<!–

<!–

<!– <!–

<!–

<!–

<!–

Direct Line shares tumbled in the first session since the Belgian candidate withdrew from takeover talks.

In an update after the stock market closed on Friday, Ageas said it was no longer interested in buying the British company after two proposals were rejected.

The takeover interest in – at least for the time being – saw Direct Line shares fall 11.3 percent, or 23.6 pence, to 185.4 pence. That valued it at £2.4 billion.

Ageas first approached Direct Line in January with an offer of 231 per share, or £3.1 billion.

It increased this to 237 pa shares, or £3.2 billion this month. Both proposals were rejected by Direct Line’s board.

Off the table: Ageas first approached Direct Line in January with an offer of 231p per share, or £3.1 billion. It increased this to 237 per share, or £3.2 billion this month

Analysts at Jefferies suggested an offer worth between 270p and 300p would have a ‘greater likelihood’ of being accepted. But Ageas decided to throw in the towel.

Direct Line said it was “confident” in its “standalone prospects”. The insurer also outlined plans for a £100 million cost-cutting mission that it hopes to complete by the end of 2025.

Direct Line this month joined electricity retailer Currys (down 0.4 percent, or 0.25 pence, to 60.5 pence) in the fight against foreign predators.

But British companies – including Wincanton (flat at 600p), Spirent (down 0.3 per cent, or 0.6p, to 176.5p) and All3Media – are all being targeted by international buyers.

Reports indicate that S4 Capital has also become a bidding target for its New York rival Stagwell.

The municipality will closely monitor whether the company, which was founded in 2018 by Sir Martin Sorrell, provides further details when publishing its annual figures on Wednesday.

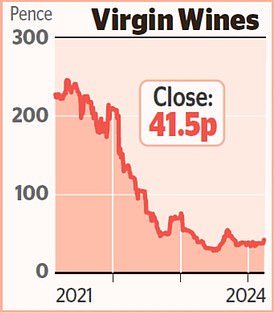

The shares, which have fallen 95 percent since their 2021 peak of 870 pence, rose 6.7 percent, or 2.84 pence, to 45.22 pence.

Russ Mould, investment director at broker AJ Bell, said: ‘This fall in valuation has made S4 look vulnerable and could turn it from predator to prey.’

The FTSE 100 fell 0.17 percent, or 13.35 points, to 7,917.57 and the FTSE 250 fell 0.56 percent, or 110.79 points, to 19,613.53.

But analysts at Goldman Sachs said they still believe a record high is on the horizon. The Footsie peaked at 8,012 in February last year and Goldman expects this level to reach 8,200 in the next twelve months.

Mobico, which was first called National Express before changing its name, came under pressure after delaying the publication of its annual results for a second time. The company is still investigating the accounts of its German division. Shares fell 0.8 percent, or 0.55 pence, to 70.9 pence.

Water company Pennon assured investors that business was going well. The group behind South West Water and Bristol Water said results for the year to the end of March should be in line with expectations.

However, shares fell 1.9 percent, or 13 pence, to 657 pence.

Wise has poached chief financial officer Emmanuel Thomassin from food company Delivery Hero. He will join the fintech company in October. Shares fell 3.9 percent, or 38 pence, to 935.2 pence.

Iron ore miner Ferrexpo rose 7.8 percent (3.38 pence) to 46.6 pence after production levels in Ukraine reached their highest level since the Russian invasion in February 2022.