Martin Lewis has revealed that now is the time to act if you want to boost your savings.

The British money-saving expert, 52, discussed his top tip for saving more money during Tuesday’s episode of The Martin Lewis Money Show Live on ITV.

With the UK base rate expected to fall this Thursday, Martin urged Britons to check what interest they are currently earning on their savings accounts.

He told the live audience: ‘The interest available to savers will continue to decline, so this is a crucial time for savers to act.

‘Check now what rate you are earning. “If it’s less than five percent, we have to fix it.”

With the UK base rate expected to fall this Thursday, Martin urged Britons to check what interest they earn on their savings accounts.

Going into more detail, Martin said: ‘The UK base rate, this is the rate set by the Bank of England, was obviously very low and then rose recently and peaked at 5.25 per cent.

“Now it’s down to five percent and we expect the interest rate to drop by about a quarter of a percent on Thursday.”

Although Martin cautions that this drop is not guaranteed, he said there is an 80 percent chance the base rate will fall to 4.75 percent by the end of this week.

He continued: ‘Over the next year, we would expect the Bank of England base rate to fall by another percentage point.

‘If we look at easy access savings (those are the ones you can put money into and take it out whenever you want) you’ll see that they follow the base rate quite closely, so we would expect that to drop next week as well.

“If you look at fixed rate savings that you keep your money in, they tend to be set based on the market’s long-term prediction of future interest rates, so they typically rise before the rise and start to fall before the fall because they are watching what is likely to happen.

“They have already started to go down.”

“When inflation was substantially higher than what you were earning from savings, putting money in the bank actually meant you were decreasing your purchasing power because it wasn’t growing as fast as prices, so when you took it out you could buy less.” than you could have done when you put it in.

‘At that time, savings were not savings, they were losses.

“Now, although we are in a position where inflation is substantially lower than interest rates, money is growing in real terms.”

“If you put money in savings and in a couple of years, you will be able to buy more with it than you could at the time you put it in.

“Saving is, finally, paying.”

Martin Lewis predicted the UK base rate will fall to 4.75 per cent this Thursday

An audience member called Ivan told Martin that he has £10,000 in his HSBC current account, which pays no interest.

He asked the money-saving expert for practical tips on saving money.

‘What should I do and where should I start?’ asked.

Martin told Ivan that by keeping this money in a current account he would be losing £500 a year.

He advised Ivan to take the “really easy and standard” first step by putting the £10,000 into an easy-to-access savings account.

‘This is where you can put money when you want and take money out when you want.

‘Very simple. The big risk? It is variable, so these rates can change both with the Bank of England and if providers decide to lower the rate, so keep an eye on your Easy Access Savings rates.

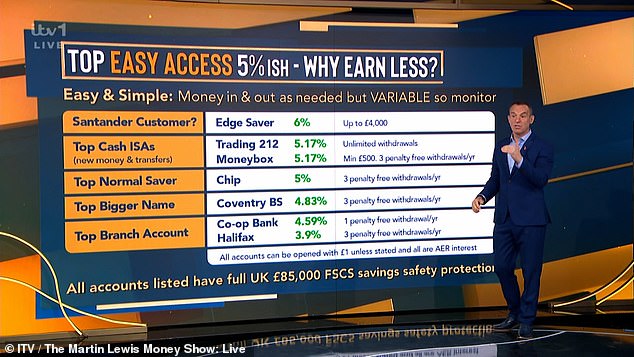

Martin goes on to explain that the current “maximum payer” is for those who have a Santander Edge bank account where they can get six per cent, but only up to £4,000.

“That’s not a huge amount in savings accounts in terms of maximum limits,” Martin said.

“Surprisingly, at the moment, cash ISAs, which are a type of savings account that you don’t pay tax on, are typically lower than regular savings, but at the moment the top two payers are the highest they have ever been. can be obtained in Easy Access”.

Martin added: “They’re both up again today, probably because we’re doing this show and they like to compete with each other.”

Moneybox and Trading 212 offer 5.15 percent interest.

Martin Lewis reviewed East Access’ accounts to open on his ITV show on Tuesday night.

Turning to Ivan, Martin said: ‘That’s the most you’re going to earn with Easy Access. You can put up to £20,000 into a cash ISA each year, so as long as you haven’t covered this year’s ISA allowance, that would be your starting point.

“Let’s do some math: 5.15 per cent of £10,000 – I can easily do that – that’s £517 a year and that’s about as good as you’d be if you just put it in there.”

If you’ve completed your ISA allowance for this year or have more money to save, Martin has some recommendations for Easy Access accounts.

He said: “You’ll have to look at the top normal savings account, which is with Chip at five per cent.”

Martin goes on to suggest Coventry Building Society with an interest rate of 4.83 per cent and for those who don’t want to bank online, the best branch options are Co-op Bank with an interest rate of 4.59 per cent and Halifax with a rate of 3.9 per cent.