago when I was working for a rival newspaper (and yes, I was still wearing shorts!) and John Major was Prime Minister.

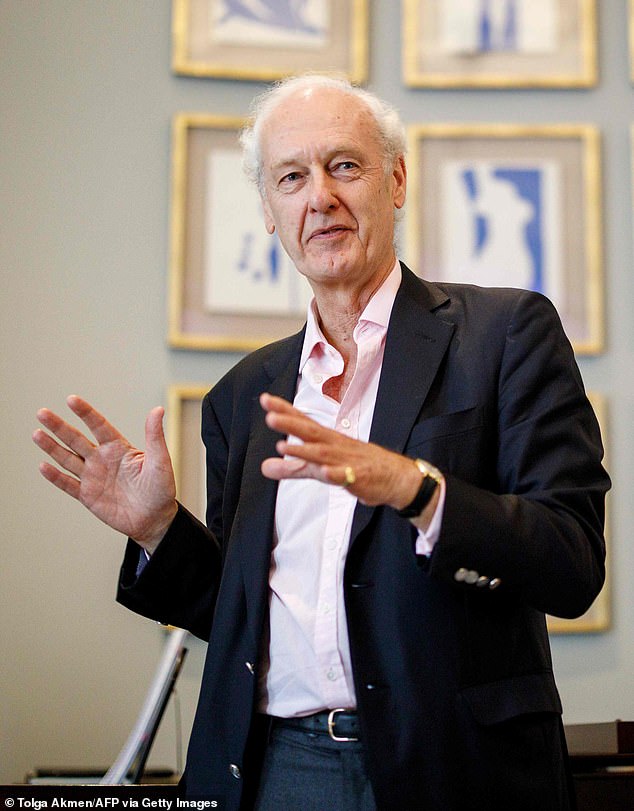

Last week I had that talk with ‘Anthony’ and it was a privilege. The man in question is Anthony Bolton, in his heyday during the 1980s, 1990s and until 2008, one of the best UK fund managers of his generation.

He was the person who ensured that the funds he managed – Fidelity Special Situations and sister investment trust Fidelity Special Values – lived up to their “special” labels, generating considerable returns for those who invested over the long term.

Now run by Alex Wright, both funds continue to make money for investors, although, as in the Anthony era, not always in a straight upward line (the 2020 lockdown hit both funds hard).

Many long-term investors loved Anthony. But in the City and in big business circles, he occasionally ruffled a few feathers, earning the nickname ‘The Silent Killer’ in 2003 when he led a successful shareholder campaign to prevent Michael Green from becoming chairman of the media group. newly merged ITV.

Fund favorite Anthony Bolton is a hands-on manager

His modus operandi as an investment manager was brave: look for ‘special situations’ – unloved British stocks that he was convinced the stock market would fall in love with again at some point. A contrarian investor, a value investor.

My 1994 article was specifically about the launch of Special Values; Special Situations had formed 15 years earlier with Anthony at the helm.

Thirty years ago, I was in awe of him: he was my investment model, a friend of the retail investor. And his vision of investment opportunities continued for a long time.

Over the next 13 years, he was tried for both Special Securities and Special Situations before deciding to move to Hong Kong and head a Fidelity China Special Situations investment trust.

Although this Far East adventure proved less special to investors, no one can question his investment record in the UK. He was smarter than the market.

During its 28-year reign at Special Situations, it delivered annualized returns averaging 19 per cent, compared with 13 per cent for the FTSE All-Share index. In Specialty Securities, the average equivalent returns were 16 percent and 9 percent. An advertisement for the virtues of active fund management.

Talking to him last week, it was like time had stopped. He was the same Anthony Bolton before me: a little grayer perhaps (he’s in his 70s now) but articulate and as sharp as ever. Although he still works for Fidelity, his energy is directed toward writing operas; his latest, Island of Dreams, was performed last summer at the Grange Park Opera House, near Guildford, Surrey.

“I found your 1994 article in an old scrapbook,” he says. “I only kept the important things.” Flatterer.

We continue talking about the birth of Special Values. “The idea to launch it was mine,” he says. «In 1994, Fidelity only managed unit funds. We didn’t have any investment funds, which was largely the domain of Scottish investment groups.

