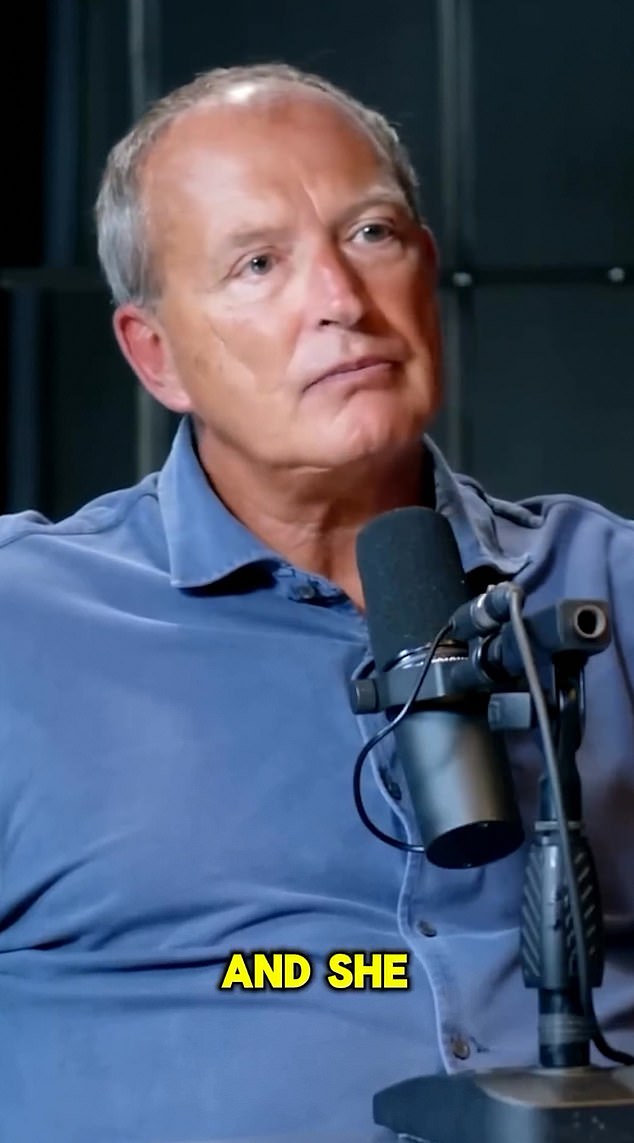

The Itsu and Pret founder spoke about the time he discovered he had a secret daughter after a brief flirtation with a society beauty.

Julian Metcalfe, who co-founded the sandwich chain Pret in 1984 with university friend Sinclair Beecham and later sold it for £364 million and now owns the Japanese fast food empire Itsu, spoke about the shocking discovery that it had spawned a teenager I didn’t know. about Steven Bartlett’s latest episodeThe Diary of a CEO.

The tycoon, who is married to his New York wife Brooke, told the Dragon’s Den star that he discovered the bombshell news fifteen years ago, when he was 45, after an unexpected phone call from his ex-girlfriend Camilla Ravenshear.

They had enjoyed a brief tryst in the mid-1980s, with Ravenshear, who died aged 57 in 2017, keeping details of her daughter’s real father a secret for almost 20 years.

Appearing on Steven Bartlett’s Diary of a CEO podcast, Metcalfe revealed how she was first told about her daughter Celeste.

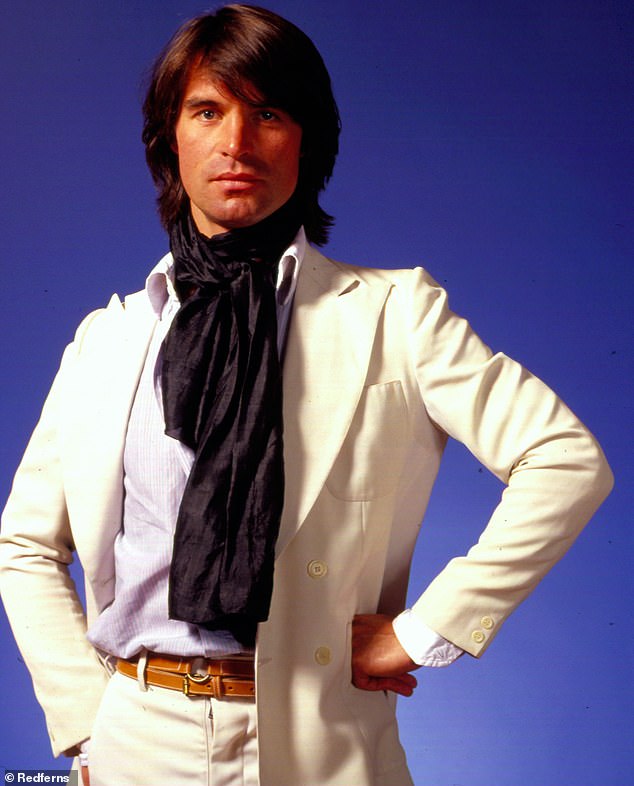

His daughter, Celeste Tobias, who now sits on his company’s board of directors, grew up believing she was the youngest daughter of Oliver Tobias, star of numerous film and television hits of the 1970s, including, along with Joan Collins, the sadly famous 1978 film The Stallion.

Camilla, niece of former Conservative cabinet minister Lord St John of Fawsley, divorced Tobias in 1991. She had two further children, Angelica and Dahlia.

He described his relationship with Celeste as “amazing,” and said he now sits next to her twice a week on his company’s board of directors.

