Kanye West has reduced the asking price of a destroyed Malibu mansion he is selling from $53 million to $39 million.

West, 46, changed the asking price earlier this week. TMZ reported Thursday, less than four months after it initially listed the dilapidated property in the luxury beachfront community.

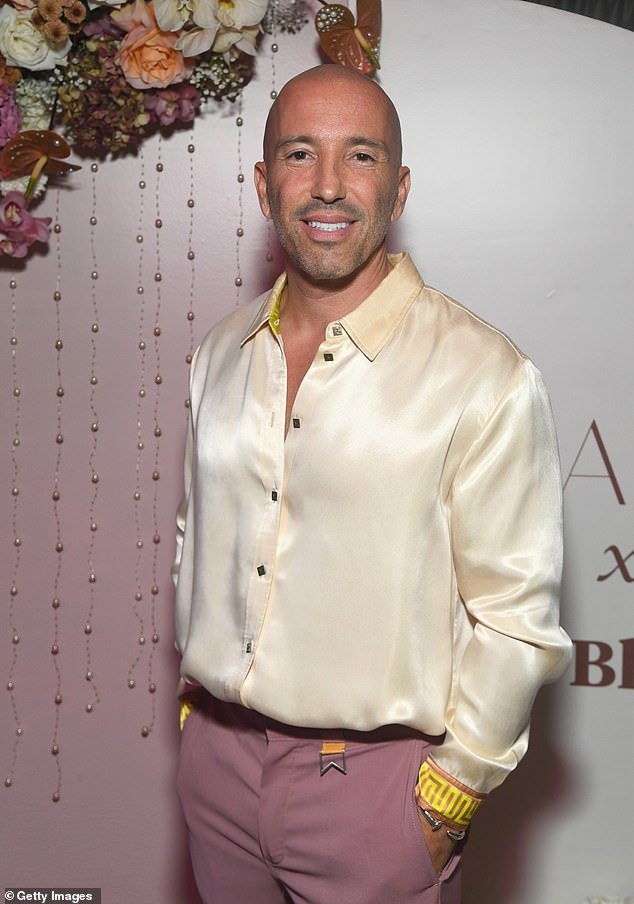

The Grammy-winning artist, whose career has foundered amid a torrent of anti-Semitic comments he has made since the fall of 2022, attracted Selling Sunset real estate agent Jason Oppenheim, 46, in his effort to sell the house at the end of last year, according to departure.

Oppenheim told the outlet that he was optimistic about the chances of selling the distressed property in the upscale area, likening the abode to “basically a blank canvas” for potential buyers.

The home, which spans more than 4,000 square feet, has four bedrooms and five bathrooms with idyllic views of the Pacific Ocean, but is missing windows, walls and roof, and has no electricity, according to TMZ.

Kanye West, 46, has reduced the asking price of a destroyed Malibu mansion he is selling from $53 million to $39 million. Photographed in Milan, Italy, in February.

The home, which spans more than 4,000 square feet, has four bedrooms and five bathrooms with idyllic views of the Pacific Ocean, but is missing windows, walls and roof, and has no electricity.

The Carnival artist, who bought the house for $57 million in late 2021, previously failed to remodel it into an “air raid shelter” after involving famous Japanese architect Tadao Ando in the remodeling process.

The price reduction is the latest in a series of headaches related to the home in the exclusive Southern California beach town.

West is being sued by the redevelopment’s former project manager, Tony Saxon, who claims he was fired after he “expressed concerns about the extreme danger” of the project.

In September, sources said TMZ that West wanted to remove the windows and electricity from the house to turn it into “a 1910s air raid shelter.”

In Saxon’s lawsuit, filed in Los Angeles County Superior Court, he claims he was hired for the project in September 2021 and worked 16 hours a day at the beach house.

Saxon claims he was sleeping on the floor of the house while working as a “project manager, caretaker and 24/7 security” for the property.

Saxon alleges that West only paid him for one week of work and ignored all of his concerns, until he was finally fired in November 2021 after refusing to remove the windows and electricity from the house.

West proposed moving large generators inside the house, but Saxon was concerned it would pose a fire hazard.

Saxon said in the lawsuit that West then threatened him and said he would be considered “an enemy” if he didn’t fulfill Kanye’s vision. When Saxon continued to disagree, West told him to “leave,” according to the lawsuit.

The Carnival performer, who bought the house for $57 million in late 2021, is asking for at least $18 million less than he paid, after emptying the mansion in a troubled renovation attempt.

The Grammy-winning artist enlisted Selling Sunset real estate agent Jason Oppenheim, 46, in his effort to sell the home. Oppenheim photographed last year in Los Angeles

Saxon also claims that West told him, “If you don’t do what I tell you, you won’t work for me, I won’t be your friend anymore, and you’ll just watch me on TV.”

After telling the father of four that he doesn’t watch TV, he was immediately fired.

In the lawsuit, Saxon said the rapper’s vision for the house was to make something like “a 1910s air raid shelter,” according to NBC Newsand knock down the marble bathrooms, as well as remove the windows, plumbing and electricity.

He also reportedly wanted to replace the stairs with slides.

Saxon is suing West for a series of labor code violations, more than $1 million in unpaid wages and damages.

“We were going to take all of that away and build him some sort of Batcave,” Saxon explained, adding that the rapper wanted a place where he could “hide from the Clintons and the Kardashians.”

While Saxon believed the house was more of an “art project,” she later realized that West really wanted to live in it.

He said West “didn’t want electricity.” He just wanted plants. He just wanted candles. He only wanted battery lights. And he just wanted to have everything open and dark.’

Spanning more than 4,000 square feet, the home has four bedrooms and five bathrooms with idyllic views of the Pacific Ocean.

The Grammy-winning artist’s career has foundered amid a torrent of anti-Semitic comments he has made since the fall of 2022. Photographed in March in Los Angeles.

West, who is looking for a buyer for the property, was spotted in Los Angeles on March 22.

The lawsuit was filed by West Coast Employment Lawyers, the same lawyers who sued the musician on behalf of former employees of Kanye’s private Christian school, Donda Academy, for alleged health and safety violations.

In recent photos of the home, the huge floor-to-ceiling windows overlooking the ocean were removed, leaving that side open to all the elements.

The interior of the house appears to be falling apart and the metal railings are rusting after being exposed to salt air, wind and water.

West purchased his 4,000-square-foot oceanfront property in September 2021. It features giant windows with ocean views. He enlisted Tadao’s help and hired top contractors to oversee the extensive remodeling plans.

But the following summer, renovations stopped and the gutted, windowless mansion sat empty. Months later, several business partners and brands dropped Ye due to his anti-Semitic outbursts.

West’s neighbors in Malibu told TMZ that his mansion was “rotted” and that they hadn’t seen “anyone around there for many months.”

The musician had previously been seen at the property checking on progress last summer, but his empire has since imploded dramatically after he went on several anti-Semitic rants, leading to the loss of around $1.6 billion of his estate. net worth and his fall from the Forbes billionaires list, according to CBS News.

He has several other properties across the country, including a sprawling ranch in Calabasas, Los Angeles, which he purchased for an estimated $3 million in 2019.

West also owns another sprawling ranch in Wyoming, which he acquired when he reportedly became “obsessed” with the Midwestern state several years ago.