Martin Lewis has revealed how households can get thousands of pounds back on their council tax bills, but warned it is “not a quick process by any means”.

Speaking on his live ITV show, the Manchester-born money-saving expert explained that hundreds of thousands of households in England and Scotland are potentially in the wrong council tax bracket.

Since 1991, properties across the UK have been classified from A to H, which determines the amount of tax you must pay. However, the government’s process of allocating these funds may not have been as comprehensive as needed.

Martin explained that, 33 years ago, the government needed to put every property into a valuation band, but due to time constraints, they asked estate agents for help.

Despite recruiting more help, they didn’t have time to gather detailed information, so they set about doing it quickly by forming pairs and driving through the streets, assigning each property a band at a glance, which became known as ‘second gear’. ‘. ratings” because they rarely stopped their cars.

Therefore, many homes have been in the wrong tax bracket since then, leading thousands of people to overpay.

The financial guru explained how viewers can challenge his band if they think it’s wrong and get back the money they might have overpaid.

The 52-year-old described a method to check if your property is in the correct band. However, Martin warned viewers that they need to “work on this.”

Money saving expert Martin Lewis (pictured) revealed how to challenge your council tax band in his latest ITV show

Martin described two preliminary checks that owners must pass before challenging their gang. First, you should compare your band with your neighbors to see if your payout is higher.

He then recommended comparing your council tax band to the price of your property in 1991, with each price range falling into a different council band.

If it passes both checks, landlords can challenge their council tax band.

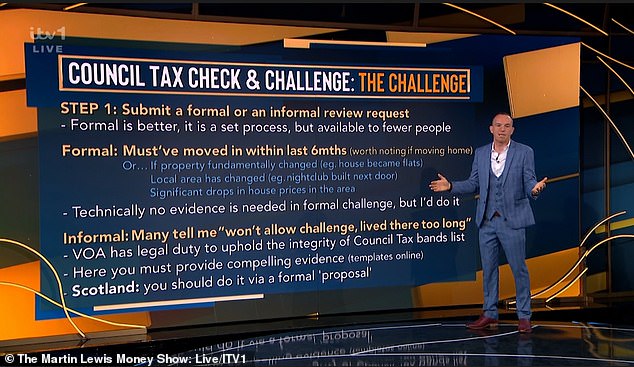

The first step in the process is to determine whether you can approach the challenge formally or informally.

Those who can formally challenge have lived in the property for six months or less. If you can challenge this way, the Valuation Office Agency (VOA) must review your band.

However, there are exceptions after the first six months if the ownership has changed, for example if a new nightclub has been built in the area.

If you do not meet the requirements to formally challenge your council tax band, there is the option to do so informally, which requires a high level of evidence to encourage the VOA to investigate the claim.

Next, Martin explained that homeowners must describe the details of their property’s attributes, including the number of rooms, bedrooms, bathrooms and floors.

The 52-year-old outlined four different steps that must be taken to challenge his council tax band.

Those who file successful claims will likely receive the amount of money they have been refunded since 1991.

The third step is to find nearby properties like yours but in a lower council tax band to include in the VOA.

Martin explained that the ways in which two properties can be considered similar is if they are on the same street or estate, if they are of similar size, age or style.

He advised that viewers can get relevant information on websites such as Rightmove and Zoopla.

The last step is to present the challenge. The expert explained that successful claims can expect a refund for the entire time council tax has been overpaid, which could equate to thousands of dollars.

Martin said people in England should lodge their challenges with the Valuation Office Agency (VOA), which can be accessed on the government website.

Alternatively, you can call VOA on 03000 501 501 for England or 03000 505 505 for Wales or email ctinbox@voa.gov.uk.

The challenging process is different if you live in Scotland, and Martin said you should visit the Scottish Government website for more information.