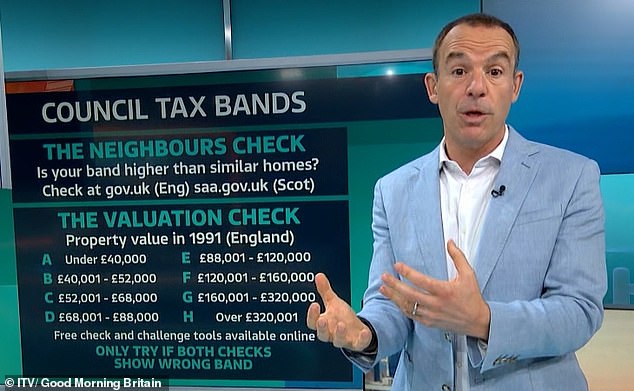

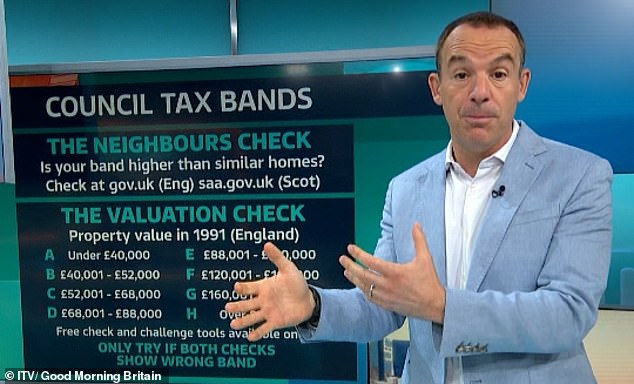

Martin Lewis has revealed a quick and easy method to check if you are overpaying your council tax.

The money-saving expert, 52, from Manchester, spoke about the issue on today’s episode of Good Morning Britain.

Council tax is a payment made to fund local services including garbage collection, schools and street repairs. Each home is placed in a band from A to D, which is based on the property’s valuation.

Today, a viewer messaged the ITV show to ask Martin how to check if they are overpaying council tax.

The money-saving expert revealed two easy ways to do it, but warned: “Don’t complain unless you pass both checks.”

Martin Lewis (pictured) revealed how to check if you are overpaying council tax on Good Morning Britain

First, Martin said compare your band to your neighbors to see if your payout is higher.

Martin explained: ‘I have two checks for you. First, the neighbors. Check with homes that are identical, preferably, but if not, with similar homes. You don’t have to ask them. Go to gov.uk to check your council tax band and saa.gov.uk if you’re in Scotland.’

Next, Martin recommended comparing your council tax band to the price of your property in 1991, with each price range falling into a different council band.

‘The second check you need to make is not probative, but you do it for your peace of mind. You have to calculate how much your house was worth in 1991 and what band it was in.

‘What it does is find out when you purchased your property… and convert it to 1991 prices. It sounds complicated, but there are free online tools that will do it for you.’

However, Martin warned: “Don’t complain unless you pass both checks.” Only make the appeal if both checks are clearly winning; If it’s just the neighbors’ check, it’s not safe to appeal.’

The expert also explained who is entitled to discounts on municipal tax: “If there is an adult in the house, you will get a 25 percent discount.”

‘If there are no adults you don’t pay anything. But what’s important to understand is that some people don’t count as adults, pardon the phrase.

Speaking alongside Susannah Reid (pictured right), Martin revealed two easy ways to check if you are overpaying your council tax.

‘If you are under 18, you are not classified as an adult, as a full-time student and as someone with severe mental impairment… it could be Alzheimer’s, it could be dementia.

‘So if they live with a partner in the home, they could technically be an adult (classified as living there) so they would be owed the single person discount.

He added: ‘It’s also worth saying that if you’re on a low income, if you’re on benefits and if you get pension credit, it’s up to each council to decide whether you get the discount.

