Table of Contents

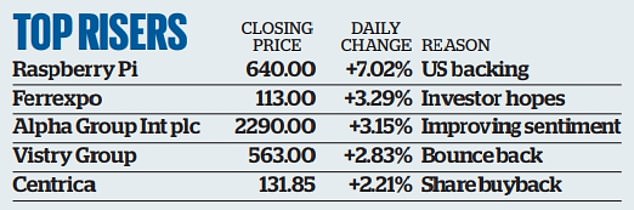

The traditional Santa Rally may not have arrived, but DIY computer maker Raspberry Pi has certainly had a fantastic time, reaching a value of more than £1 billion.

FTSE 250 shares rose again yesterday and are up 74% this month.

Much of this has come since December 18, when it was revealed that US-based SW Investment Management had built up a 3.59 per cent stake in the UK company, which was only listed in London six months ago.

Raspberry Pi made a strong debut on June 11 after its public offering at 280 pence per share, jumping to 385 pence at the close of trading that day. Since then, the shares – more than half of which are owned by just two holders – had been rising steadily before this month’s boost.

Raspberry Pi rose another 7 per cent, or 42p, to 640p, retreating after hitting a new intraday high of 721.5p, proving to investors that tech floats can work in London, albeit thanks to American influences.

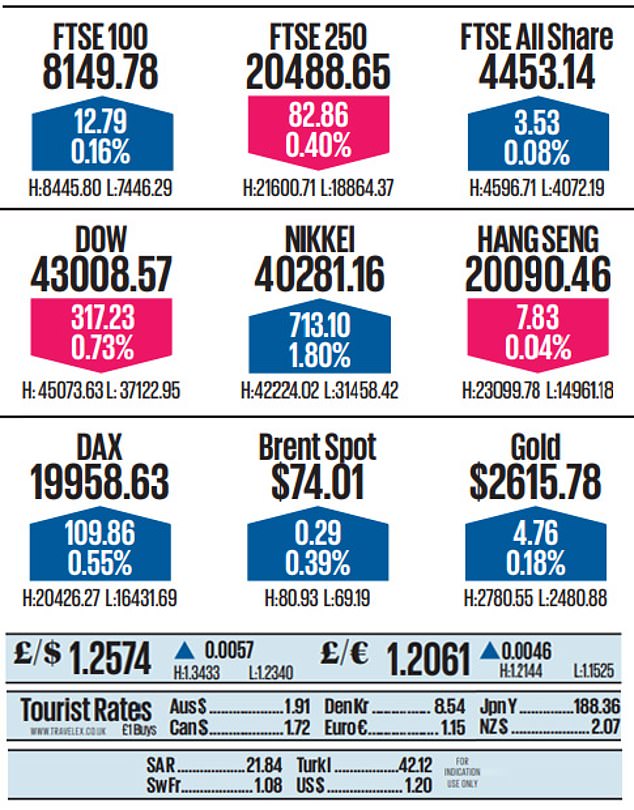

In general, the post-Christmas atmosphere was mixed, although based on reduced volumes. The FTSE 100 index closed down 0.16 per cent, or 12.79 points, at 8,149.78, but the FTSE 250 closed down 0.4 per cent, or 82.86 points, at 20,488.65.

Among the minority of FTSE 100 gainers, Centrica rose 2.2 per cent, or 2.85p, to 131.85p, as the owner of British Gas began buying back £300m of shares, which will take the total buyback to £1.5bn from November 2022.

Energy companies also rose, with BP up 1.1 per cent, or 4.2 pence, at 385.45 pence and Shell up 0.47 per cent, or 11.5 pence, at 2,440.5 pence, while Oil prices remained firm, supported by new economic stimulus measures from China.

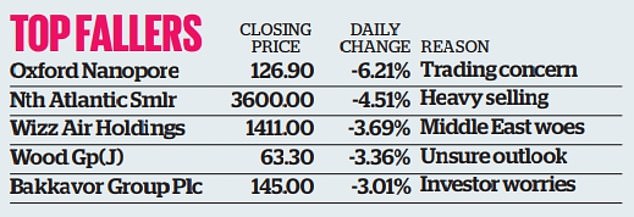

But Anglo American fell 1.66 per cent, or 39.5 pence, to 2,342 pence, as Chile’s environmental regulator brought four charges against the Los Bronces copper mine.

Builder Taylor Wimpey fell 0.74 per cent, or 0.9p, to 120.6p, with the sector rattled by concerns over mortgage rates. But fellow builder Vistry recovered modestly, adding 2.83 per cent, or 15.5 pence, to close at 563 pence, having plunged 16 per cent on Christmas Eve after issuing an off-season profit warning: the third of the year.

While the market was forgiving after the holidays, analysts were less so, with analysts at Irish broker Davy reducing their rating on Vistry from “outperform” to “neutral.”

Also on the FTSE 250, Syncona rose 0.58 per cent, or 0.6p, to 103.2p, as it revealed that one of its investments, Achilles Therapeutics, had sold its technology assets to AstraZeneca for £9.5 millions.

Syncona said the value of its stake in Achilles was £8.5m as of September 30, representing 0.7 per cent of its net asset value.

Among small caps, Zenith Energy jumped 35.3 per cent, or 1.2 pence, to 4.6 pence, buoyed by the latest ruling by the International Center for Settlement of Investment Disputes arbitration tribunal in the case of the company against Tunisia.

The energy group is suing the Tunisian state for £500m, alleging breaches of trade agreements with the UK in relation to the Sidi El Kilani and Ezzaouia concessions.

But Walker Crips lost 5.56 per cent, or 1p, to close at 17p, as the London stockbroker and asset manager posted a first-half loss of £1.5m despite Sales increased 2.3 percent.

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free Fund Trading and Investment Ideas

interactive inverter

interactive inverter

Fixed fee investing from £4.99 per month

sax

sax

Get £200 back in trading fees

Trade 212

Trade 212

Free trading and no account commission

Affiliate links: If you purchase a This is Money product you may earn a commission. These offers are chosen by our editorial team as we think they are worth highlighting. This does not affect our editorial independence.