‘I was a fan of them (better protection for investors when share prices are falling and the ability to borrow to increase exposure to shares) so I made the case for launching one to my boss Barry Bateman and the green light was given. Special Values was born.’

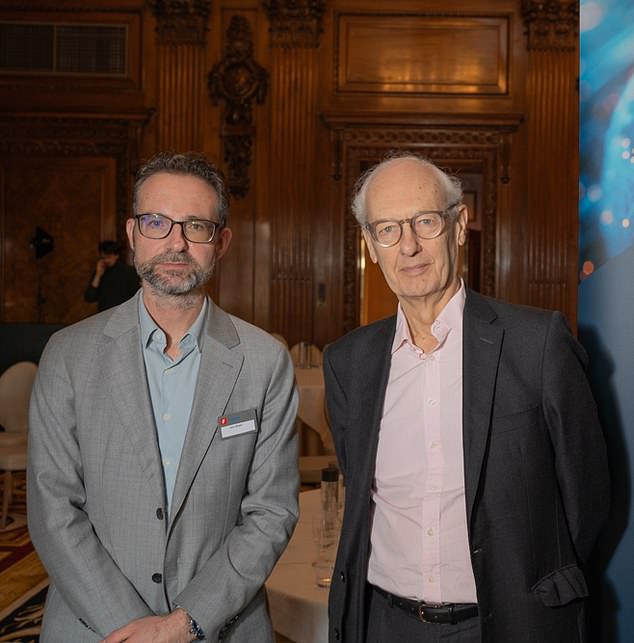

Alex Wright, who now runs Fidelity Special Situations and sister investment trust Fidelity Special Values, with Anthony Bolton

Initially, he had £44m in assets under his wing. Today, it is capitalized at £1 billion. Someone investing £1,000 30 years ago would have seen their investment grow to just under £27,400. Under Anthony’s 13-year management, it made a 605 percent profit.

Today, Alex Wright, who was born in 1979, the year Special Situations was launched, manages Special Values and the £3bn Special Situations fund.

He has been directing both since September 2012 and January 2014 respectively, with the help of Jonathan Winton. He joined our conversation. Alex says: ‘One of my first memories of Anthony when I joined Fidelity in 2001 as a research analyst is that he agreed to buy the uniform for the company’s indoor football team. We called it Special Situations and we played on Tuesdays for almost 20 years.’

Anthony jokes, “It was one of my best investments.”

The investment approach of the two funds has changed little over their respective lives. Like Anthony before him, Alex constantly seeks to invest in undervalued UK companies with the expectation of upward appreciation in the future.

Top holdings in stocks and special situations include tobacco stocks Imperial Brands and banks NatWest and Standard Chartered. By contrast, Special Values’ first annual report from 1995 identifies the advertising agency WPP, the computer software company Misys (now a private company Finastra) and the Mirror group (now Reach) among its big bets.

“I think fund managers should always stay true to their particular investment style,” Anthony says.

‘No one should be a contrarian investor one moment and a growth investor the next. Why was I contrarian? It’s because I became more comfortable doing completely different things than everyone else. It’s in my nature.’

Like Anthony, Alex is a big believer in meeting the management of companies you want to invest in or looking at businesses that can give you useful information about a rival company you have in the funds. Two or three meetings a day are normal, a characteristic of Anthony’s investing style.

Anthony believes he had it easier as an investment manager, saying: ‘Fund management is more competitive these days. When you managed money, you could visit companies unseen by rival managers and perhaps identify an investment gem before anyone else.

‘Nowadays, there is greater use of technology, more analysts looking at stocks and of course funds that follow the stock markets rather than trying to beat them (passive investing). However, I still believe there is a huge opportunity for contrarian investors to make money for investors.”

Alex agrees. “The general consensus is that the US market is the place to be,” he says. ‘But consensus is dangerous and there is a risk that everything will change.

‘It’s interesting that when I meet people they ask me if I’m depressed because all the noise is about US stocks. My answer is a resounding “No.” “The two funds I manage have outperformed the FTSE All-Share Index over the past year and I will strive to keep this going.”

In 1994, Anthony told me that Specialty Securities “should offer investors a good long-term investment story.” How right he was. Thirty years of a good long-term investment story.

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.