Celeste photographed in her early twenties in 2011; She told the Evening Standard in 2012 that she had no idea that Oliver Tobias was not her real father when she was a child.

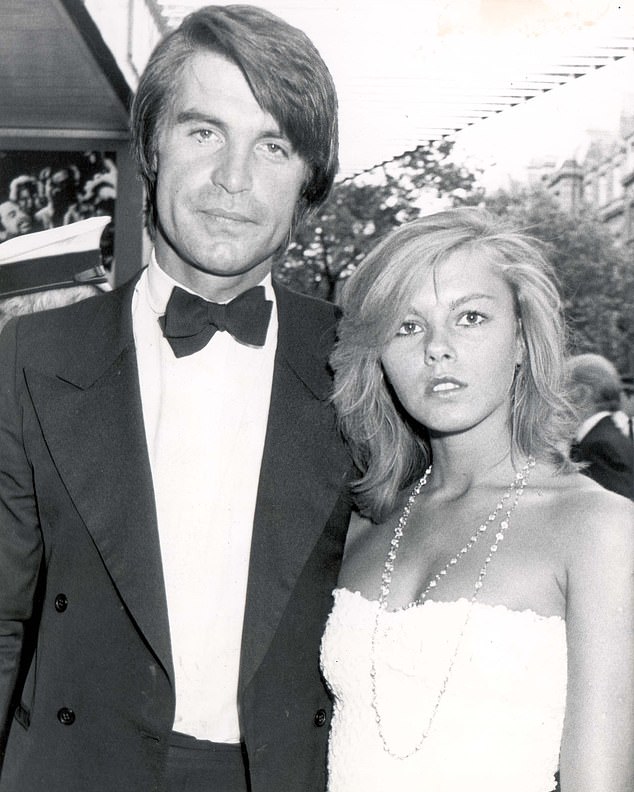

Oliver Tobias and his ex-wife Camilla; The couple divorced in 1993 after nine years of marriage. Camilla died in October 2017 at the age of 57.

Metcalfe reveals in the episode how Camilla broke the news to her daughter, then a student at Bristol University, that he was her biological father two weeks before meeting the businessman in London’s King’s Road to tell him.

He said: ‘His mother called me who I hadn’t seen for a long time. She had no idea that her daughter was my daughter, she had never met her. Her mother asked to see me and we met on the King’s Road.

Bartlett asked: ‘Weren’t you suspicious when she asked to see you?

He said he had no idea about the news to come, saying: “I certainly didn’t suspect it.” I thought maybe he needed help.

Actor Oliver Tobias, now 76, was well known for his role in The Stud alongside Joan Collins; He was married to Camilla Ravenshear until 1991.

He described his former lover as a “genius, intelligent, quite wonderful, eccentric and brilliant woman” whom he remembered “very fondly”.

Metcalfe, who met his current wife, society author and interior designer Brooke de Ocampo in 2007, said she told him: ‘I have a daughter and she is your daughter.’

He added that he then asked Celeste how long she had known about it and she said just fifteen days: ‘I asked him “when did you tell him and how did it go?” She replied: “I told him two weeks ago and not well.”

The trio are said to have first met at the luxurious Babington House, near where Celeste was studying.

After the news broke, Metcalfe said: ‘I have a bright, beautiful and thoughtful 19-year-old daughter. I think I’m the luckiest man who ever lived.

In 2012, Celeste told the Evening Standard: “They told me just before I went to university in Bristol. I think my mother thought I always knew it wasn’t Oliver’s, but of course she didn’t know. How can you know something like that? I had no idea.’

Julian Metcalfe with his wife Brooke, interior designer and author; The couple met in 2007 and married in 2008; between them they have seven children

Metcalfe, who lives in a south Oxfordshire manor house with his wife, said he was now close to his daughter after forming a relationship with her in adulthood. She said: “She’s on the board now and sits next to him two days a week and she’s amazing.”

Metcalfe is an old Harrovian whose grandfather Edward was godfather to the recently abdicated Edward VIII in his marriage to Wallis Simpson.

He has three children and became a grandfather when Celeste gave birth to a daughter, Tiger-Lily, in 2019.

During the episode, Bartlett also revealed how an unknown family member had entered his own life, saying that an uncle he didn’t know he had had walked into his mother’s store one day.

He said: ‘At some point in my early life, a man walked into my mother’s shop and said he was my uncle. Turns out he was. I didn’t know he had uncles in this country. Turns out, yes.”

Metcalfe created the Japanese fast food brand Itsu in 1997; He sold the brand that made him famous, Pret, for £364 million

Metcalfe’s first business venture was opening a wine shop in Fulham while working as a chartered surveyor.

The popularity of its healthy fast food brand, Itsu, has skyrocketed in recent years, with 77 branches currently across the UK. The chain, named after “always” in Japanese, opened in 1997 with a £1 million restaurant in Chelsea, west London.

Last month, Metcalfe warned against possible Labor reforms on workers’ rights, saying they would come at a cost to the country.

Of the Labor Party’s mooted plans he said: “Nothing is free. The cash-strapped consumer ends up having to pay much more for goods and services, as costs, taxes and bureaucracy easily paralyze motivation and sensible commerce.’

The party plans to introduce labor market reforms within its first 100 days of coming to power.

The policies, spearheaded by Angela Rayner, a former union steward, would give workers rights from day one in new jobs, as well as a crackdown on zero-hours contracts.

Labor also plans to abolish all union reforms enacted since 2010, when it was last in power, and scrap Tory measures to prevent workers from going on strike.