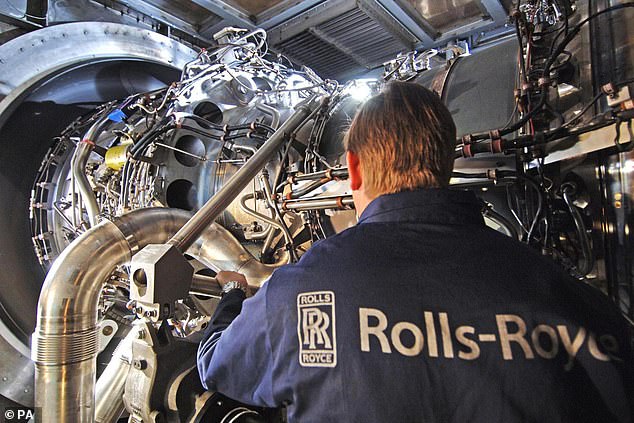

Rolls-Royce shares hit an all-time high, pushing its value above £40bn for the first time.

In another upbeat session for the engineering giant, analysts at Goldman Sachs raised their price target on the stock to 545p from 524p.

The upgrade helped Rolls-Royce shares rise 2.8 per cent, or 13p, to 485.5p, valuing it at £40.7bn.

That has taken profits since ‘Turbo’ Tufan Erginbilgic took over as chief executive in January 2023 – when the company was valued at less than £8bn – to almost 420 per cent.

An investor who bought £1,000 worth of shares when he took over would now have a stake worth almost £5,200.

Shares rise: In an upbeat session for engineering giant Rolls-Royce, analysts at Goldman Sachs raised their price target on the stock to 545p from 524p.

Susannah Streeter, head of money and markets at Hargreaves Lansdown, said: ‘Rolls-Royce has made great progress over the last 18 months.

‘A restructuring program has driven improvements in productivity, while sales have eased the burden of recent financial scars and reduced its debt.

‘Pented travel demand, which has turned into strong airline bookings, has been a positive tailwind for Rolls-Royce, given that a large amount of its revenue comes from maintaining engines for larger long-haul aircraft.

‘Its position in the aerospace and defense industry is enviable, particularly given the high barriers to entry, meaning there are very few smaller competitors approaching its space.

“With the defense budget set to increase, that potentially puts the company in an even better position.”

With all eyes on the Bank of England, the FTSE 100 rose 0.8 per cent, or 67.35 points, to 8,272.46 and the FTSE 250 added 0.6 per cent, or 117.67 points, up to 20,498.72.

The Bank kept rates at 5.25 per cent once again, but with inflation back on target at 2 per cent, it indicated a cut is likely this summer.

Precious metals were on a roll as gold prices rose, with Fresnillo gaining 4.4 per cent, or 24p, to 565p and Hochschild rising 4.1 per cent, or 7.2p, to 184p. .8p.

CMC Markets soared 12.8 per cent, or 36 pence, to 317 pence after reporting a 21 per cent rise in annual profits to £63.3 million as it benefited from strong retail trading and institutional and strict cost control measures.

Trading platforms like CMC enjoyed increased revenue during the pandemic and in 2022 due to increased market volatility due to events such as the Russian invasion of Ukraine.

Additionally, despite a quieter 2023, they saw an increase in revenue at the end of the year due to increased volatility stemming from the Middle East conflict.

Shares in Upper Crust owner SSP fell 6.1 per cent, or 9.7p, to 150.3p after analysts at Berenberg cut their price target on the share to 180p from 280p.

Oil and gas producer Energean jumped 4 per cent, or 41p, to 1,073p after it agreed to sell its assets in Egypt, Italy and Croatia to private equity fund Carlyle for up to £745m.

NCC Group said profits for the year to the end of May were stronger than expected amid demand for cybersecurity.

Although annual revenue appears to have fallen 1 per cent to £324 million, operating profits exceeded the City’s expectations of less than £30 million, or around £31 million. The shares rose 8.5 per cent, or 12.2p, to 156p.