<!–

<!–

<!– <!–

<!–

<!–

<!–

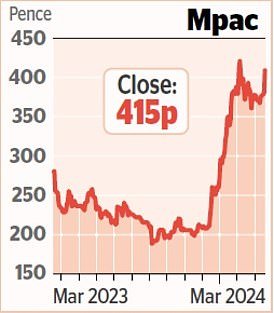

Rolls-Royce shares closed at a record high, the latest sign of its remarkable turnaround.

The FTSE 100 jet engine maker is one of Britain’s largest defense companies and has gone from strength to strength following the recovery in air travel.

An upgrade from analysts at Jefferies has sent the stock above 400p for the first time.

The broker said Rolls had consolidated its finances and an improvement in its credit rating meant it could start paying dividends.

Last week it announced a £55 million investment and the creation of 300 jobs to meet growing demand for its large civil aircraft engines.

Flying high: Rolls-Royce shares have more than quadrupled in value since ‘Turbo’ Tufan Erginbilgic took over as CEO in January last year

The shares, which peaked at 396.5p in January 2014, rose 2.7 per cent, or 10.7p, to 400.7p.

This means the stock’s value has more than quadrupled since “Turbo” Tufan Erginbilgic took over as CEO in January last year.

The FTSE 100 rose 0.2 percent, or 15.75 points, to 7,738.3 and the FTSE 250 fell 0.3 percent, or 53.72 points, to 19,432.81.

Results from two home goods retailers show consumers are cutting back on big-ticket purchases such as kitchens, bathrooms and sofas, suggesting many are still experiencing the cost of living crisis.

DFS revenue fell 7.2 percent to £505.1 million in the six months to December 24. Profits fell to £900,000 from £6.8m in the same period the previous year.

The sofa seller added that trading had weakened over the past two months, leading it to downgrade its sales and profit forecasts for the year to the end of June.

DFS added to its misery by warning that Red Sea disruptions could further wipe out its annual profits. Shares fell 6 per cent, or 6.8p, to 106p.

At Wickes, the home improvement company’s revenues and profits remained largely flat last year.

It will also buy back shares worth £12.5m from investors as part of its wider £25m buyback programme.

Wickes acquires a 51 percent stake in the solar installation company Solar Fast. Shares slipped 2.4 per cent, or 3.6p, to 146.4p.

Drug developer PureTech Health is to return £79 million to shareholders following the £11 billion sale of a company it founded which is working on a treatment for schizophrenia.

The London-listed company will pocket around £230 million from its remaining stake in Karuna Therapeutics, which was sold to Bristol Myers on Monday. Shares gained 9.3 per cent, or 19p, to 223p.

Review website Trustpilot returned to profit last year following a surge in customers searching for the best deals.

The company made a profit of £12.6m in 2023, compared to a loss of £3.1m the previous year, while revenue rose 18% to £138m l ‘last year.

Trustpilot’s monthly user numbers soared 30 per cent to more than 57 million in 2023. Shares rose 1.4 per cent, or 2.8p, to 208p.

US natural gas producer Diversified Energy has outlined plans to strengthen its balance sheet by adjusting its dividend payout to factors such as current commodity prices.

The group also agreed to buy four assets from Oaktree Capital for £322 million, but warned it may need new funds to complete the deal. Shares fell 3.8 per cent, or 35p, to 888.5p.