“Finally, if you have a disability and have had to move your home because of it, you can allow a band to be removed.”

It comes after Martin Lewis explained how you can make money by simply changing your bank account.

Speaking on the show, he said that many people believe that keeping the same account for many years is a good thing.

According to host Ben Shephard, people got in touch to explain how they feel.

He said he had heard people say things like: ‘I can’t be bothered to go through the whole process of changing banks… I’ve been at the same bank my whole life. What’s the point of changing if it’s just about salaries to pay bills?

On the other side of the argument, some people believe that there is no benefit in remaining loyal to a specific bank.

Ben said: “But (for) a lot of people, their relationship with their bank isn’t usually seen as something they can change quickly because it certainly takes a long time to get to know your bank, to get to know your bank manager, (but) things have changed a little bit now. over the years.’

He continued: ‘People always felt like they had this relationship with their bank.

‘They knew their private banker, they knew their bank director and that’s why they didn’t want to change. The panorama is very different now, isn’t it?

According to Martin: ‘Absolutely. Most people bank online. Now look, I was going to start by saying that if you love your bank, it gives you great service, you’re happy with it, and it tickles your toes whenever you want, there’s no need to change.

“But the point is that right now there are four banks that are willing to legally pay you bribes if you want to switch, so if you think my bank is neither good nor bad, then they can pay you to switch too.” Also make money from it.’

He added that there are “some people who make about a thousand dollars a year by regularly switching bank accounts.”

Martin continued: ‘What’s really happening here is that I’m talking about the financial terms of banking.

‘Again, if you have very good customer service, the specific personalized relationship should remain with your bank, then don’t bother.

“But it’s worth knowing what’s out there and a lot of people find it really easy to switch banks. Last time I did a survey, over eighty per cent said it’s easy and hassle-free.”

The money-saving expert urged viewers to undergo two different checks: the neighbor check and the appraisal check.

He added that many of the people who have had bad experiences did so “before they implemented the seven-day change, which was about a decade ago and was a nightmare.”

Now, he explained, to exchange money, you go through the bank’s seven-day exchange service (which takes about 10 days, since they are working days).

‘They move your balance for you. They transfer standing orders to you. “They transfer the direct debits for you, close your old account and all the money paid into the old account is automatically transferred to the new one,” Martin said.

“It’s actually a pretty smooth process that goes on very easily and without many problems.”

The amount of time it takes to get the money from the account switch depends on the account, he added.

Martin said: “So it takes about a month or two, so you’ll have the money in your bank account pretty quickly.”

‘Let me go over the best ones that are available right now so people can get them.

‘I will do it in order of advance money that you will receive for the change. So NatWest RBS pays the most – it gives you £200 to exchange, so £200 in your hand, which will be very useful for many people.

‘It also gives you £36 cashback a year. What actually happens is you pay it a £2 fee a month and it gives you £5 cashback a month, as long as you meet some very basic criteria like having a couple of direct debits and making sure you check the app once a month. So that’s about £36 extra.’

Next up, he said, is the Santander Edge account: “It’s been around for a while, it’s been one of my top picks, it’s a bill account – it gives you cash back on the bills you pay.”

He added that there are a couple more, including Lloyds, which is a £375 switching bonus with perks like Disney plus, for a year, and HSBC, which is £100 free, and you can get £10 a month, but there are a lot of hurdles. jump to get the 10 pounds a month.

He concluded: ‘So there are four banks willing to pay people to switch right now.

‘Like I say, if you’re happy with your bank, don’t do it. If you’re not happy with your bank, why not get free cash?

‘I think the only caveat… is that having a decent long-term relationship with your bank can be beneficial for credit and of course when applying for a bank you will have to pass a not too strict credit rating.

‘So if you were about to apply for a mortgage or do something really important in terms of credit, you wouldn’t do this in the three to six months beforehand.

“But if you have nothing in the way of credit, switching bank accounts is a very lucrative way to make money.”