Famed photographer Annie Leibovitz is selling her “dream” California farm estate, just five years after purchasing the historic rural property.

Annie, 74, known for her photographs of high-profile celebrities, bought the sprawling property in 2019 for $7.5 million.

Located in Bolinas, a coastal community about an hour from San Francisco, the 65-acre property is listed for $9 million and has views of Bolinas Lagoon, Stinson Beach, Mount Tamalpais, the Pacific Ocean and San Francisco.

The property has been cataloged by Alexander Lurie and Nick Svensonand has four structures on the estate: a four-bedroom house, a guest house, a caretaker’s residence and a converted garage.

Famed photographer Annie Leibovitz is selling her “dream” California farm estate, five years after purchasing the historic rural property.

Annie originally purchased the sprawling 65-acre property in Bolinas, California, for $7.5 million in 2019.

Annie said that when Rolling Stone moved to New York in 1977, she didn’t think she would move too, much less stay.

Additionally, there are two barns, one built in the 1930s, and a banquet hall with a stage for shows.

“Tucked away in the serenity of Bolinas, California, where the Pacific Ocean and Mount Tamalpais meet, The Hideaway is an extraordinary 65-acre coastal retreat,” the online listing gushes.

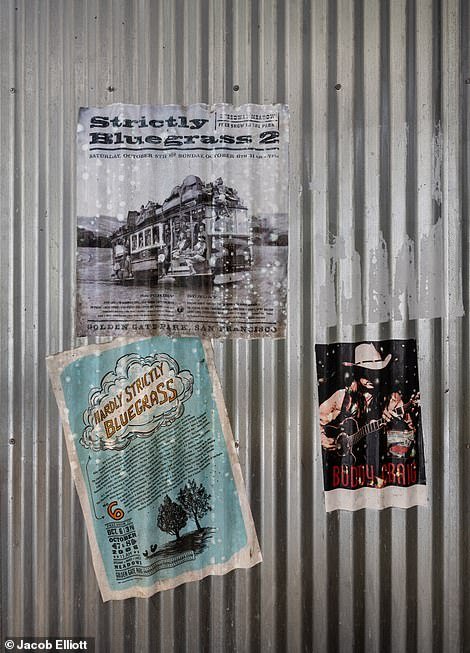

‘With stunning views of Bolinas Lagoon, Stinson Beach and San Francisco, this iconic property presents a rare combination of history, agricultural opportunities and an equestrian paradise. The Hideaway was the site of photographic interest for Ansel Adams in the 1930s and later became a sacred site for famed investor and founder of the Hardly Strictly Bluegrass festival, Warren Hellman.

‘Abundant fields and terraces for sustainable agriculture, livestock stands and vast pastures decorate this extensive property. An equestrian facility offers a picturesque riding arena next to a seven-stall barn with offices.

‘The updated residential complex features a four-bedroom 1920s SFH, guest house, workshop and two-bedroom caretaker’s residence. Adjacent hay and dairy barns have been transformed into a banquet hall with a stage for performances and Hellman’s famous recording studio.

‘Surrounded by world-class coastal beauty, The Hideaway is just minutes from incredible surfing, kayaking, hiking and wildlife reserves. Filled with lush hills, sensational sunrises and sunsets and expansive views, this is a unique opportunity to own a piece of history.’

Annie, who lives in New York and is originally from California, admitted that she had always thought she would return to the West Coast.

“I had always considered myself a California person,” he reflected, adding that he always “dreamed” of returning.

‘I went to school there, at the San Francisco Art Institute. There I learned to be a photographer.”

There are four structures on the estate: a four-bedroom house, a guest house, a caretaker’s residence and a converted garage.

Additionally, there are two barns, one built in the 1930s, and a banquet hall with a stage for shows.

Annie, originally from California and living in New York, admitted that she had always thought she would return to the West Coast.

Annie invested about $2 million into the property, installing infrastructure improvements and renovating the 1920s residence, including adding a new kitchen.

Annie made sure to preserve the character and history of the house, keeping many original details.

Annie said that when Rolling Stone moved to New York in 1977, she didn’t expect to move too, much less stay.

‘I thought he lived in California. But the job was in New York. Or Europe,” said the photographer.

However, even after spending years living and working in New York and raising my children on the East Coast, Annie said she always “dreamed of returning to California.”

His dream of owning a piece of California came true after he purchased a property in Bolinas, California, for $7.5 million in 2019.

‘They told us about this extraordinary property that from the top of the hill had magnificent views of the lagoon, the bay and the coast. It has its own special climate,” Annie recalled.

“Everything can grow all year round,” he continued. ‘There were 65 acres with an old milking barn that Ansel Adams had photographed.

“In its time it was used as a gathering place for country and folk music concerts.”

Annie invested about $2 million into the property, making infrastructure improvements and renovating the 1920s residence, including adding a new kitchen.

However, he made sure to preserve the character and history of the house, with a rotary telephone still hanging on the wall as an ode to the estate’s history.

The previous owner converted a disused farmhouse on the property into a music studio and another into a music hall to host private concerts.

According to the mother of three, she bought the house when her oldest daughter was looking at colleges on the West Coast, but her daughters ended up in the Northeast.

Before Annie’s purchase in 2019, the Bolinas farm was owned by Warren Hellman, a San Francisco financier and founder of the Hardly Strictly Bluegrass music festival.

In February, Annie sold her Manhattan apartment for $10.62 million, taking a nearly $1 million loss on the platform, which she bought for $11.24 million in 2014.

He kept a rotary telephone hanging on the wall as an ode to the estate’s history.

“We plan to partner with a legendary hill farmer to return the site to its former status as a working and teaching farm,” he added.

According to the mother of three, she bought the house when her oldest daughter was looking at colleges on the West Coast. However, when her three daughters ended up in the northeast, she made the decision to sell it.

Before Annie’s purchase in 2019, the Bolinas farm was owned by Warren Hellman, a San Francisco financier and founder of the Hardly Strictly Bluegrass music festival.

He converted a disused farmhouse on the property into a music studio and another into a music venue to host private concerts.

Annie, who worked for Rolling Stone for 13 years and whose credits include Vanity Fair and Vogue, is known for her portraits of celebrities, including the late John Lennon and Yoko Ono.

In addition to her West Coast abode, Annie has owned several Manhattan properties, including an Upper West Side apartment she sold for $10.6 million earlier this year and a complex in Manhattan’s West Village composed of three brick townhouses that sold for $28.5 million in 2013.

However, it is New York’s Hudson Valley that his family calls home on a “wonderful property.” [along] the river.’